Market Focus

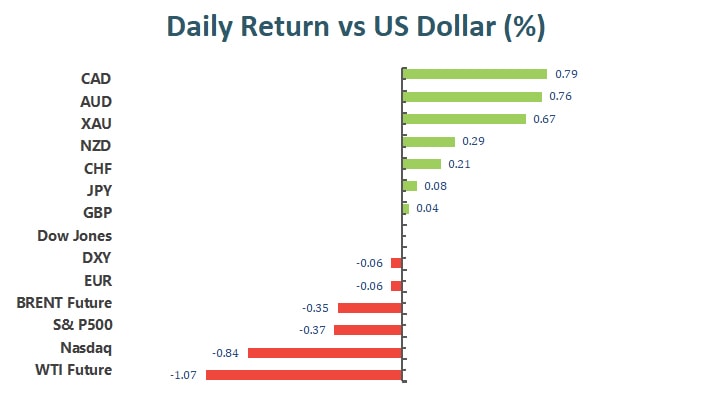

Stock turned lower to close a choppy session at the start of another busy week for corporate earnings and fresh economic data, as investors continue to assess the Federal Reserve’s path forward for monetary policy. S&P 500 declined after posting its best weekly rise of the year last week, close 0.37% lower at 4483.86. Dow Jones traded sidelined, and the Nasdaq underperformed as technology shares fell anew, down 0.58% to 14015.67 at the end of the day.

U.S. President Joe Biden said the controversial Nord Stream 2 natural gas pipeline between Russia and Germany would be stopped if President Vladimir Putin orders an invasion of Ukraine. “We will bring an end to it,” Biden said at a joint news conference at the White House on Monday with German Chancellor Olaf Scholz in a short answer to a question about whether he had received assurances from Scholz. “The notion that Nord Stream 2 is going to go forward with an invasion by the Russians — that’s not going to happen.”

Earlier, Scholz’s top diplomat said that Europe’s largest economy was willing to “pay a high economic price” that would come with supply cutoffs. Foreign Minister Annalena Baerbock is a member of the Greens and has been more explicit than Scholz in pledging to target Nord Stream 2.

A main concern for Europe, which depends on Russia for gas, is trying to secure supplies in a scenario where it could get cut off. Biden sought to address this worry and said the U.S. had been looking for alternative sources: “We think we could make up a significant portion of it that would be lost.” The comments from Biden represent the largest-yet commitment by the U.S. to ensure European allies have sufficient supplies of natural gas amid potential conflict with Russia, which provides about 40% of the bloc’s needs today.

Main Pairs Movement:

The week started in slow motion, and the dollar ended the day mixed across the board. It managed to add some ground against its European rivals, although EUR/USD held above 1.1400, while GBP/USD settled at around 1.3530. ECB President Christine Lagarde poured cold water on rate hikes speculation. Speaking before the EU Parliament she said that there is no sign that inflation will measurably exceed the bank’s 2% target in the medium term.

Commodity-linked currencies, on the other hand, managed to advance with AUD/USD trading at around 0.7120 and USD/CAD accelerating its slide at the end of the day to trade in the 1.2660 price zone.

Gold maintained its bullish stance throughout the day, ending the American session at $1,820 a troy ounce. Crude oil prices, however, retreated from their multi-year highs and WTI settled at $91.20 a barrel, Brent at $92.90. US Treasury yields were sharply up ahead of the opening, holding on to gains, but pulling back from intraday highs.

Technical Analysis:

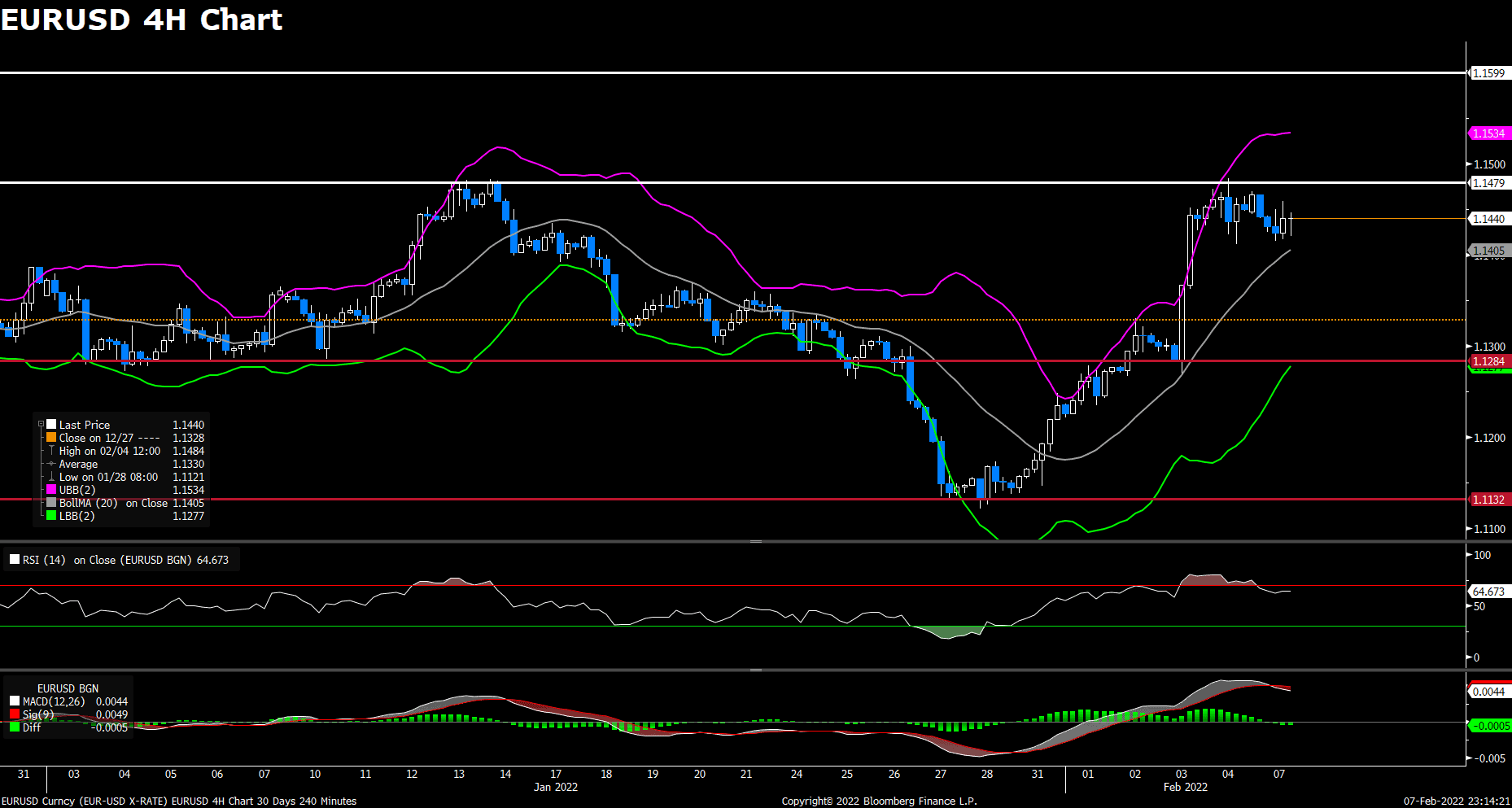

The EUR/USD pair declined on Monday, retreating from multi-week highs above 1.1470 mark that touched last Friday. The pair was trading lower and dropped to a daily low during Asian session, now starting to see fresh selling again after trying to rebound earlier in the session. The pair was last seen trading at 1.1441, posting a 0.08% loss on a daily basis. EUR/USD stays in the negative territory amid the recovering US dollar, despite the greenback remains on the back foot most of the day and failed to build on the post-NFP recovery. A softer tone around the US Treasury bond yields also weighed on the greenback. In Europe, ECB’s Lagarde will speak before the European Parliament later in the session. The expectation for a potential ECB lift-off in September or December might keep acting as a tailwind for the Euros.

For technical aspect, RSI indicator 63 figures as of writing, suggesting that the upside is more favored as the RSI stays above the midline. But looking at the Bollinger Bands, the price dropped towards the moving average after touching the upper band, which indicates that the pair could remain its downside traction. In conclusion, we think market will be bearish as long as the 1.1479 resistance holds. But if the pair break through that level, a rally towards the 1.1550 region could be expected.

Resistance: 1.1479, 1.1599

Support: 1.1284, 1.1132

The pair GBP/USD edged lower on Monday, trading broadly flat at the start of the week within 1.3500-1.3550 area. The pair was surrounded by bearish momentum and dropped to a daily low below 1.3500 level during European session, then rebounded back to eliminate most of the intraday’s losses. At the time of writing, the cable stays in negative territory with a 0.01% loss for the day, witnessing some fresh selling. The pair is having a difficult time making a decisive move in either direction ahead of Fed policymakers and BoE Governor Andrew Bailey’s speech this week. The upbeat US job data and renewed speculations for a larger Fed rate hike at the March policy meeting should undermine the British pound and keep a lid on the upside for the cable.

For technical aspect, RSI indicator 48 figures as of writing, suggesting that the downside appears more favored as the RSI sits below the midline. But the Bollinger Bands showed the pair is now rising from the lower band, therefore the pair should experience some upside movements. In conclusion, we think market will be slightly bullish as markets weigh on Fed/BoE tightening themes in the coming days. The cable might continue to flirt with the 1.3500-1.3600 area.

Resistance: 1.3608, 1.3687, 1.3739

Support: 1.3456, 1.3372

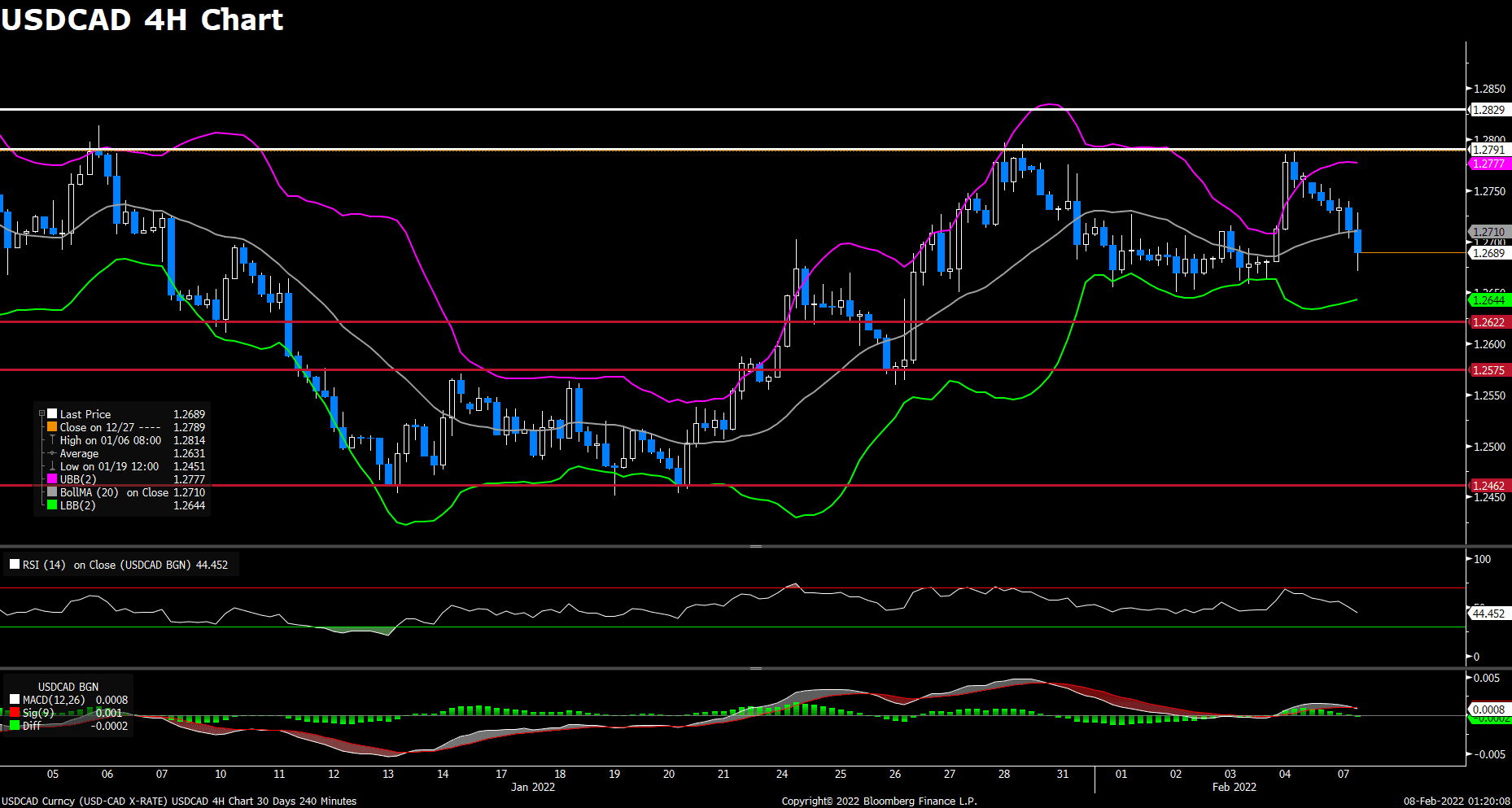

USDCAD (4-Hour Chart)

After last Friday’s rally to a weekly high above 1.278 level, the pair USD/CAD was surrounded by downside momentum today amid modest US dollar weakness. The pair remained under pressure most of the day and dropped to a daily low during American session, losing 0.60% on a daily basis. The bearish momentum witnessed in USD/CAD is caused by weaker US dollar, as the greenback suffered from a softer tone around the US Treasury bond yields. On top of that, the crude oil is now swinging between the $91.00-$92.00 area, remaining well supported by expectations that global supply would remain tight amid the conflict between Russia and Ukraine. The US/Iran nuclear negotiations would also be looked upon by investors.

For technical aspect, RSI indicator 44 figures as of writing, suggesting bear movement ahead. As for the Bollinger Bands, the pair crossed below moving average after moving out f the upper band, therefore the downside momentum should persist. In conclusion, we think market will be bearish as the pair is heading to test the 1.2622 support. The demand for oil might remain strong and acted as a headwind for the USD/CAD pair in the near-term, as many analysts also expect WTI to hit $100.

Resistance: 1.2791, 1.2829

Support: 1.2622, 1.2575, 1.2462

Economic Data:

|

Currency |

Data |

Time (GMT + 8) |

Forecast |

|

|

NZD |

RBNZ Gov Orr Speaks |

10:15 |

||

|

BRL |

BCB Copom Meeting Minutes |

19:00 |

||