Daily Market Analysis

Market Focus

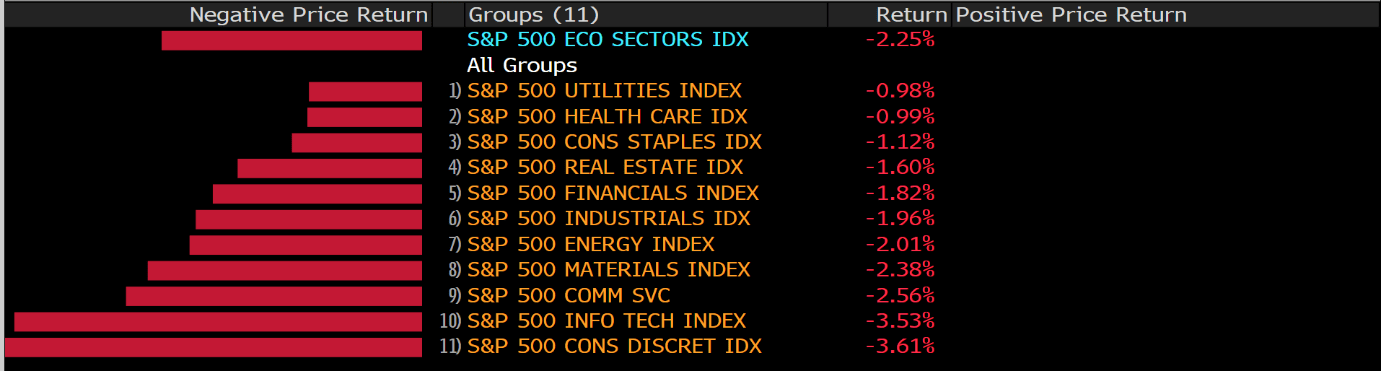

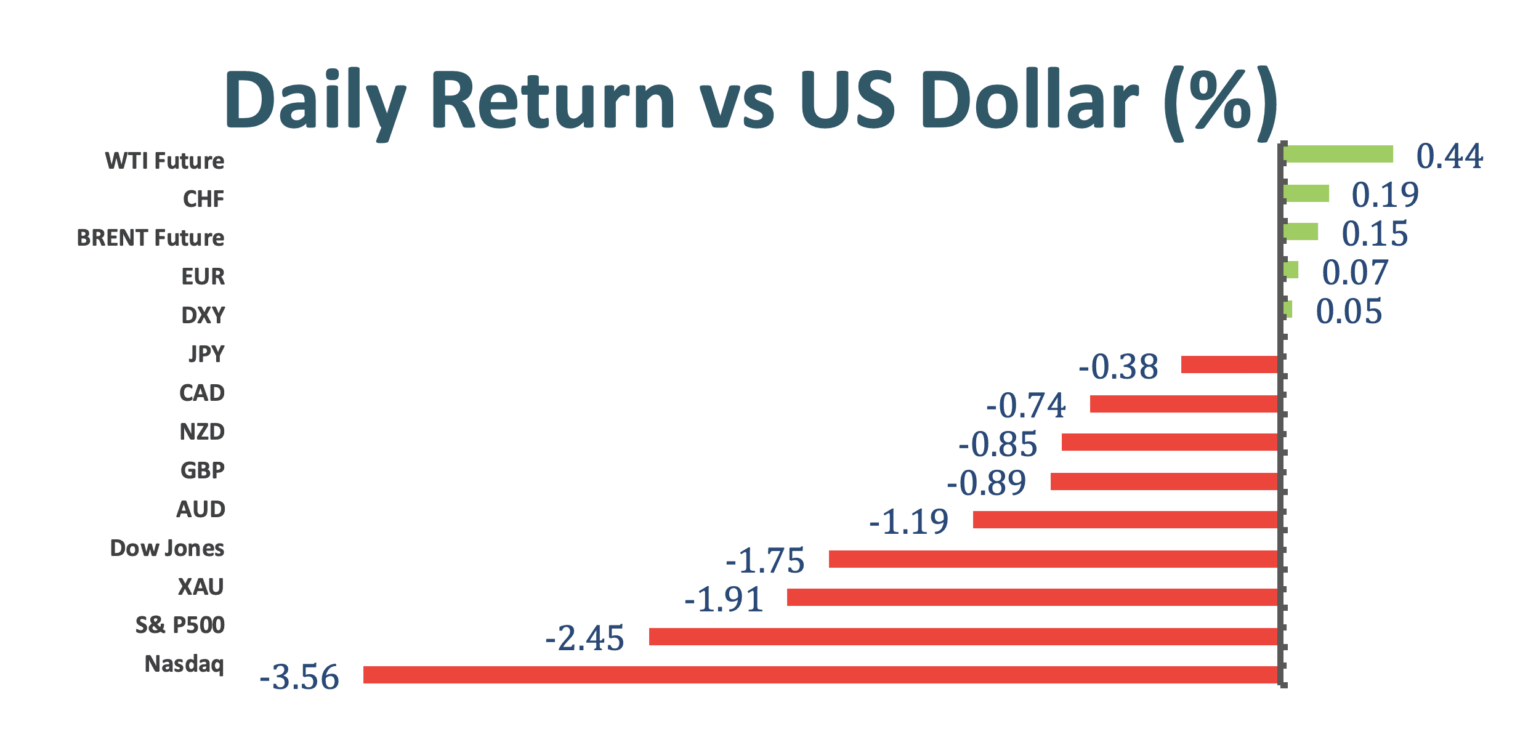

US equities plummeted whilst the selloff in global bonds deepened, the US 10-year treasury yield SOARED to one-year high of 1.545%, a jaw-dropping 10.56% in one day. Technology stocks were leading the rout, the Nasdaq 100 slumped about 3.6%. The recent Tesla-ARK synergy took a big hit today, Tesla Inc dropped 9.17% while ARK Innovation ETF down 6.7%. It was blood bath in the S&P 500 Index as well, every sector ended up in the red, with Consumer Discretionary sector suffered the worst of 3.61%.

Several Federal Reserve presidents argued Thursday that rising Treasury yields reflect economic optimism for a solid recovery from the Covid-19 crisis and stressed that the central bank is not planning to tighten policy in the near term. St. Louis Fed president James Bullard told Bloomberg report that “rise in yields is probably a good sign so far because it does reflect better outlook for US economic growth and inflation expectations which are closer to the committee’s inflation target.”

Coronavirus hospitalization rate dropped 72% in a month in the US as the vaccination push accelerated. Meanwhile, President Joe Biden said the federal government will distribute Johnson & Johnson’s vaccine as fast as the company can manufacture it, assuming the shot is approved by the FDA.

Market Wrap

Main Pairs Movement

Aussie staged a significant pullback upon touching 0.8 hurdle, closed the day down 1.2%. This retreat is hardly any surprise since the pair has been overstretched since last week, probably plenty of profit taking orders were triggered a bit north of 0.8. On the other hand, Kiwi was slightly behind its peer, dropped 0.86%.

Euro dollar ended where it started, albeit ramping up 0.64% during European session. The dollar index is clinging to 90.25 near closing hours. US Core Durable Goods Orders for January doubled expectation to 1.4%, and Initial Jobless Claims printed 730,000, beating forecast of 838,000.

Speculators were dumping Cable amid bond selloffs, erased 0.92% on Thursday. The pair is currently hovering above 1.401. US bond market was under pressure since investors were optimistic on global economic outlook, thus betting on higher growth and inflation ahead. The safe-haven US greenback becomes attractive as investors worrisome in overvaluation in the stock market.

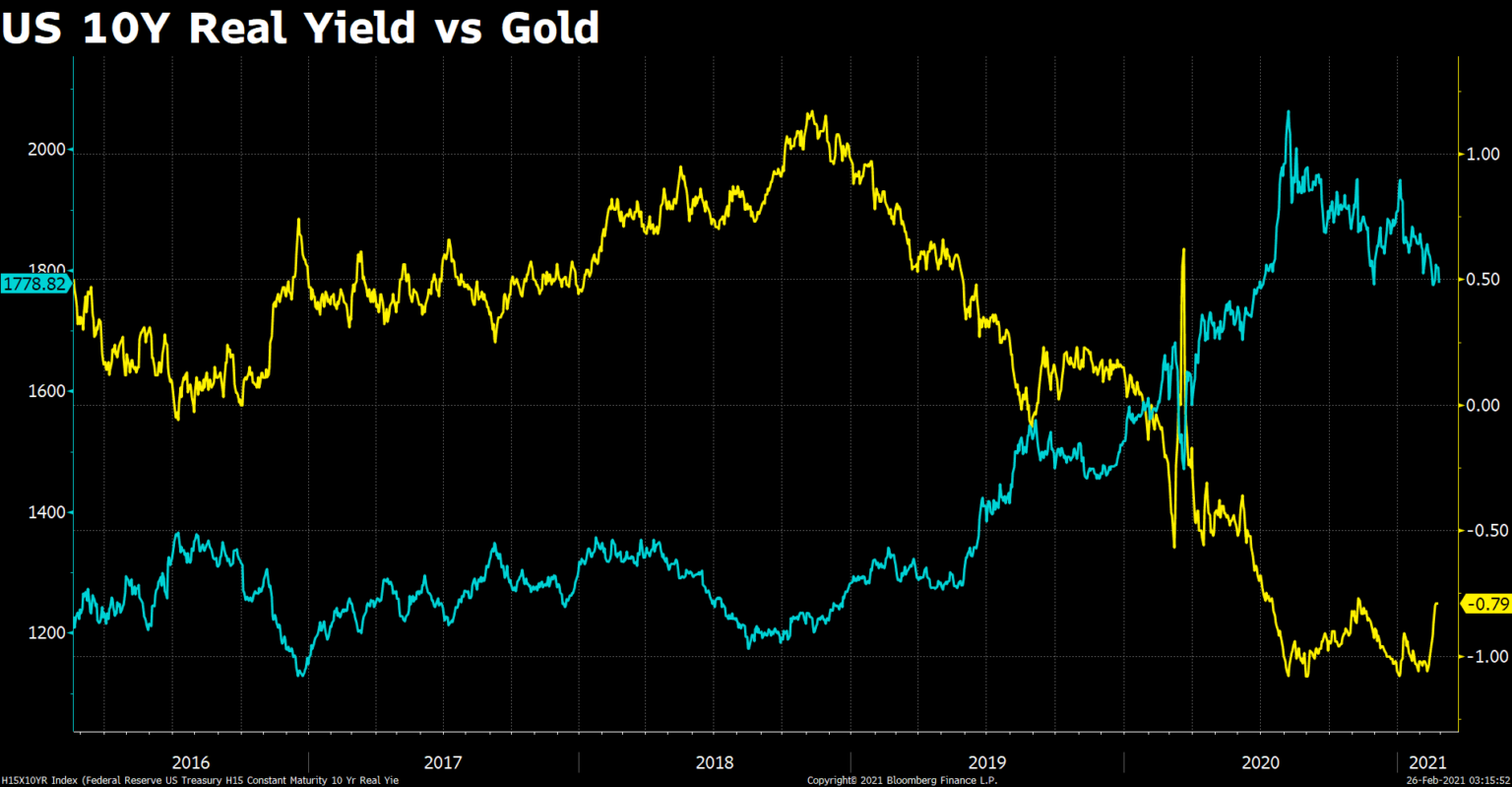

Another ugly day for Gold, which has been losing core value since this year as market grew confident on economic recovery around the globe. The negative link between Gold and US Treasury yield continues to drag the precious metal lower and lower.

Technical Analysis:

EURUSD (Daily Chart)

Euro dollar ramped up as much as 0.64% in earlier session, but pared most of its gain amid soaring US treasury yield. This pair was capped by 1.22 hurdle, created a long upper wick on the daily chart. Nonetheless, bullish bias is very much intact for now. It managed to stand above the short term descending trendline, and has validated that the breakthrough was indeed solid. If price heads south, we expect the downward trendline to provide defense for the euro again. If broken, then the shared currency will find support upon meeting the long standing ascending trendline. Conversely, it will have to find acceptance above 1.22 to boost bullish momentum. MACD on the daily chart points to a bullish trend.

Resistance: 1.22, 1.2327

Support: 1.193, 1.163

USDJPY (Daily Chart)

USDJPY has been on a textbook like zig-zag uptrend, which was bolstered by the blue ascending line. The pair was heavily linked to the US treasury yield as the Japanese Yen is particularly vulnerable under surging yield. However, this pair somehow lagged behind Thursday’s soaring yield, only up 0.3% while the 10-year treasury yield was up 9%. This could suggest exhausting bullish strength, and offer another chance for the bears to contest the ascending trendline, which intersect with 38.2% Fibonacci support near 105.4. The bulls should flourish in the long term, near resistance sits around 50% Fibonacci of 106.72.

Resistance: 106.72, 108

Support: 104.6, 103.8, 102.7

XAUUSD (Daily Chart)

Gold plunged another 1.51% on Thursday, it is on a three losing streak. The precious metal touched as low as 1765, which was the 50% Fibonacci support since last November. It was the second attempt to breach lower within a week, the more frequent a support is under attack, the more fragile it becomes. Moreover, US 10Y treasury inflation-index security rate (aka 10Y real treasury yield) has been rapidly rising from the bottom, a higher real yield usually leads to declining safe-haven gold price. SPDR and iShares Gold ETF continues to load off their holding amid plummeting gold price. However, investors should be alerted as we also witnessed quite some volatility in the equity market, which could draw attention for safe-haven sheltering assets.

Resistance: 1823, 1872

Support: 1765, 1691

Economic Data

|

Currency |

Data |

Time (TP) |

Forecast |

||||

|

NZD |

RBNZ Gov Orr Speaks |

07:30 |

|||||