On Wednesday, US stock markets finished down as tensions between Russia and Ukraine remained unchanged, and US President Joe Biden was en route to Brussels for the NATO and G7 summits, highlighting the possibility of NATO forces being increased surrounding Ukraine. The Dow Jones Industrial Average finished 1.32 percent lower, the S&P 500 finished 1.24 percent lower, and the Nasdaq Composite finished 1.30 percent lower.

Since Russia’s initial strike on Ukraine in February, over 140,000 NATO troops have been deployed, 100,000 of which are US forces. Troops are dispersed throughout Ukraine’s neighboring nations, including Poland, Slovakia, Hungary, and Romania. At least 140 warships and 130 aircraft are stationed in this alliance, ready to battle if a NATO country is attacked or if Russia begins to utilize biological or chemical weapons. This situation will most probably result in a conflict that escalates in Eastern Europe, having a direct effect on Europe’s and the United States’ capital markets.

With the Russia-Ukraine conflict intensifying, it will exacerbate future disruptions in the supply of energy and raw materials, causing global inflation to continue to rise and persist for an extended period. A recession indicator appeared in the form of the 10-year US bond yields passing the two-year yield. This condition very likely implies that long-term economic growth will be riskier and that the local and global economies would stagnate, posing a threat to the global economy.

World gold prices began to gradually edge out of the bearish zone and exhibit turnaround characteristics. The current rising in international gold prices is a result of the deteriorating situation in the Ukraine-Russia war, which has lasted more than a month.

It is worth noting that Russia began a military campaign against Ukraine on February 24 and there has been no sign of peace between the two nations in the month afterward. The most recent development in the Ukraine-Russia confrontation is NATO’s backing for Ukraine by stationing extra troops on its border. This, of course, has the potential to re-ignite tensions between the two belligerent nations.

On the other side of the COVID-19 pandemic, a new virus strain, Omicron Subvariant BA.2, has been claimed to have infected over 250,000 people in Germany in just one day last week. This exacerbates the pandemic situation and creates an opportunity for safe-haven assets such as gold to strengthen once more this week.

Main Pairs Movement

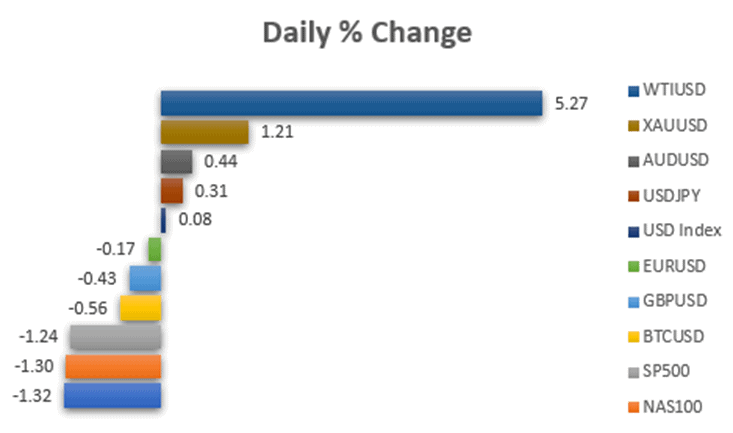

On Wednesday, WTI gained moreover 5% as Russia threatened to upset the natural gas market.

Gold edged higher on Wednesday, finishing at $1948, owing to the uncertainty surrounding US President Biden’s talks with NATO, as well as the fact that US inflation continued to spiral out of control as the Ukraine issue intensified.

On Wednesday, higher energy costs continued to dominate currency market fluctuations, with the Australian dollar gaining and the yen weakening. The Australian dollar increased to its highest level since December 2015 against the Japanese yen and has gained 8% so far in March.

Technical Analysis

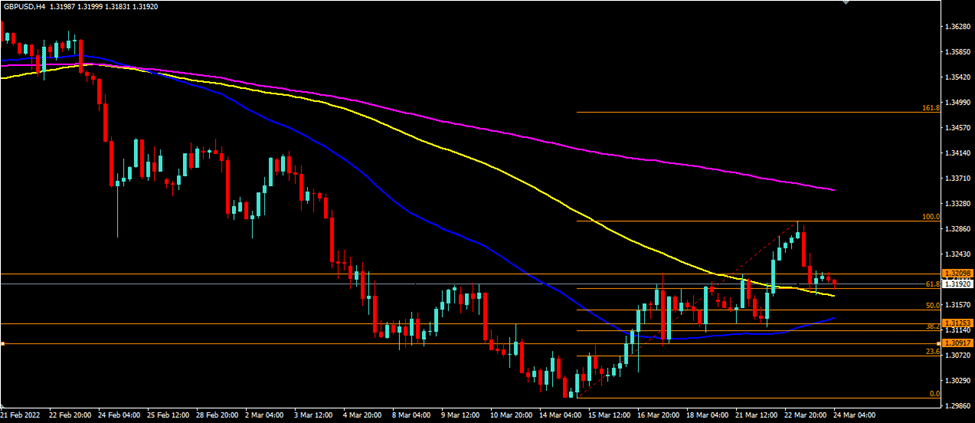

GBPUSD (4-Hour Chart)

Cable has broken over our previously anticipated resistance level of 1.3209 on the technical side, although upward momentum appears to be waning and back below the resistance level. Cable is currently trading above its 50-day and 100-day SMAs but below its 200-day SMA on the four-hour chart.

Resistance: 1.3209

Support: 1.3125

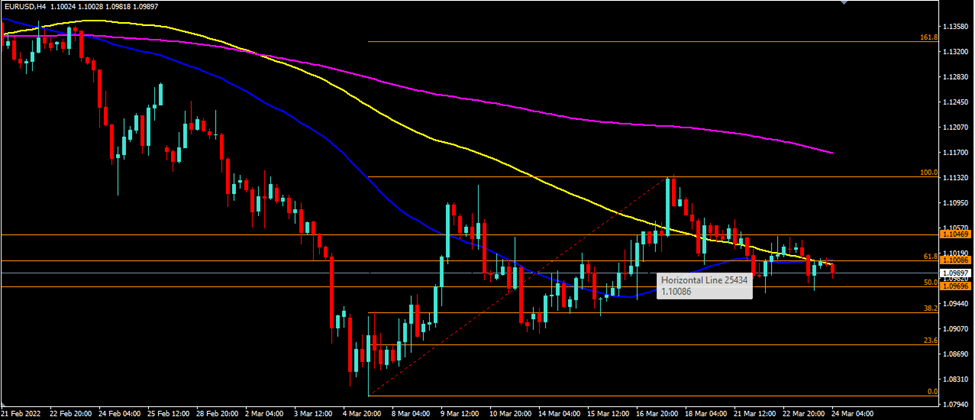

EURUSD (4-Hour Chart)

On a technical level, the EURUSD has successfully defended our previously anticipated resistance level at 1.1008, while the nearest support level is at 1.0969 (50% Fibonacci levels). EURUSD is currently trading below its 50-day, 100-day, and 200-day SMAs on the four-hour chart.

Resistance: 1.1008, 1.1046

Support: 1.0969

XAUUSD (4-Hour Chart)

On a technical level, our previously anticipated resistance level of $1953 per ounce remains untested. On the other hand, the XAUUSD’s near-term support has been tested and the price bounces back from the $1921 per ounce level. XAUUSD is currently trading below its 100-day SMA but above its 50-day and 200-day SMAs on the four-hour chart.

Resistance: 1953

Support: 1921