Market Focus

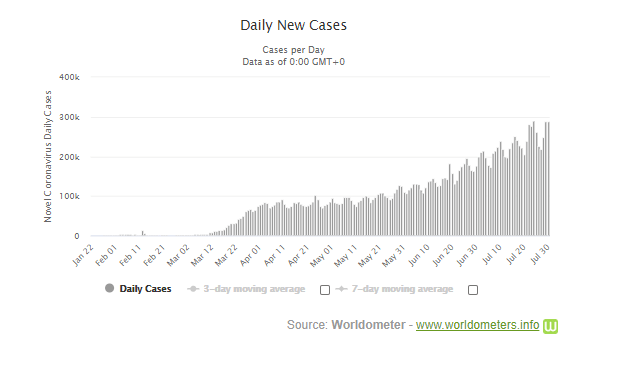

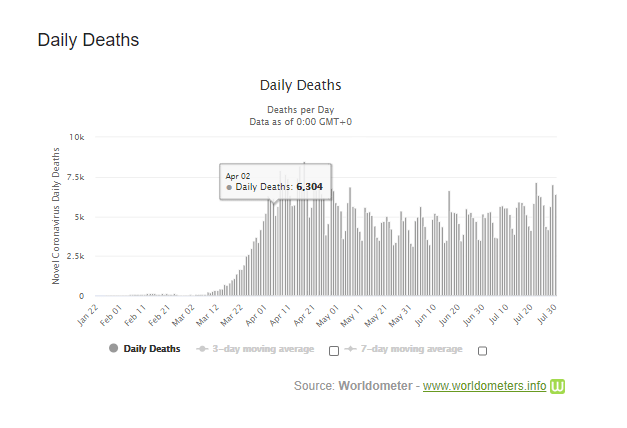

U.S. market continues to fall amid the concern of a resurgence of COVID-19 and a selloff in giant oil businesses. Energy shares, such as Exxon and Chevron, lead declines in the S&P500. Along with recent poor fundamentals, U.S. economic rebound might make it tougher for equities to gain further momentum. Risk sentiments continue to take place while the greenback continues to behave weaker. Nonetheless, there is good news, which the U.S. Senate just passes the House’s HERO Act, which can potentially be view as a temporary savior for American economy.

The British government announces to tighten its lockdown policy again across a large part of northern England. In the meanwhile, France and Spain also consider locking- down their regions. If the lockdown policy is imposed, it will essentially lead the euro- area into another economic shrinkage. Meanwhile in Asia, Tokyo also announces that a tighter restriction is considered to be necessary if coronavirus situation worsens. To sum up, global economy might confront another economy contraction while waiting for a coronavirus vaccine.

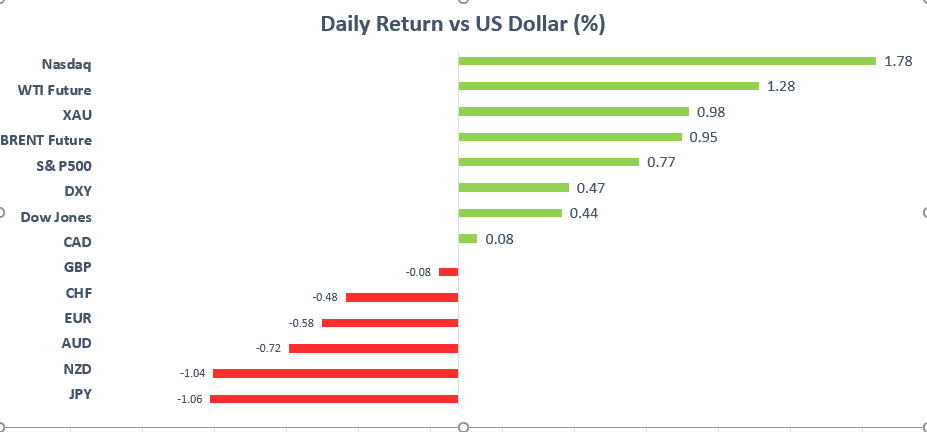

Market Wrap

Main Pairs Movement

The dollar Index sinks below 93.00 since 2010. The dollar continues to stay under pressure in the ongoing scenarios of the unabated COVID-19, weak fundamentals, and low U.S. yield. The dollar against its main peers is down about 4.5% in July, which is the worst in a decade. The greenback, one of the most reservable currencies, is dragged down by the election issue raised by President Trump, and the disappointment over America’s response to COVID-19.

EURUSD erased the day’s gains; however, the euro still stayed on track for its best month since early 2010. EURUSD dropped about 0.51% at 1.1790 as of writing under the onset of dismal economic reports from Europe. Although the dollar extended its declines, the euro still gave up its gain due to the potential economic contraction in the eurozone.

COVID-19 Data (EOD):

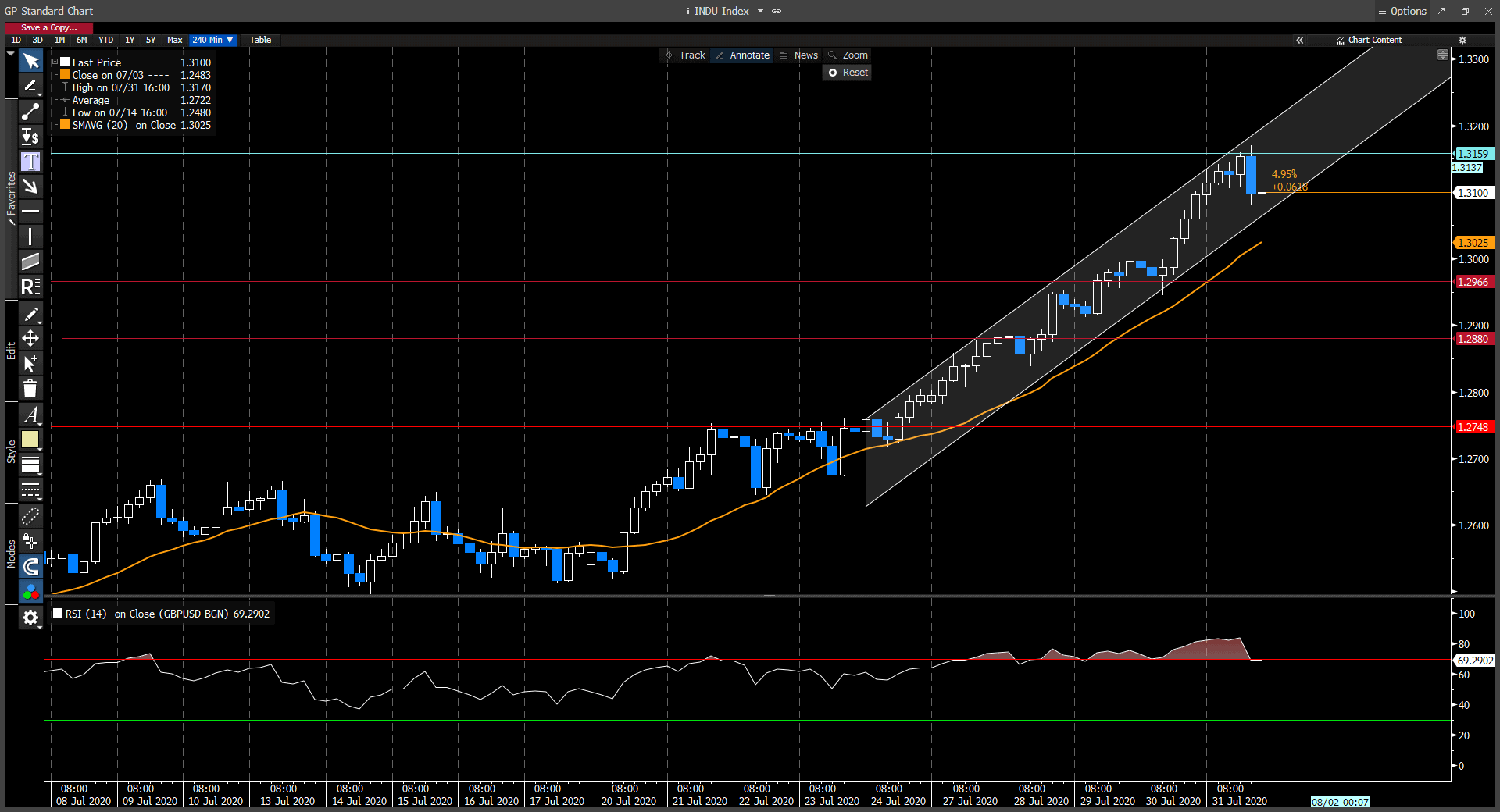

Technical Analysis:

EURUSD (H4)

Despite of declining around 0.50% in a daily basis, GBPUSD in general is still in an upward momentum. The RSI indicator on the 4- hour chart shows that EURUSD is in an extreme overbought condition at the level of 82%. Currently, two support pivots await at 1.2966 and 1.2748. EURUSD should be expected to carry its monthly bullish momentum as the pair is firmly trading above the 20 SMA in the four- hour chart.

Resistance: 1.3159

Support: 1.2966, 1.2880, 1.2748

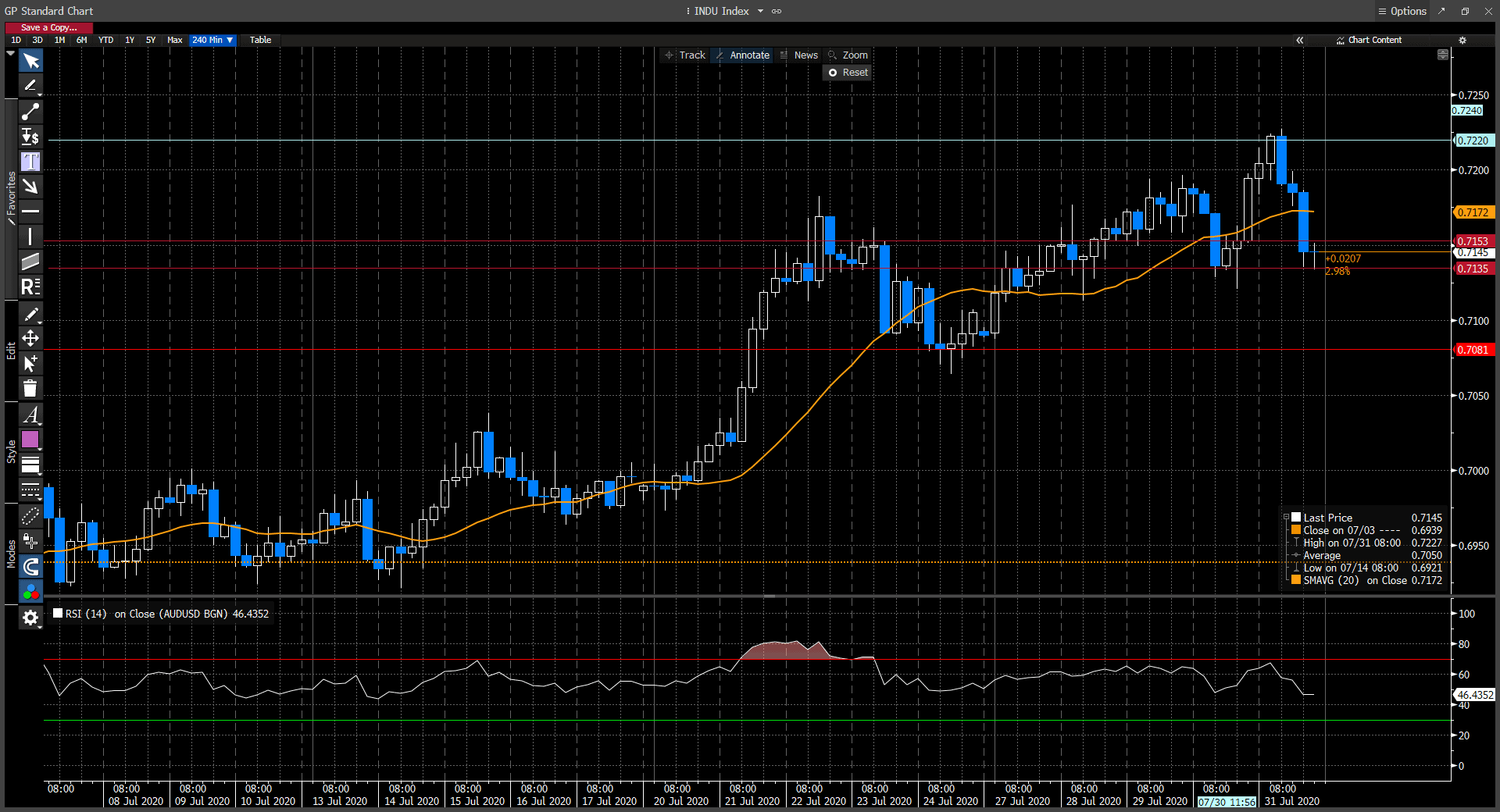

AUDUSD(H4)

AUDUSD finished its fifth straight day in the positive territory. On the 31st of July, USD bounded back as the U.S. Senate approved the stimulus plan and the Fed promised to help the domestic economy. AUDUSD retreated back to the zone of correction. The pair currently traded closely on the 20 SMA with a strong support level at 0.7153, followed by 0.7135 and 0.7081. Since the pair is currently in the stage of correction, this coming week will be crucial for the pair to determine its direction.

Resistance: 0.7220

Support: 0.7153, 0.7135, 0.7081

USDJPY (H4)

USDJPY gained traction during American trading session. After 5 days of depreciation, the pair was up around 0.4% on a daily basis at 105.13, which was the highest since last week. USDJPY has high possibility to retreat due to the breakthrough of the 20 SMA in the 4- hour chart. Current resistance level at 104.32 seems to be weak because the pair only test it once. On the other hand, the second resistance level at 105.06 is a strong pivot for the pair due to previous consolidation.

Resistance: 105.06, 104.32

Support: 105.59, 106.77

Economic Data

| Currency | Data | Time (TP) | Forecast |