Market Focus

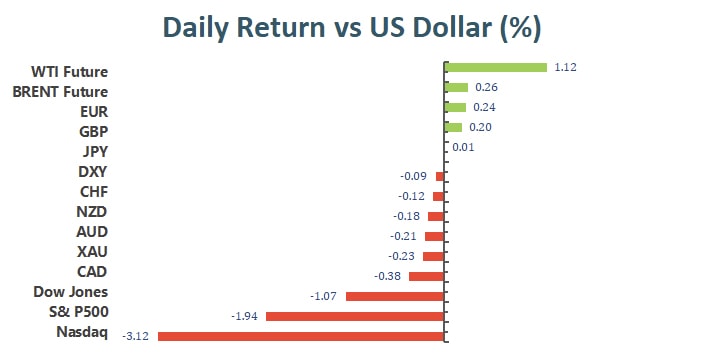

The U.S. stocks market faced gloom on Wednesday. The Nasdaq Index plummeted by more than 3%, marking the biggest one-day percentage drop since February. Earlier minutes of the Federal Reserve meeting suggested that the central bank may raise interest rates sooner than expected. After the meeting minutes were released, the three major stock indexes quickly expanded their declines. Investors think the minutes of the meeting are more hawkish than they feared. The Dow Jones Index, which set a record high earlier in the day, reversed the trend and closed down more than 1%. At the end of the market, the Dow Jones Industrial Average fell 1.07 to 36,407.11 points, the S&P 500 index lost 1.94% to 4,700.58 and the Nasdaq Composite Index plummeted 3.34%.

All S&P 500 sectors closed down, while the Cboe Volatility index closed at its highest level since December 21. Undoubtedly, concerns about rising interest rates severely hit the technology sector and the real estate sector. The technology sector fell 3.13%, which was the biggest drag on the benchmark index, while the interest rate-sensitive real estate sector fell 3.2%, the biggest one-day percentage drop since January 4, 2021. In the terms of the tech stocks, AAPL droped 2.66%, TSLA fell 5.35%, and Nvidia dwon 5.76%.

Main Pairs Movement:

The dollar fell on Wednesday but recovered its lost ground after the FOMC meeting, the meeting showed that the Fed may need to act more quickly to raise interest rates to combat inflation. In addition, the statement caused losses in all major indexes, and the 10-year yield has reached the important threshold of 1.70%. As the yield rose, the U.S. dollar index surged 0.22% in the last hour to closed at 96.171.

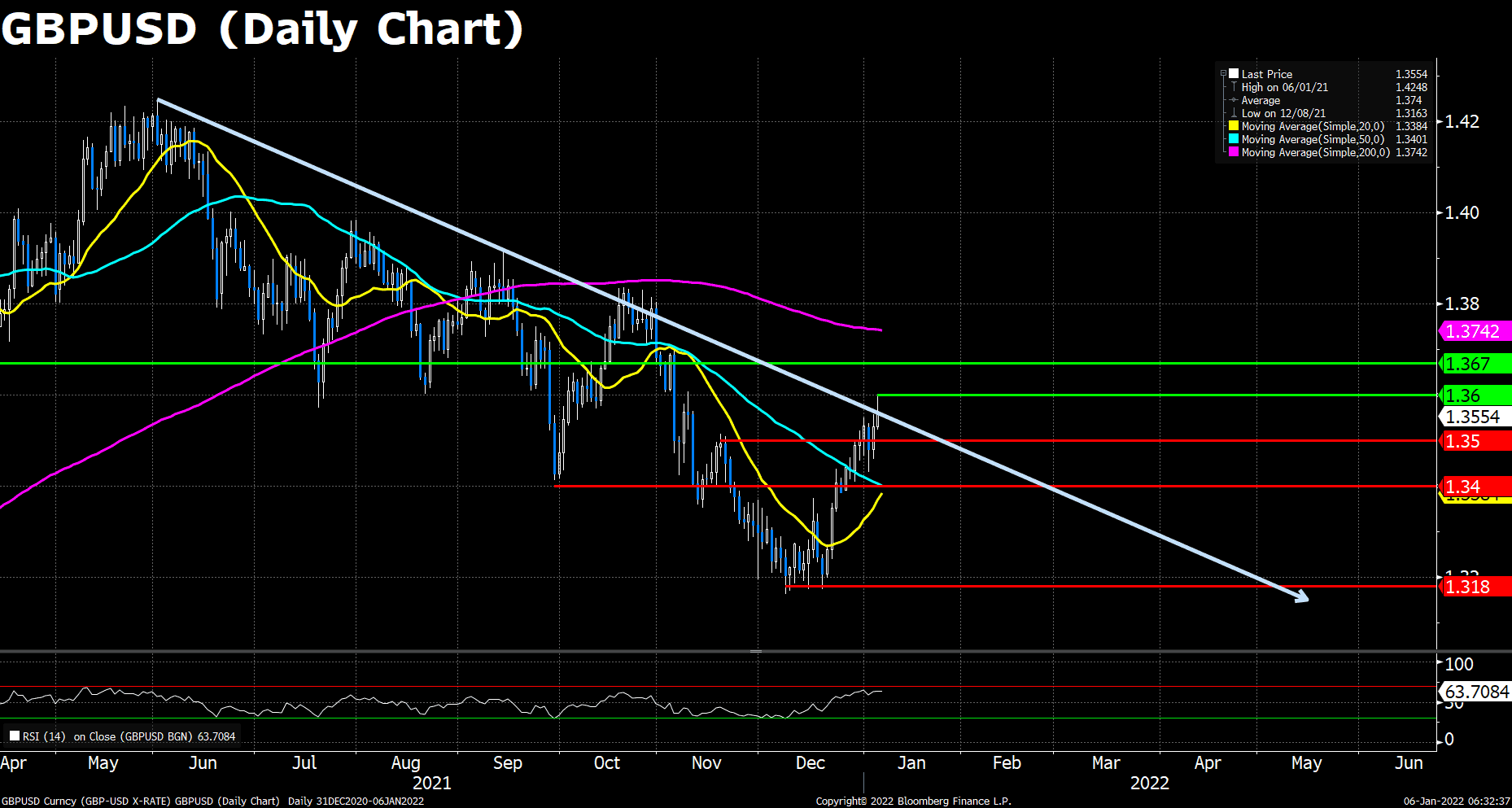

The pound almost touched the 1.3600 level and maintained a strong upward trend.

However, as the U.S. dollar soared eroded the pound’s gains and closed at 1.35520.

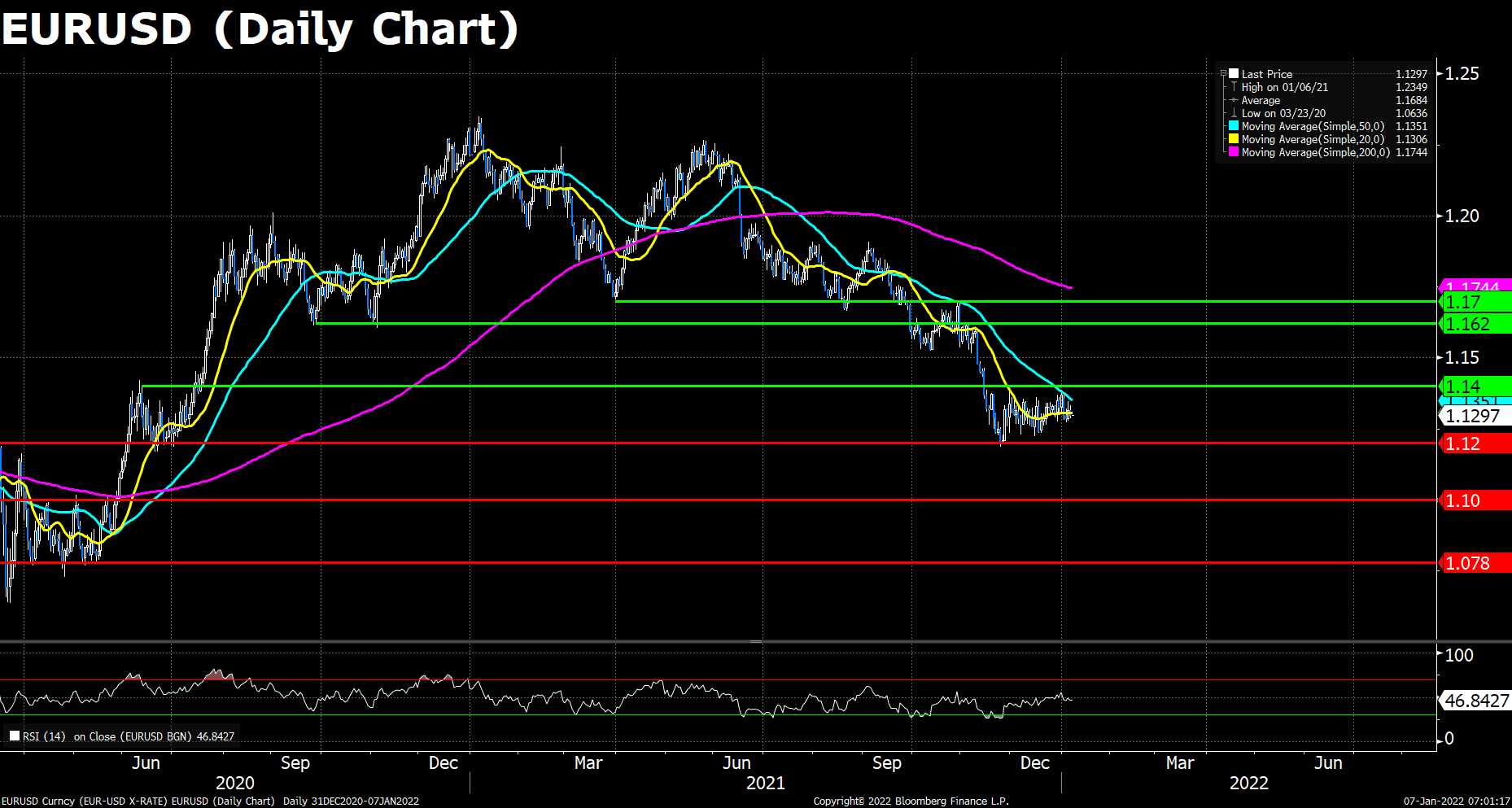

The euro continued to fall against the US dollar, and the currency pair remained slightly fluctuating between 1.12690 and 1.13829.

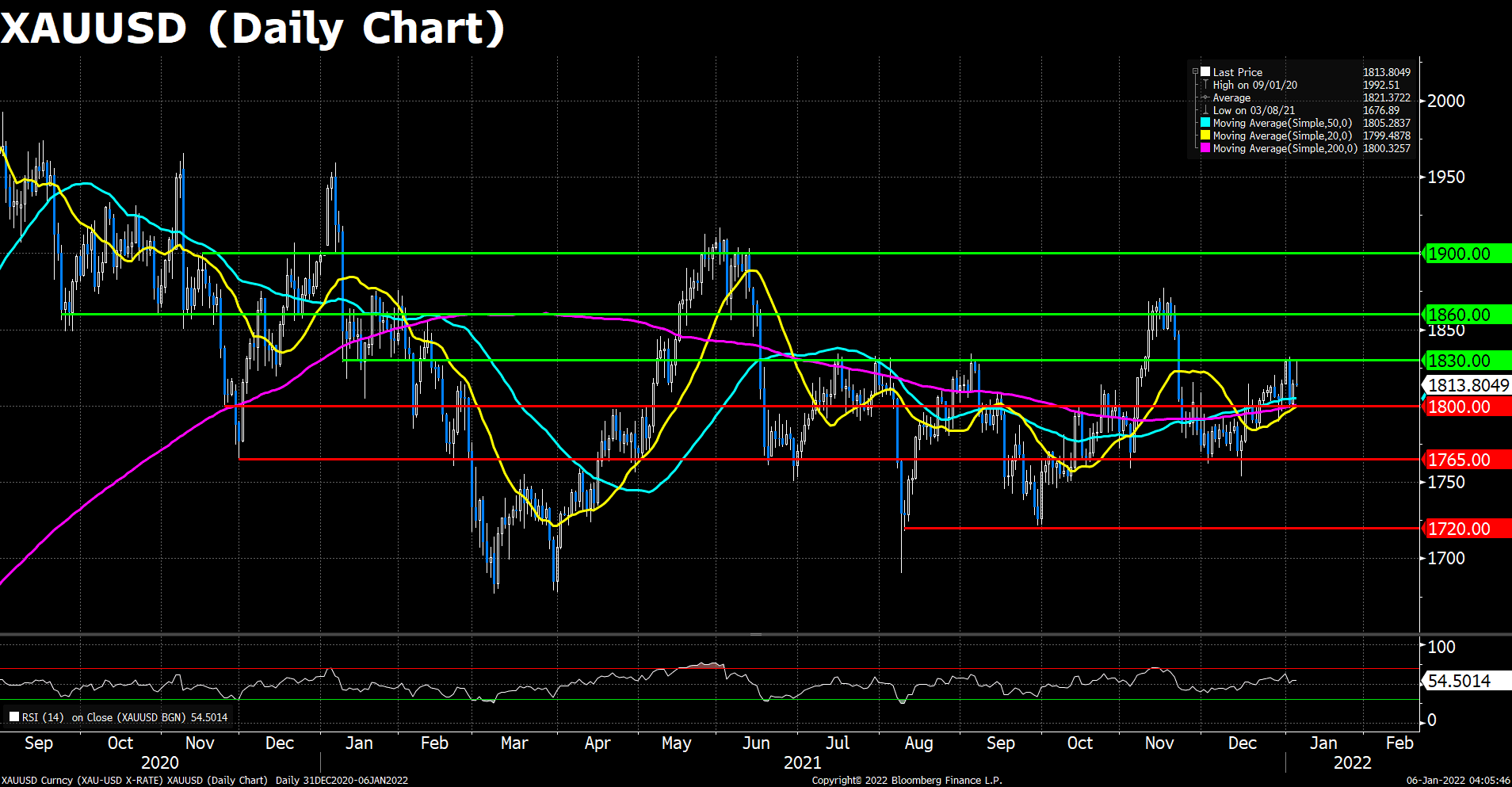

The price of gold peaked at 1,829.70 and began to fall before the Fed meeting. It closed at $1810.14 per ounce after the meeting, which means it almost lost a whole day of gains. Crude oil maintained a moderate increase, but also lost after the meeting and closed at $77.17 per barrel.

Technical Analysis:

Cable gained another 70 pips during the New York session but snapped nearly half of its gains after the Fed’s hawkish talks during the latest FOMC meetings. The pair now trades at 1.3592 at the time of writing. The market sentiment turned soar, with US equities plummeted. Investors are all eye on Friday’s US Nonfarm Payroll for further catalyst.

On the technical front, Cable lingers around the top of the June downslope trendline. The 1.3600 resistance is close at hand, and a solid breakthrough of that level could be a good indication that a recovery is on the way, as the nearest resistance after that is 230 pips above. The price action is now above its 20 and 50 DMA, still far from the key 200 DMA. The RSI for Cable is 63.70, still plenty of rooms ahead of the overbought territory.

Resistance: 1.3600, 1.3670

Support: 1.3500, 1.3400, 1.3180

The Euro pair managed to cling on the 1.1300 level despite a broader strength of the greenback, trading at 1.1310 as of writing. However, the rally of the shared currency seems somewhat temporary, as the ECB’s dovish stance on the monetary policies makes investors worry about the widening rate gap between EU and the other main currencies. Looking ahead, the investors are waiting for further catalyst, including the upcoming FOMC minutes, as well as Friday’s US NFP and the Retail Sales data of both the EU and the US.

On the technical, the pair has just climbed above its 20 DMA. The RSI indicator remains slightly below the average line, showing the market sentiments are not pretty well. Amid the mixed technical indications, the pair must breached 1.1400 resistance to prove a convincing comeback. On the flip side, losing the 1.1200 support may be the last straw for the pair to continue its downward sliding.

Resistance: 1.1400, 1.1620, 1.1700

Support: 1.1200, 1.1000, 1.0780

XAU/USD advances during the first half of the North American session, but slid sharply to $1813.8 after the hawkish FOMC statements. Gold’s short term decline may extend to Friday, when the US NFP provides further instructions.

As to technical , though the pair still above all its moving averages, the fresh selling pressure amid strengthened US dollar may push the gold price to dip further. If the retreat of the pair continues, a strong support will appear at $1800, which once breach should increase the bearish pressure, targeting $1,790. On the flip side, a bounce to the upside will lead the price action to $1,830. A close clearly above $1,830 would suggest more gains ahead for the yellow metal.

Resistance: 1830, 1860, 1900

Support: 1800, 1765, 1725

Economic Data:

|

Currency |

Data |

Time (GMT + 8) |

Forecast |

|

|

GBP |

Composite PMI (Dec) |

17:30 |

53.2 |

|

|

GBP |

Services PMI (Dec) |

17:30 |

53.2 |

|

|

USD |

Initial Jobless Claims |

21:30 |

197K |

|

|

USD |

ISM Non-Manufacturing PMI (Dec) |

23:00 |

66.9 |

|