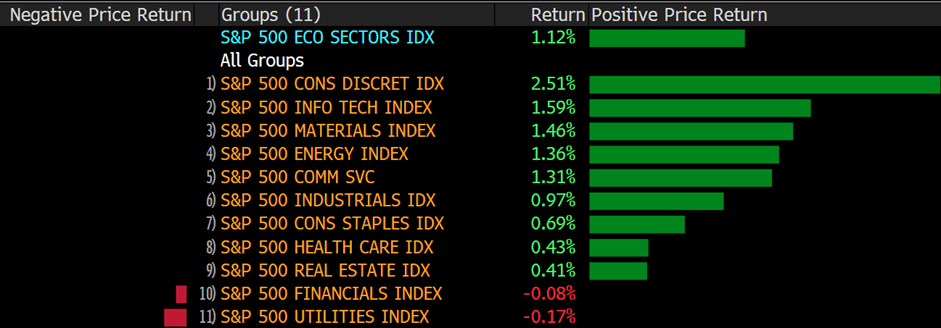

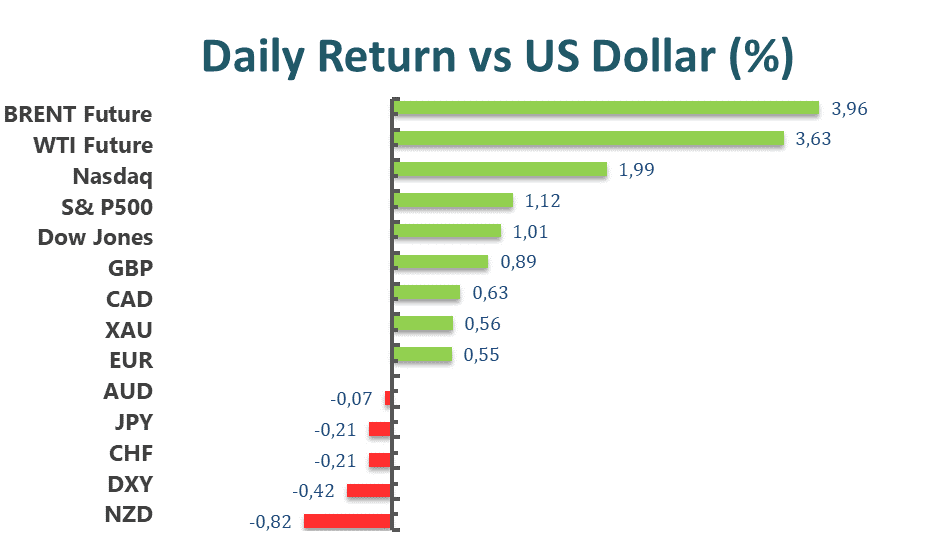

On Wednesday, US stocks climbed as investors digested a series of carefully anticipated quarterly reports and continued to absorb a scorching reading on US inflation. The S&P 500 index gained more than 1%, snapping a three-day losing trend. The Nasdaq Composite excelled and gained 2% as technology stocks rallied and Treasury yields across the curve fell. Early Wednesday morning, investors received several quarterly reports from several significant US firms and stock index components. These included JPMorgan Chase (JPM), the largest bank in the United States in terms of assets, Delta Air Lines (DAL), and Bed, Bath & Beyond (BBB) (BBBY).

Inflation is on the rise, central banks are on the move, and earnings season has here. To top it off, stock traders must contend with the market-roiling prospect of a monthly options expiry worth more than $2 trillion.

Approximately $495 billion in single-stock derivatives are expected to expire Thursday, followed by $980 billion in S&P 500-linked contracts and $170 billion in options tied to the State Street fund that tracks the S&P 500, according to estimates from Goldman Sachs Group Inc.’s Rocky Fishman. Volumes of this nature have been a cause of volatility throughout the last year.

While nothing is certain in markets, indexes have historically declined on days when contracts are closed out. This time, it comes as equities endure yet another round of volatility, with the S&P 500 recording only four positive days since the month began.

Main Pairs Movement

Inflation, central banks, and the Eastern European crisis remained at the center of the market’s attention, weighing on sentiment. The latest UK CPI increased to a three-decade high of 7%, while the US CPI increased by 8.5 percent year on year, both figures above expectations.

The Bank of Canada boosted benchmark interest rates by 50 basis points to 1.00 percent and also revealed intentions to begin shrinking its balance sheet on April 25, citing an increased risk of forecasts of rising inflation becoming entrenched. Earlier that day, the RBNZ increased the official cash rate by 50 basis points to 1.5 percent. Today, the European Central Bank will make its monetary policy announcement.

For the time being, Germany has opposed the EU’s ban on Russian oil, while Moscow has announced that US and NATO vehicles bringing weaponry to Ukraine would be deemed valid military targets.

Euro/dollar is trading near 1.0880, while the cable is barely above the 1.3100 level. Australian trades in a range around 0.7440, while the Loonie closed in the red at 1.2565. USD/JPY hit a new multi-year high of 126.31.

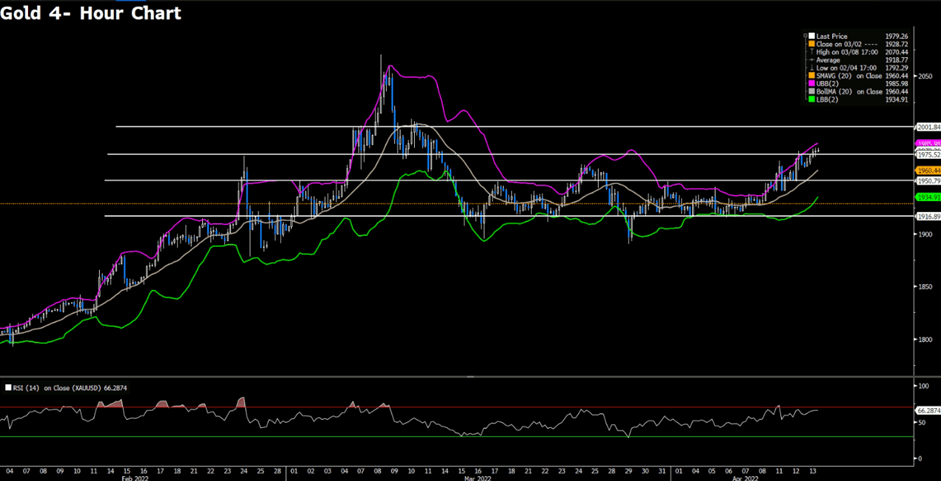

Gold prices continue their upward trend, trading around a new multi-week high of $1,981.57 per troy ounce. Risk-off emotions in general, along with the dollar’s decline during the American session, kept the metal bid intact throughout the day. Crude oil prices continued to rise, reaching a high of $103.50 per barrel for WTI and $108.40 per barrel for Brent.

Technical Analysis

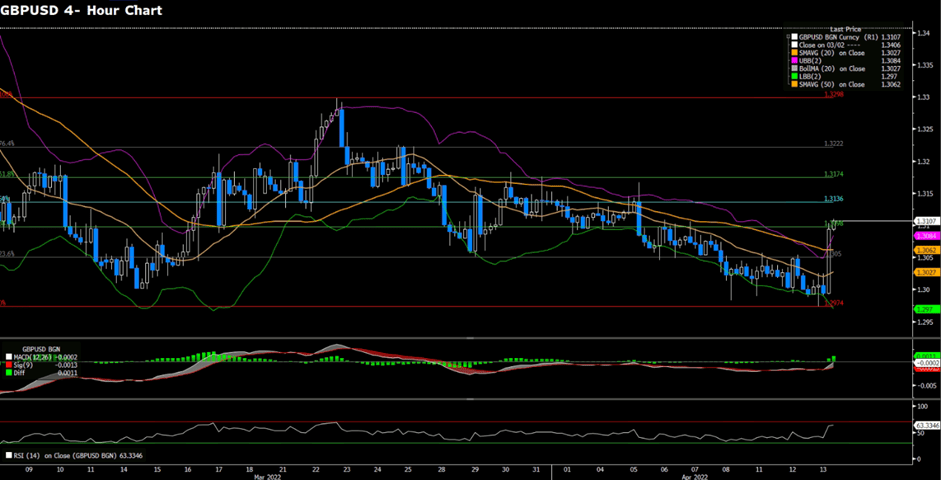

GBPUSD (4-Hour Chart)

GBPUSD trades near an intraday high of 1.3100 as market players drop the US dollar. Market players bet on the BOE’s monetary policy meeting next week. From the technical perspective, GBPUSD’s intraday bias punctuates the bearish tone as it successfully up-breaks the 20 Simple Moving Average and the midline of the Bollinger band. At the same time, the upside momentum also breaches the descending trend line on the four-hour chart. However, to attract bulls, GBPUSD needs to close its intraday price above 1.3098 to fully reclaim its bullish momentum. As the RSI has not reached the overbought condition, GBPUSD still has room to extend further north.

Resistance: 1.3136, 1.3174

Support: 1.3098, 1.305, 1.2974

XAUUSD (4-Hour Chart)

Gold continues to climb, trading near a fresh multi-week high of $1981.57, alongside the US dollar’s weakness on Wednesday. From the technical aspect, gold maintains its bullish bias, continuing to favor the upside. On the four-hour chart, gold has breached the immediate hurdle at $1975, showing some upside strength. At the same time, gold sustainably trades above the 20 Simple Moving Average and trades within the upper bounce of the Bollinger band, suggesting absent selling interest at the time being. Gold’s positive move is expected to go on as the RSI has not fully reached the overbought territory, giving room for gold to extend further north toward $2001.

Resistance: 2001

Support: 1975, 1950, 1916

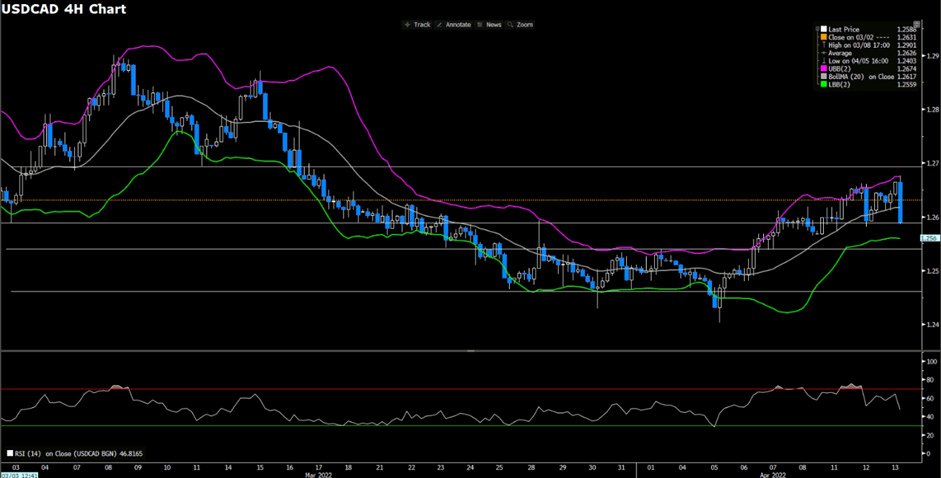

USDCAD (4-Hour Chart)

The Canadian dollar gains traction against the US dollar following the announcement from the Bank of Canada Governor Tiff Macklem that the BOC raises the interest rate to 1% in response to the inflationary pressure. USDCAD slides toward its support at 1.259 after the BOC raises 50 bps on its interest rate. From the four-hour chart, the near-term outlook of USDCAD turns downside, piercing below the midline of Bollinger Band. Failure to defend the 1.2590- 1.2600 level will attract some fresh sellings toward the next support at 1.2543. As the RSI is well above the oversold territory, USDCAD has plenty of room to move further south.

Resistance: 1.2700

Support: 1.2590, 1.2543, 1.2460

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

| AUD | Employment Change (Mar) | 09:30 | 40K |

| EUR | Deposit Facility Rate (Apr) | 19:45 | -0.5% |

| EUR | ECB Marginal Lending Facility | 19:45 | 0.25% |

| EUR | ECB Monetary Policy Statement | 19:45 | N/A |

| EUR | ECB Interest Rate Decision (Apr) | 19:45 | 0% |

| USD | Core Retail Sales (MoM) (Mar) | 20:30 | 1% |

| USD | Initial Jobless Claims | 20:30 | 171K |

| USD | Retail Sales (MoM) (Mar) | 20:30 | 0.6% |

| EUR | ECB Press Conference | 20:30 | N/A |