Key points:

- Australian dollar hits 20-month high against the kiwi at NZ$1.1017.

- Aussie reaches 33-year high against the yen at 109.21 yen.

The Australian dollar is showing robust performance against both the New Zealand dollar and the Japanese yen. This surge we believe is largely driven by contrasting monetary policy expectations in Australia and New Zealand.

The Australian dollar (AUDUSD) stood strong at NZ$1.1080, close to a 20-month high of $1.1017 reached on Wednesday. This strength followed the Reserve Bank of New Zealand’s (RBNZ) unexpected signal of potential rate cuts, which has weighed heavily on the kiwi. Market resistance for the Aussie is at NZ$1.1088, matching the high from February

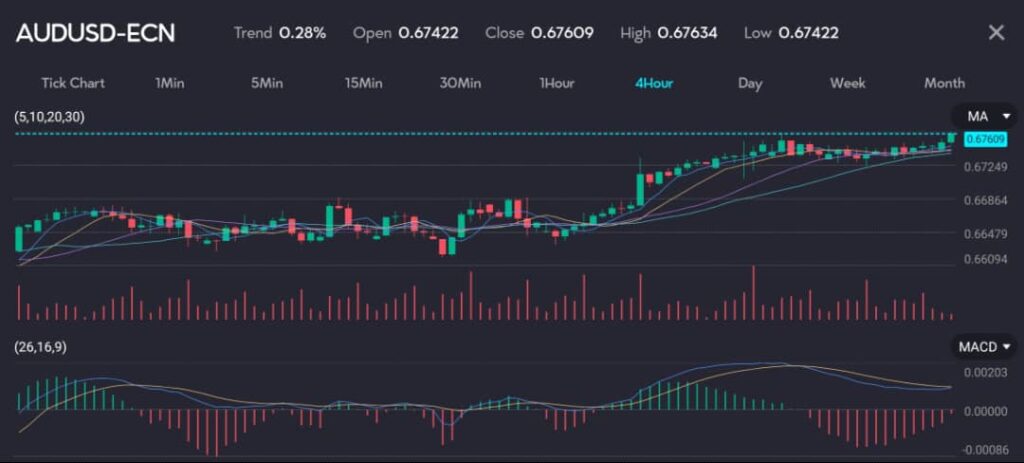

Picture: Aussie on the rise, trading at 0.67609 on the VT Markets app.

RBNZ dovish stance impacts Australian rate expectations

The dovish shift from the RBNZ has rippled through the market, influencing expectations in Australia as well. Currently, swaps indicate a 20% chance of a rate rise from the Reserve Bank of Australia (RBA) in August, a decrease from 30% prior to the RBNZ’s announcement. Despite this, the potential for another rate hike has helped the Australian dollar outperform, especially against the Japanese yen.

On Thursday, the Australian dollar hit another 33-year peak against the yen, reaching 109.21 yen (AUDJPY). This milestone underscores the strength of the Aussie amidst diverging interest rate expectations between the two countries.

Also read: Aussie approaches six-month high despite diverging rate expectations

Against the US dollar, the Australian dollar was up 0.1% at $0.6752, with resistance noted at $0.6762. This modest rise indicates steady market confidence in the Aussie, despite broader economic uncertainties.

Kiwi edges up amid RBNZ stance adjustments

The New Zealand dollar (NZDUSD) also saw a slight increase of 0.1%, trading at $0.6088 after a 0.7% decline overnight that took it to $0.6082. The kiwi has support at the 200-day moving average of $0.6075, reflecting ongoing market adjustments to the RBNZ’s dovish stance.

Two-year New Zealand swap rates fell by another 4 basis points to 4.575%, marking the lowest level in 20 months, following an 18 basis point drop the previous day. This decline highlights the market’s recalibration in response to the RBNZ’s communication.

Market sentiment currently implies a 50% chance that the RBNZ could cut interest rates at their next policy meeting in August. Additionally, 45 basis points of easing are anticipated throughout 2024. In contrast, investors do not expect any rate cuts from the RBA until late 2025, showcasing the differing economic trajectories of the two nations.

Start trading now — click here to create your live VT Markets account.