Key points:

- Investors are on high alert for the U.S. inflation report due this Wednesday, expected to influence future rate decisions.

- The Japanese yen approaches intervention-trigger levels, reviving concerns as it nears a two-week low against the U.S. dollar.

The dollar held its ground on Tuesday, as the market’s attention turns to an inflation report that could dictate the course of U.S. interest rates. Meanwhile, the yen stayed close to a two-week low, igniting fears of potential governmental intervention.

Federal Reserve response to labour data in May 2024

This calm in the currency market reflects a period of evaluation, with traders considering the Federal Reserve’s potential actions in response to recent U.S. labor market figures and central bank commentary. Investors have moderated their expectations for rate reductions this year, now forecasting a reduction of 42 basis points, with a 60% probability of a cut by September.

Wednesday’s spotlight will shine on the Consumer Price Index, anticipated to report a 0.3% increase in core CPI for April, a slight decrease from March’s 0.4%.

Before this, the market will digest the U.S. Producer Price Index, set for release later today, to assess whether inflation trends towards the Federal Reserve’s 2% goal.

Euro and pound steady as dollar index holds firm

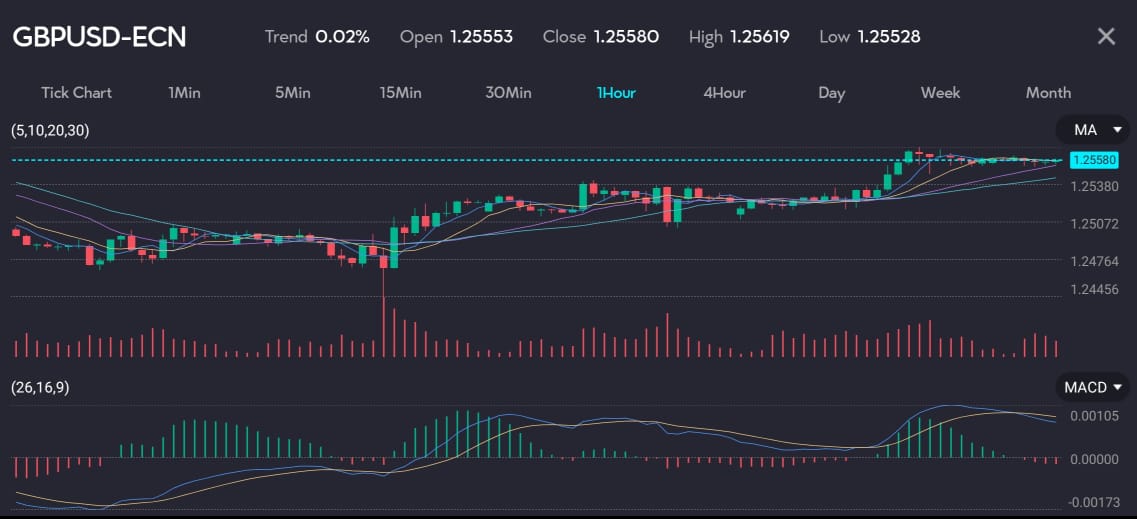

In currency pairs, the euro held nearly steady against the dollar at $1.0786, showing a 1% gain this month, while the British pound also saw a modest increase to $1.2554. The dollar index, a measure against six major currencies, stood at 105.25.

You might be interested: Calm in currency markets before US inflation test

Yen remains under pressure despite intervention

Picture: GBP sees an increase on the VT Markets app.

Regarding the yen, it traded at 156.32 per dollar after hitting a low of 156.40 earlier today. This movement brings back memories of late April when the Japanese Ministry of Finance likely stepped in after the yen dropped to a 34-year low. Despite these interventions, the currency remains under pressure due to Japan’s significantly lower yields compared to other major economies.

Japan’s Finance Minister emphasised ongoing cooperation with the Bank of Japan to maintain orderly currency movements, aligning with economic fundamentals rather than specific price targets.

Bond purchase cut offers yen brief support

On the bond market front, the Bank of Japan’s recent reduction in its Japanese government bond purchases sent a slightly hawkish signal, providing brief support for the yen.

The IMF has commented on Japan’s flexible approach to the yen, suggesting it aids the central bank’s focus on price stability. This stance is crucial as some analysts call for monetary adjustments to curb the yen’s weakening.Start trading now — click here to create your live VT Markets account.