Key points:

- US CPI and Fed speakers: Potential impact on interest rate expectations.

- Global market trends: Insights into current shifts in major stock indices and commodity prices.

The US consumer price index (CPI) will be closely monitored this week, as it could influence the Federal Reserve’s decision on a potential rate cut in September. Market participants are particularly sensitive to changes in core CPI, which is expected to rise by 0.3% for the month of April.

A figure lower than the March increase of 0.4% could heighten expectations for a rate cut as early as July, despite the market currently pricing in only a 25% probability of such an event.

Jerome Powell to remark on policy changes in May 2024

Federal Reserve Chair Jerome Powell and other Fed officials are scheduled to speak this week, which could provide further clarity on the central bank’s policy direction. Their comments are especially crucial after Powell’s upcoming appearance with the head of the Dutch central bank.

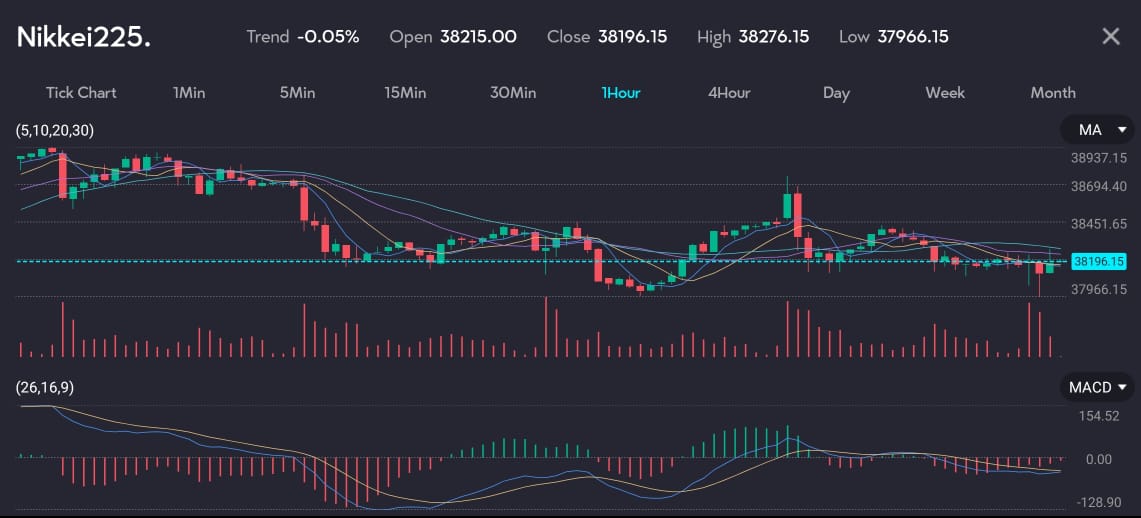

Yen’s weakness sparks Nikkei decline

In Asia, the Japanese Nikkei index has seen a slight decline by 0.2% due to ongoing speculation about potential monetary tightening by the Bank of Japan in response to the yen’s weakness. Intervention risks loom if the yen continues to fall, currently standing firm at 155.92 against the US dollar.

Picture: Nikkei on decline as seen on VT Markets app.

Chinese markets soar on economic data optimism

Chinese markets have reacted positively to recent economic data, with blue chips reaching a seven-month high. This optimism is underpinned by an uptick in inflation and the anticipation of key economic indicators set to be released on Friday, including retail sales and industrial output.

Additionally, the potential issuance of 1 trillion yuan in bonds could further stimulate domestic spending.

US futures steady after strong earnings season

In the US, the S&P 500 and Nasdaq futures have stabilised early Monday, following a robust earnings season that saw a 7.8% increase in earnings, surpassing initial expectations.

Commodity prices show mixed signals; while gold has seen an increase, reaching $2,362 per ounce due to sustained buying interest, oil prices have slightly decreased with Brent crude at $82.52 a barrel, reflecting rising US inventories.

Start trading now — click here to create your live VT Markets account.