Daily Market Analysis

Market Focus

U.S. stocks fell for the first time in three sessions and the dollar weakened as investors mulled risks to the economic outlook including inflation and a spike in Covid-19 cases in parts of the world.

Technology and communication services led the benchmark S&P 500 into the red, while energy shares rose. Apple and Microsoft weighed on the tech-heavy Nasdaq 100. Semiconductor stocks continued to be under pressure, with the Philadelphia Semiconductor Index dropping as low as 10% from a peak in early April.

Bitcoin tumbled to as low as $42,133 before stabilizing after a volatile weekend that saw Tesla Inc. Chief Executive Elon Musk whipsaw prices with a series of tweets that touched on the energy usage of the cryptocurrency and whether he was selling. Coinbase Global Inc. fell to a record low and below the reference price used in its April direct listing. Gold climbed to the highest in more than three months.

Elsewhere, Oil edged up as rising optimism around a demand recovery in regions such as the U.S. offset Covid-19 flare-ups in parts of Asia.

Main Pairs Movement:

The greenback traded lower in modest turnover as U.S. economic optimism helped lift an index of commodity prices most in a month, boosting resource-related currencies including the Australian and Canadian dollars. The pound climbed for second day as U.K. economy reopens.

Federal Reserve Vice Chair Richard Clarida said during a webinar that weaker-than-expected April payroll report shows “we have not made substantial further progress” on the central bank’s goals for employment and inflation laid out as thresholds to begin scaling back the central bank’s massive monthly bond purchases.

Concerns that policy makers may have to pull back support sooner than expected to quell rising inflation have weighed on global equities. Investors this week will parse the minutes from the Federal Open Market Committee’s latest meeting for any discussion about accelerating price pressures, and hints of a timeline for reducing asset purchases.

USD/CAD falls as much as 0.4% to 1.2061, on pace for lowest close in six years; eyes the YTD low of 1.2046. Loonie gains supported by rising WTI oil prices and gold; the Bloomberg commodity index jumps 1.4%, biggest gain in a month.

USD/JPY remains lower, trades -0.2% at 109.19; bids anticipated beneath 109.00 while macro-offers are placed around 109.50, according to traders.

Technical Analysis:

EURUSD (4 hour Chart)

Euro fiber pair end Monday little change around 1.2157. A scarce macroeconomic news and fading risk-appetite maintained pairs at the upper end of it slightly range. For technical aspect, RSI indicator shows 59.4 figures, which suggest a bullish momentum sentiment. On average price view, 15-long SMA indicator is ongoing ascending trend in day market after it euro slightly upper change and 60-long SMA turned slightly upside slope.

As price action at current stage, price momentum seems ongoing with gain traction in recently days, expecting market could testing next psychological level at 1.22 if 1.215 could hold and remain bull.

Resistance: 1.22

Support: 1.2151, 1.2106, 1.207

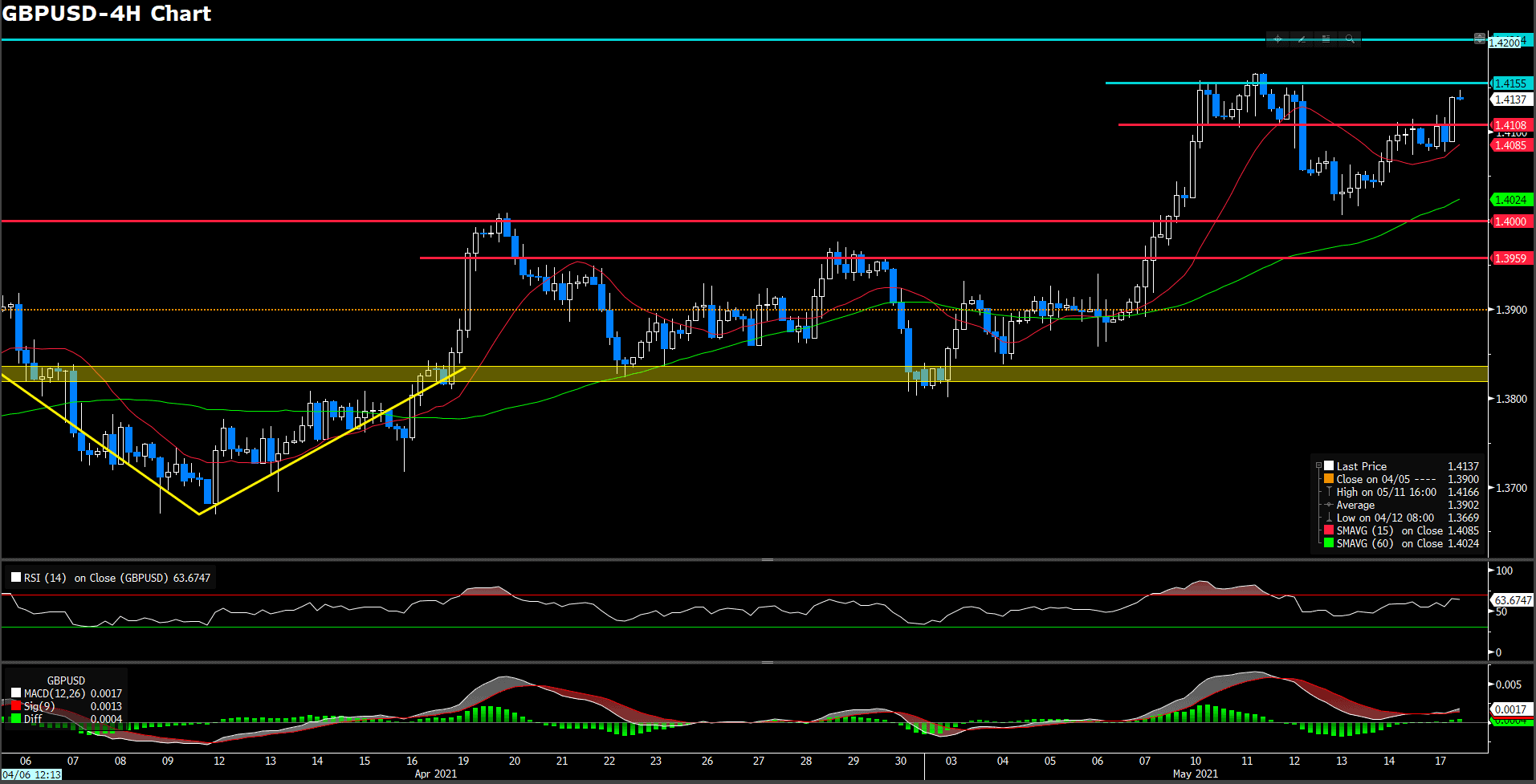

GBPUSD (4 Hour Chart)

Sterling rose to nearly day high for the second day in a row and recently which printed the fresh high at 1.414 level, boosted by fell dollar and also by a retreat in EUR/GBP. During the U.S. session the dollar lost momentum and pulled back, even as three main U.S. shares market under pressure. Sterling was supported by fix-related buying and improved risk tone following comments by BOE Vlieghe on stimulus; 1.4237 is the YTD high in February. For RSI side, indicator shows 64 figure, suggesting a bullish momentum for short run. On the other hands, 15-long SMA indicator turn slope to north way in the day and 60-long SMA indicator remaining a ascending movement.

All of all, sterling has successfully breached over 1.41 level to challenging last time high at 1.4155. Moreover, we see there still have a room for upper stage as bullish momemtun retained in relative strong indicator. Therefore, we see first immediately resistance will on 1.4155 and 1.42 follow.

Resistance: 1.4155, 1.42

Support: 1.3959, 1.4, 1.4108

XAUUSD (4 Hour Chart)

Gold consecutive two day gains to nearly multi-month high after it hover over 1.26%, trading at 1865.9, as U.S. share extended to day to day low and U.S. 10 year Treasuries yields had 1% upper gain. For moving average side, 15-long SMA indicator retained it slope to upside trend and 60-long SMAs indicator retaining it north side momentum. For RSI side, inidcator shows 71 figure, suggesting over bought sentiment at current stage.

As price action, we see gold has tried to penetrated multi-month downside trend. Overall, we await of gold whether could stand above downside trend solid for upside favor. For longer perspective, if it could stand above and not break below 1850, gold would head to 1900 level.

Resistance: 1900

Support: 1850, 1812.88, 1800, 1763.837

Economic Data

|

Currency |

Data |

Time (GMT + 8) |

Forecast |

||||

|

JPY |

GDP (QoQ)(Q1) |

07:50 |

-1.2% |

||||

|

AUD |

RBA Meeting Minutes |

09:30 |

– |

||||

|

GBP |

Average Earnings Index ex-Bonus (Mar) |

14:00 |

4.5% |

||||

|

GBP |

Claimant Count Change (Apr) |

14:00 |

– |

||||

|

USD |

Building Permits (Apr) |

20:30 |

1.77 M |

||||