Key points

- The U.S. dollar eased by 0.08% against the yen and 0.11% against the euro following Biden’s exit from the reelection race.

- The yuan remained steady after the People’s Bank of China cut a key interest rate to 1.7%.

The dollar eased on Monday following U.S. President Joe Biden’s decision to end his reelection campaign, which opens the door for another Democrat to challenge Donald Trump.

China’s yuan remained stable despite the central bank’s decision to cut a key interest rate.

The U.S. currency slipped by 0.08% to 157.38 yen early in the Asian day, while the euro gained 0.11% to $1.0895.

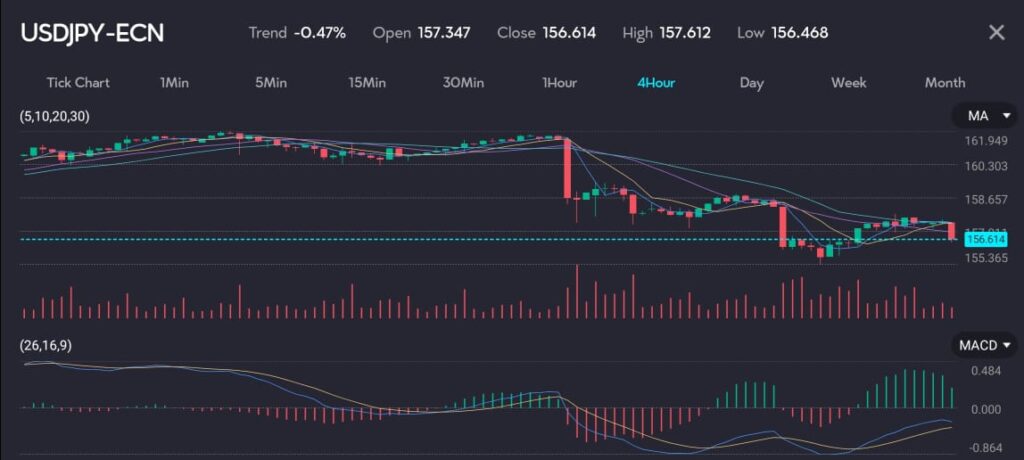

See: USDJPY trading at 156.614 as seen on the VT Markets app.

Biden endorses Harris as Trump gains momentum in betting markets

Biden announced his exit from the race on Sunday and endorsed Vice President Kamala Harris as the Democratic candidate for the November election. Former President Trump, the Republican nominee, leads betting markets after Biden’s poor debate performance last month and rising concerns about his mental competence.

This shift in the political landscape could influence market sentiments. If Harris proves to be a stronger candidate, it might turn the polls and affect the dollar’s value. The upcoming polls will play a crucial role in determining the dollar’s direction, especially in relation to the odds of a Trump win.

The British pound gained 0.15% to $1.2931, while the Australian dollar added 0.08% to $0.6691.

You might be interested: GBPUSD reaches one-year high on positive UK and negative US economic data

Dollar steady against yuan following China’s rate cut

Meanwhile, the dollar held steady at 7.2881 yuan in offshore trading after the People’s Bank of China cut the seven-day reverse repo rate to 1.7% from 1.8%. This move aims to improve open market operations and support the real economy.

Start trading now — click here to create your live VT Markets account.