Market Focus

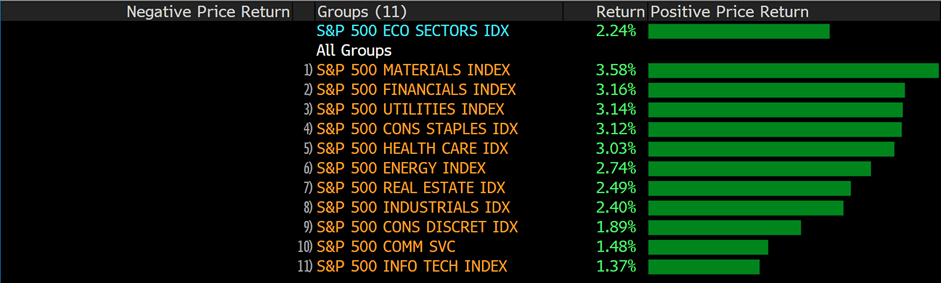

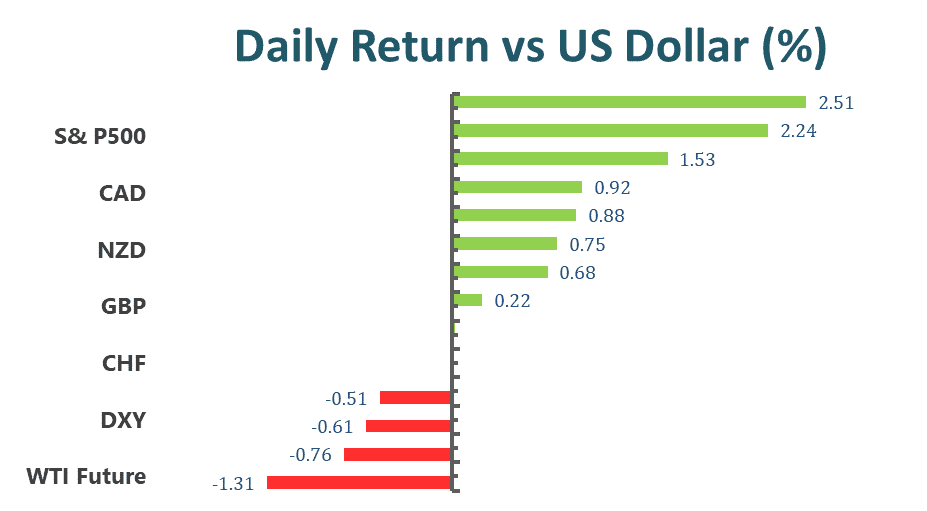

Stocks closed out a volatile week of trading, rebounding on Friday as markets reassessed the information from the war between Russia and Ukraine. US major equities, the Dow Jones Industrial Average climbed 2.5%, while the S&P 500 added another 2.2% on Friday. The technology-heavy weighted Nasdaq Composite rose 1.6%, climbing back to the bullish territory. The equities market got a boost after Moscow Kremlin said that Russia is ready to send a delegation for negotiation with Ukraine.

Countries around the world are imposing sanctions against Russia and President Putin over his aggressive invasion of Ukraine. At the moment, several countries are working on the potential ban on SWIFT toward Russia. Moreover, Germany halts its certification of the Nord Stream 2 following Russia’s invasion. The US applied sanctions on Russian banks and companies; it would cut off Russian companies from raising funds in the US, including some energy giants and banks.

Main Pairs Movement

Gold hovers slightly below $1,900 as markets take a breather from the tension between Russia and Ukraine. The main price action of gold remains to focus on the intensity of the war and the tightening expectations from the FOMC.

EURUSD falls to fresh low following the weekend headline surrounding the war. As there is no full picture of the prospects of the negotiations between Russia and Ukraine, markets embrace the safe-heaven, resulting in a decline in EURUSD.

GBPUSD tumbles toward 1.3300 on Russia’s nuclear deterrent on Ukraine. In the meantime, Russia announces the ban on the UK- registered aeroplanes from landing in Russia’s airspace in terms of retaliation.

AUDUSD slumps below 0.7200 amid the escalation of war between Russia and Ukraine. The nuclear comment from Russia put a huge downside pressure toward non-safe- haven currencies.

Technical Analysis:

EURUSD (4-Hour Chart)

The EUR/USD pair advanced on Friday, recovering from the lowest level since June 2020. This is because of the improving market mood, as Russia indicated it was ready for talks with Ukraine. The pair dropped to a daily low near the 1.1170 mark during the European session but then regained upside tractions to recover most of its daily losses. The pair is now trading at 1.1244, posting a 0.47% gain daily. EUR/USD stays in the positive territory amid weaker US dollar across the board, as the risk aversion weighed on the greenback and helped riskier assets like EUR/USD to find demand. Russia said it was ready to send a delegation to Minsk, which revived some minor hopes that a diplomatic solution could ease the conflict. For the Euro, ECB President Christine Lagarde said today that the central bank stands ready to take whatever action is needed to ensure price and financial stability.

For the technical aspect, RSI indicator 44 figures as of writing, suggesting that the downside is more favoured as the RSI stays below the mid-line. But for the Bollinger Bands, the price rise towards the moving average after touching the lower band, indicating a continuation of upside traction for the pair. In conclusion, we think the market will be bullish as the pair is now testing 1.1240 resistance—a break above that level might open the road for near-term profits.

Resistance: 1.1240, 1.1382, 1.1465

Support: 1.1161, 1.1132

GBPUSD (4-Hour Chart)

The pair GBP/USD edged higher on Friday, struggling to extend the rebound from a two-month low that touched yesterday on mixed market sentiment. The pair was trading higher to a daily top above 1.3430 level during the Asian session but failed to preserve its bullish momentum and retreated to surrender some daily gains. At the time of writing, the cable stays in positive territory with a 0.16% gain for the day, flirting with 1.3380~1.3400 area on renewed US dollar weakness. The news reported that a probable meeting between Russian and Ukrainian officials have lent some support to the market mood. But the fact that Russian forces have entered the Obolon district in Kyiv might limit further gains for the cable. For the British pound, British finance minister Rishi Sunak said he had spoken with BoE Governor Andrew Bailey on Thursday to ensure financial stability after Russia’s invasion.

For the technical aspect, RSI indicator 36 figures as of writing, suggesting that the pair remain technically bearish in the near term. For the Bollinger Bands, the price seems to lack momentum to rise towards the moving average, indicating that the pair could witness some downside movement. In conclusion, we think the market will be bearish as the pair might re-test the 1.3372 support—a significant positive shift risk sentiment is also unlikely to be seen in the short term.

Resistance: 1.3456, 1.3508, 1.3636

Support: 1.3372, 1.3336

USDCAD (4-Hour Chart)

As the market mood improved slightly heading into the weekend, the pair USD/CAD came under selling pressure and extend its previous day’s slide from a two-month high amid the retreating US dollar. The pair was trading lower at the start of the day and failed to stage a rebound in the early European session, now seeing fresh selling on positive news about the Russia/Ukraine war. USD/CAD is trading at 1.2740 at the time of writing, losing 0.60% daily. Reports from Russia said that Vladimir Putin is open to sending a delegation to Minsk for talks with Ukraine. Therefore, the latest headlines about the Russian invasion disfavored the greenback and dragged USD/CAD lower. On top of that, falling crude oil prices failed to act as a tailwind for the USD/CAD pair, as WTI has eased back to near $92.00 a barrel, amid the absence of sanctions from the US, EU and UK that directly restrict Russian energy exports.

For the technical aspect, RSI indicator 46 figures as of writing, suggesting that the downside is more favoured as the RSI stays below the mid-line. As for the Bollinger Bands, the price has crossed below the moving average, showing that the downside traction should persist. In conclusion, we think the market will be bearish as long as the 1.2840 resistance line holds.

Resistance: 1.2840, 1.2911

Support: 1.2682, 1.2575, 1.2462

Economic Data:

| Currency | Data | Time (GMT + 8) | Forecast |

| AUD | Retail Sales (MoM) (Jan) | 08:30 | 0.4% |