Key points:

- The dollar remains steady as investors anticipate US inflation updates.

- Speculations about Federal Reserve rate cuts shape market expectation.

The dollar is holding its ground against major currencies as market participants await crucial US inflation data, set to be released this week. The data is expected to play a significant role in the Federal Reserve’s decision-making about potential rate cuts in 2024.

Recent employment figures, which came in below expectations, along with the Fed’s pause on rate hikes, have led traders to predict a softer monetary policy, with around 40 basis points of cuts anticipated next year.

PPI and CPI releases in May 2024

This week, all eyes will be on the US as the Producer Price Index (PPI) and Consumer Price Index (CPI) are due for release.

These indicators will provide valuable insights into inflation trends, which are pivotal in shaping the Fed’s upcoming decisions.

Yen intervention concerns rise ahead of US CPI data release

On the topic of intervention, the yen remains a focal point due to Japan’s potential currency interventions. With the US CPI data on the horizon, there’s a heightened awareness that strong inflation numbers could prompt Japan to act to stabilize its currency.

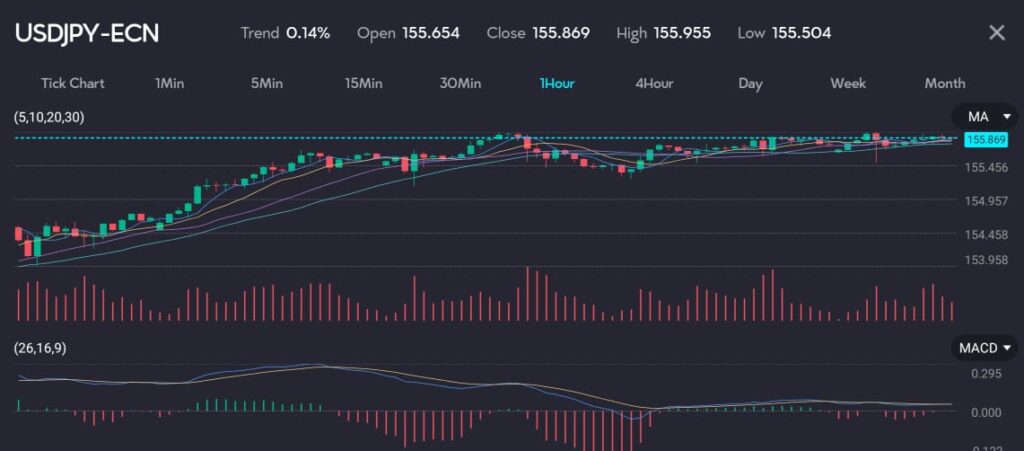

Currently, the dollar is trading at 155.87 yen, a slight increase following suspected intervention by Japanese authorities aimed at bolstering the yen.

Picture: The dollar sees slight increase on VT Markets app.

Yuan weakens, bank lending drops

Meanwhile, China’s financial metrics continue to draw attention. The yuan has slightly weakened, with offshore trading at 7.2412 and onshore dipping to its lowest since late April.

You might be interested: Chinese Stocks See Mixed Results Before Labour Day

Recent reports indicate a drop in new bank lending and a record low in broad credit growth, adding layers of complexity to China’s economic landscape.

Start trading now — click here to create your live VT Markets account.