Daily Market Analysis

Market Focus

U.S. equities mounted a comeback from their worst loss since October as moves to limit retail traders’ speculation in some companies opened the door for hedge funds to load up on stocks they had been ditching.

The S&P 500 Index rose 1% after trading platforms restricted activity in stocks whipsawed by internet chatter, from GameStop Corp. to AMC Entertainment Holdings Inc. and American Airlines Group Inc. Hedge funds that had shorted the stocks were burned in recent days, forcing them to reduce holdings in shares they loved in order to cut risk.

That dynamic reversed Thursday, and a Goldman Sachs basket of stocks favored by hedge funds jumped the most since early November, halting a five-day slide. An index of the most-shorted shares tumbled more than 7%, the most since June. GameStop whipsawed, rising as much as 39% in early trading before plunging as much as 68%. It closed down 44%. AMC sank 57%, American was up 9.3% and Tootsie Roll Industries lost 9.5%.

The trading restrictions sparked outrage on the WallStreetBets forum where day traders have convened to drive the manic rallies that burned hedge funds across Wall Street. Washington took notice of what some have called inequitable rules, with Democratic and Republican lawmakers criticizing restrictions imposed on retail investors.

All 11 industry groups in the S&P 500 traded higher, with sentiment also boosted by solid corporate earnings from the likes of Mastercard Inc. and Comcast Corp. and a surprise drop in jobless claims.

Stocks have seen volatile trading after a prolonged rally that spurred talk of possible asset bubbles and predictions of a pullback given a raging pandemic and patchy rollout of vaccines. The turmoil created by internet chat rooms has stoked fears of broader consequences for Wall Street, particularly hedge funds, but that fear seemed to fade on Thursday.

The Stoxx Europe 600 Index edged higher. Earnings beats from STMicroelectronics NV and Diageo Plc were accompanied by a miss from Swatch Group AG and a revenue drop at EasyJet Plc.

The benchmark 10-year Treasury yield rose after touching the lowest level since Jan. 5. Bitcoin climbed past $32,000.

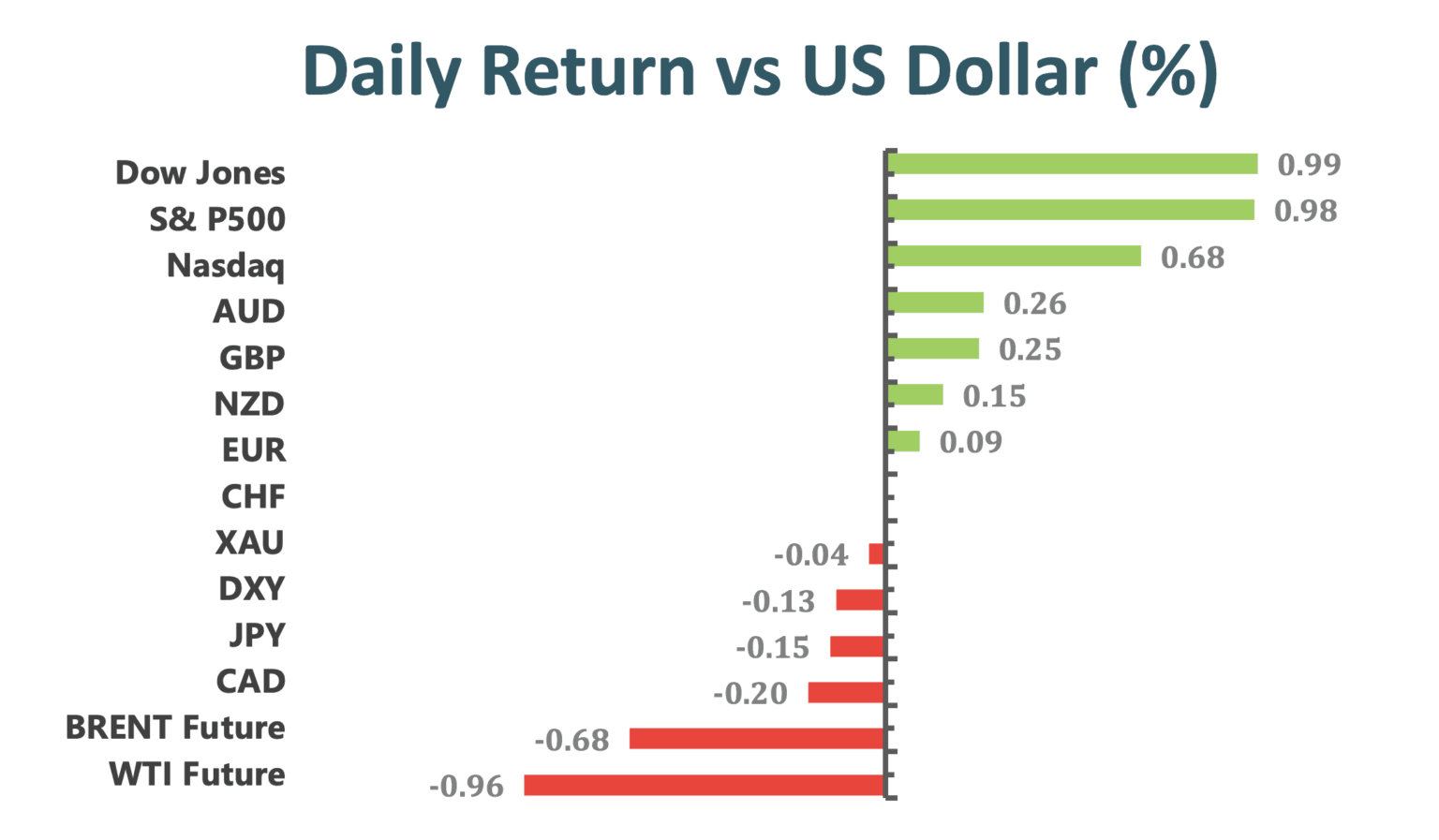

Market Wrap

Main Pairs Movement

The dollar fell against all of its Group-of-10 peers except the yen as risk sentiment improved, with U.S. equities rallying after their worst rout since October.

A gauge of the dollar traded near session lows after rising to a five-week high earlier. The Norwegian krone and New Zealand dollar were the best performers against the greenback

Equity markets rose following moves to curb trading on a few stocks that had swung wildly on retail demand, which allowed hedge funds to load up on names they had ditched. Better-than-expected earnings results and solid economic data, including the first increase in new-home sales since July, also supported risk sentiment.

AUD/USD rebounds from a decline of almost 1%, rising 0.4%; NZD/USD up 0.4% after losing as much as 0.8%; GBP/USD climbs 0.4% to 1.3742, near session highs of 1.3746.

Technical Analysis:

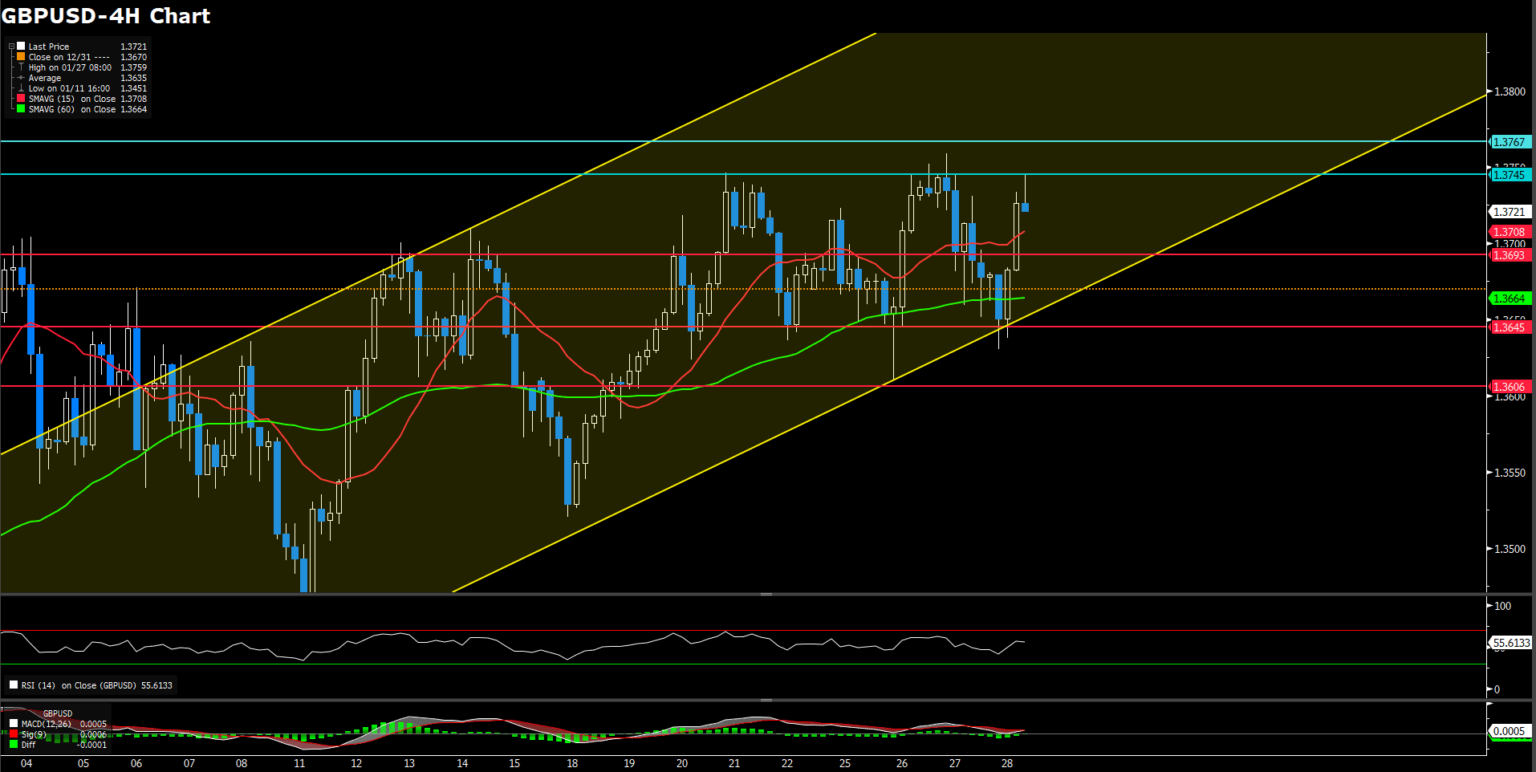

GBPUSD (4 Hour Chart)

The Cable once slipped to lower bound of upward trend channel which at 1.3645 level then pull up to first pivot resistance as we measure previously. Cable climbed as much as 0.37% to 1.3729, near session highs of 1.3746 and it was amongst the top three best performing G10 currencies on the day. Risk appetite took a turn for the better in wake of better-than-expected weekly initial jobless claims data dropping to 847k from 914k, beat expectations of 875k. In terms of domestic U.K. fundamentals, there hasn’t been too much of news stuff today.

From a technical perspective, short and long-term SMAVG indicators are both boosting to higher level while short term indicator is accelerated it upward momentum. Additionally, the RSI indictor located at bullish trend suggestion area at 57 figures which left amount space for further downwind momentum. On up way perspective, 1.3745 level is still a powerful resistance at current stage which curb the bullish movement in recent day. On slid way, just focus on whether it would go down below the lower bound of upward trend channel. We expect that cable is still lacking a decisive way and momentum trigger; therefore, first pivot support and resistance is more comfortable for cable at current stage.

Resistance: 1.3745, 1.3767

Support: 1.3693, 1.3645, 1.3606

EURUSD (4 Hour Chart)

The euro dollar has seen a gradual grind to the upside for the majority of Thursday, with the gains accelerating slightly before the US cash open amid an extension of US dollar weakness. The pair now trades comfortably above the 1.2100 level again and in the 1.2120s, up from lows of the day around 1.2080 set just prior to the EU cash open. Gains on the day have for now been capped at the 1.2140 mark. Like cable, euro creep up amid the better-than-expectation labor market data and risk appetite has improved.

Technically speaking, short and long-term SMAVG indicator were both in negative slope position then it really close to death cross, suggesting a bearish momentum ahead. On the other hands, RSI indicator has turned back its status from yesterday low to 46 around. Therefore, combing suggestions above that first critical support on downside still on 1.21, like yesterday estimate. If market momentum turn positive side, it would please above the 1.213 level and propel further is more likelihood above the second resistance at 1.2165.

Resistance: 1.2131, 1.2165, 1.2182

Support: 1.21, 1.2077, 1.2054

USDJPY (4 Hour Chart)

The yen slid versus the greenback for a second day, sending the USD/JPY to the highest since December. USD/JPY has been unreliable as a safe haven pair since the COVID pandemic began in early 2020. On the other hands, choppy shares market is seemingly driven carry-trade investors redemption yen dollar from selling shares at top probably. USD/JPY up +0.1% at 104.23, after climbing to 104.46, highest since Dec. 10.

From a technical perspective, the RSI indicator undermine from the overbought zone to 67 figures which still suggest the bullish trend ahead. Additional, short- and long-term SMAVG is just golden cross that propel market in torrid. On price action, day high reached to last time highest approximately. Therefore, we believe market is awaiting more clues for further upward momentum. Conversely, the first pivot support is eyes on 104.02 which seen to support the current bullish movement, the last crucial support would be 103.56.

Resistance: 104.58, 104.73

Support: 104.02, 103.8, 103.56

Economic Data

|

Currency |

Data |

Time (TP) |

Forecast |

||||

|

EUR |

German Unemployment Change (Jan) |

16:55 |

6 K |

||||

|

EUR |

German GDP (QoQ)(Q4) |

17:00 |

|||||

|

CAD |

GDP (MoM)(NoV) |

21:30 |

0.4% |

||||

|

USD |

Pending Home Sales (MoM) |

23:00 |

-0.1% |

||||