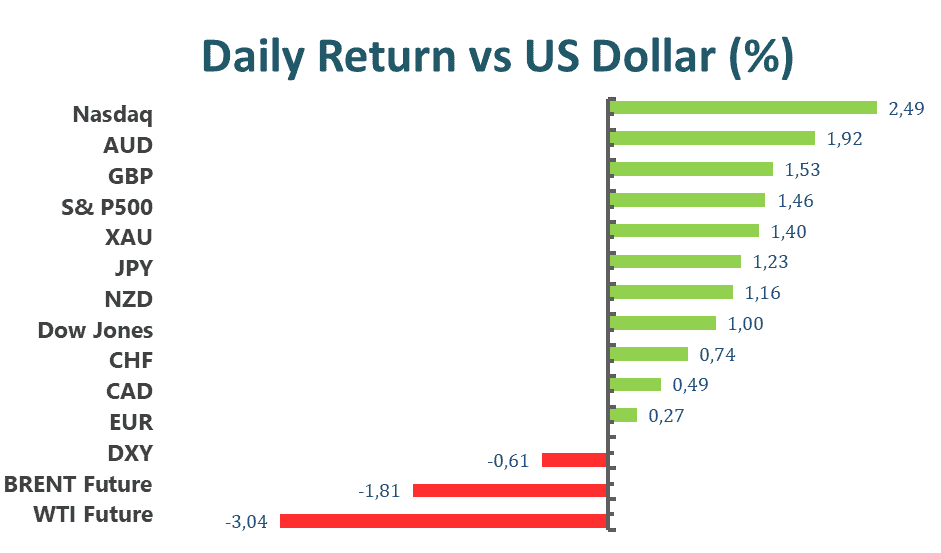

US shares rallied on Wednesday after the Fed raised the interest rates by 75 basis points, the largest increase since 1994. In the meantime, the Fed chairman, Jerome Powell signalled that the Fed could raise interest rates by a similar magnitude in July, promising to tackle the inflation. The markets were boosted and given confidence, thus three major US indices jumped at the end of the day on Wednesday; the Nasdaq Composite rallied 2.5% and the S&P 500 climbed 1.46% to 3789.99; the Dow Jones Industrial Average rose 1%, ending a five- day losing streak. Despite rising rates at such a rapid pace from the Fed had no surprise to the general, the market seemed to cheer for the confirmation of the Fed’s commitment to fighting the inflation battle.

The ECB announced that it plans to create a new tool to tackle the risk of eurozone fragmentation, attempting to calm the fears of a new debt crisis. The new decision came after the ECB surprised markets with an emergency meeting to address higher borrowing costs for several European governments compared to the benchmark German bonds. In response to the fragmentations, the ECB mentioned that it would reinvest redemptions from its emergency bond-purchasing program, the so-called PEPP. In the meantime, the ECB promised that it will accelerate the completion of the design of a new anti-bond fragmentation instrument.

Main Pairs Movement

NZD/USD traded 1.17% higher and closed at 0.62853 on Wednesday. The greenback lost ground after the FOMC interest rates decision as Fed Chairman Powell said the next hike could either be 50 or 75 basis points, causing the demand for the greenback goes down.

EUR/USD was up 0.24% and closed at 1.04403 at the end of the day. The greenback seemed to lose interest on Wednesday, the day that the US Fed was in the spotlight. Though the Fed raised the rates by 75 basis points, the highest since 1994, the greenback lost interest after the Fed dismissed the chances of 100 basis points.

The US dollar Index was on the backfoot, dropping 0.6%. The demand for the greenback declined after a dovish hawkish Fed following the comment from Fed Chairman Powell, denying the possibility of a 100 basis point hike in July. With the dovish move from a hawkish Fed, most of the G-10 currencies got boosted, and so did the precious metal, gold, edging 1.41% higher, to $1833.97 per ounce.

Technical Analysis

EURUSD (4-Hour Chart)

EURUSD rebounded throughout Thursday’s trading. The dollar fell sharply after the FOMC raised interest rates by 75 basis points. The broad-based Dollar weakness allowed the Euro to rebound from earlier losses during the Europan and Asia trading hours. This short-term rebound, however, might not be sustainable as the interest rate difference between the Fed and the ECB has now increased even further.

On the technical side, EURUSD has found fresh support around the 1.038 price region. Near-term resistance has formed near the 1.049 price region. RSI for the pair has recovered from the oversold territory and is currently indicating 43.6. On the four-hour chart, EURUSD trades below its 50, 100, and 200-day SMA.

Resistance: 1.049

Support: 1.03783

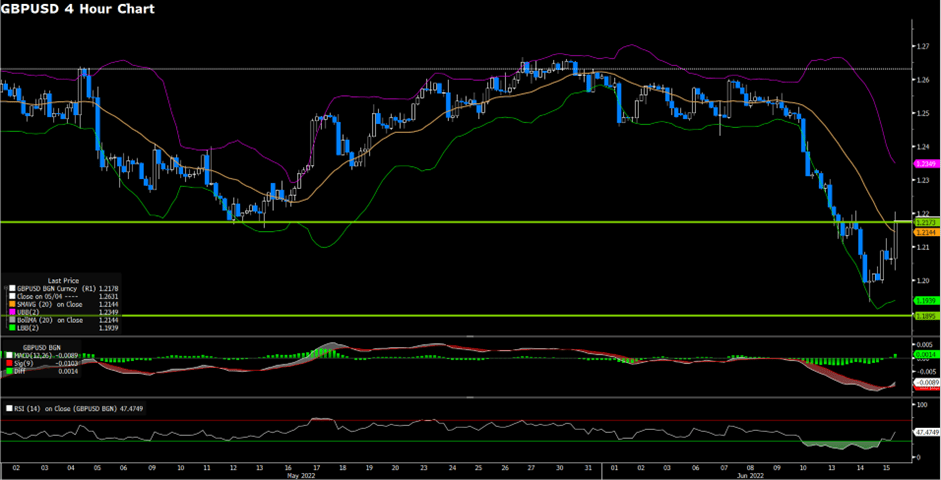

GBPUSD (4-Hour Chart)

GBPUSD gained 1.5% throughout Thursday’s trading. The FOMC has increased interest rate by the most significant margin in 40 years, in an attempt to control soaring inflation. Fed chair Jerome Powell has also indicated that either a 50 or 75 basis point interest rate hike is likely at the FOMC’s July meeting. The BoE is set to announce its interest rate policy and financial guidance during the European trading session.

On the technical side, GBPUSD has rebounded strongly from our previously estimated support level of 1.20824, the pair met fresh resistance around the 1.218 price region. RSI for Cable is currently sitting at 66.16. On the four-hour chart, GBPUSD is trading above its 50-day SMA, but below its 100 and 200-day SMA.

Resistance: 1.25944

Support: 1.20824

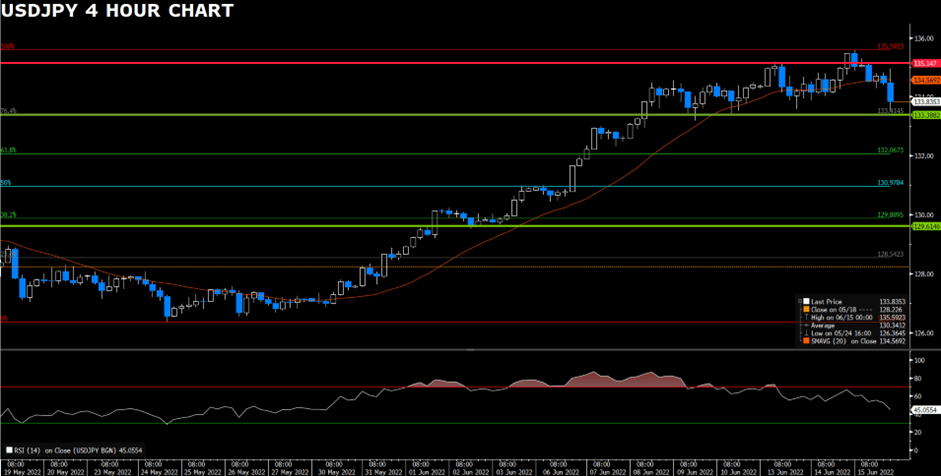

USDJPY (4-Hour Chart)

USDJPY fell 1.23% throughout Thursday’s trading. The 75 basis point increase in interest rates has weakened the Dollar as the U.S. 10-year Treasury yield retreats below the 3.3% level. The interest rate difference between the U.S. and Japan will further encourage carry trades as the interest rate differential increases. The BoJ’s insistence on an easy money policy shows a stark contrast between the two central banks.

On the technical side, USDJPY has met its fresh resistance at 135.6, while support levels at 133.5 and 132.5 remain firmly intact. RSI for USDJPY indicates 66.18, as of writing. On the four-hour chart, USDJPy currently trades above its 50, 100, and 200-day SMA.

Resistance: 134.56

Support: 133.5, 132.5

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

| USD | FOMC Economic Projections | 02:00 | – |

| USD | FOMC Statement | 02:00 | – |

| USD | Fed Interest Rate Decision | 02:00 | 1.5% |

| USD | FOMC Press Conference | 02:30 | – |

| NZD | GDP (Q1) | 06:45 | 0.6% |

| AUD | Employment Change (May) | 09:30 | 25K |

| CHF | SNB Interest Rate Decision (Q2) | 19:00 | -0.75% |

| GBP | BoE Interest Rate Decision (Jun) | 19:00 | 1.25% |

| USD | Initial Jobless Claims | 20:30 | 215K |

| USD | Philadelphia Fed Manufacturing Index (Jun) | 20:30 | 5.5 |