Key points:

- Asian Markets Rally: Fresh optimism about potential U.S. interest rate cuts boosts stocks across Asia, despite ongoing concerns in China and Japan.

- Major Economic Indicators: Upcoming reports on Japan’s GDP, Australian unemployment, and monetary policy in the Philippines could steer market directions.

Asian markets are set to climb higher on Thursday, fuelled by the positive sentiment that followed benign inflation figures from the U.S. This optimism suggests that the Federal Reserve might begin reducing interest rates, a move eagerly anticipated by investors.

Economic uncertainties in China and Japan

In China, however, the economic outlook remains clouded by the threat of deflation, which continues to suppress the appetite for risk. Meanwhile, the Japanese market faces potential disruptions from a recent yen rebound, which may impede the recovery of its equity markets.

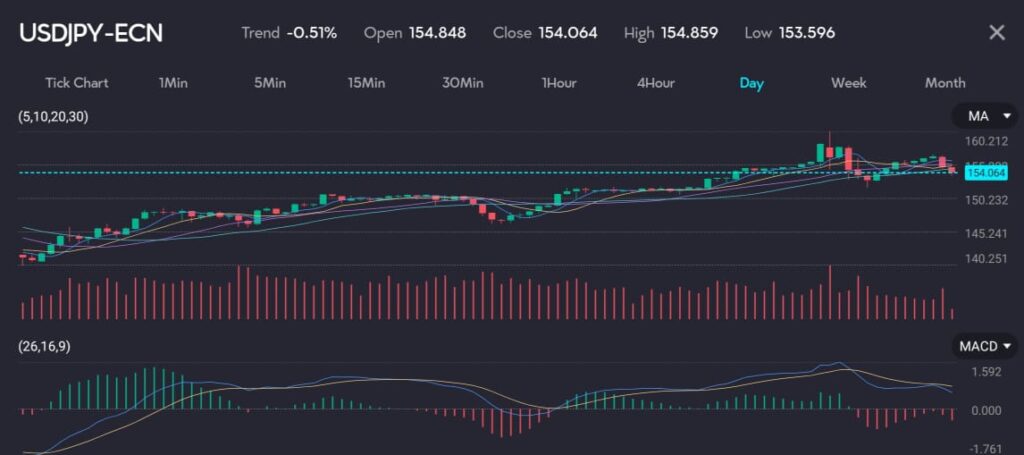

Picture: Recent strengthening of the yen as seen by the VT Markets app.

Across the broader market, the atmosphere is overwhelmingly positive. Stock prices are soaring, bond yields are at their lowest in months, the U.S. dollar is weakening, and there’s a robust demand for riskier assets, including those in emerging markets.

Investors eye rate cuts following U.S. inflation report

The April U.S. inflation report has become a focal point, leading investors to anticipate rate cuts as early as July, with expectations of a total reduction reaching 50 basis points for the year. This sentiment is bolstered by historical data indicating a consistent slowdown in the core CPI changes over the past 18 months.

In Asia, investors are also preparing for several critical economic updates. These include the first-quarter GDP from Japan, which is expected to show a contraction, hinting at economic challenges that could influence future policy decisions by the Bank of Japan. Despite these difficulties, the market anticipates a rate hike in 2024.

New U.S. tariffs intensify economic challenges in China

In China, market struggles are more pronounced, reflecting broader economic challenges. These are exacerbated by new U.S. tariffs on select Chinese imports, which could dampen investor sentiment further.

Investors will keenly watch these developments, along with the Australian unemployment figures for April, as they navigate the market dynamics and adjust their investment strategies accordingly.

Start trading now — click here to create your live VT Markets account.