In a positive turn for the stock markets, Tuesday saw a surge driven by robust earnings reports, yet concerns linger over lofty tech valuations. Major companies like Coca-Cola and Spotify exceeded expectations, while General Motors faced challenges. David Bahnsen of Bahnsen Group emphasized worries about high-tech valuations. Meanwhile, the US dollar gained strength with a rebound in Treasury yields and strong US PMI data, impacting currency markets. The article highlights the potential impact of upcoming economic data and central bank meetings on the currency market.

Stock Market Updates

On Tuesday, stock markets saw positive gains driven by a fresh wave of earnings reports and cautious monitoring of Treasury yields. The Dow Jones Industrial Average rose by 204.97 points, a 0.62% increase, closing at 33,141.38. The S&P 500 followed suit, climbing by 0.73% to finish at 4,247.68, and the Nasdaq Composite experienced a significant 0.93% uptick, reaching a level of 13,139.87. Earnings reports from major companies were a key focus for investors, with Coca-Cola reporting earnings and revenue that surpassed estimates, leading to a 2.9% increase in its stock price. Similarly, Spotify experienced a notable 10% surge after surpassing expectations with its third-quarter results. On the other hand, General Motors’ shares declined by 2.3% as the company withdrew its full-year outlook due to increased costs attributed to strikes by the United Auto Workers union. Despite this setback, the automaker did manage to post better-than-expected third-quarter results. Several tech giants, including Alphabet and Microsoft, were scheduled to release their results after the market closed, with Amazon and Meta also set to report later in the week. Despite strong earnings, some experts like David Bahnsen, the chief investment officer at Bahnsen Group, cautioned that the lofty valuations of big tech companies remain a cause for concern, suggesting that the market may be pricing them for perfection.

The ongoing earnings season has been generally positive, with around 23% of S&P 500 companies already reporting their earnings, and a significant 77% of them surpassing analysts’ expectations, according to FactSet. Despite this favorable start, concerns persist about the high valuations of many tech companies. Bahnsen Group’s David Bahnsen emphasized that the current valuations of big tech firms are excessively high, even considering the recent stock price declines observed over the past few months. He expressed skepticism about the sustainability of such valuations, suggesting that this dynamic may not end well. A significant number of S&P 500 companies are yet to report their earnings for the week, totaling around 150, making it a pivotal period for investors as they continue to assess the overall health of the market.

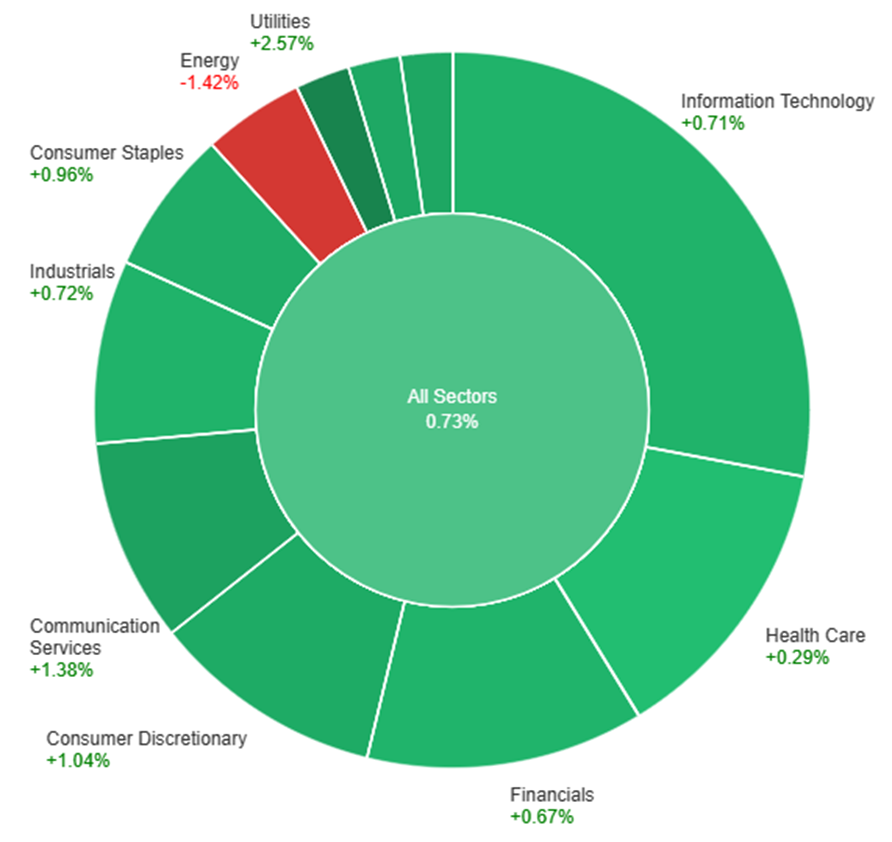

Data by Bloomberg

On Tuesday, across all sectors, the market saw a 0.73% increase in value. The top-performing sectors were Utilities, with a significant gain of 2.57%, followed by Communication Services at 1.38%, Real Estate at 1.19%, and Materials at 1.13%. Other sectors also showed positive performance, including Consumer Discretionary (1.04%), Consumer Staples (0.96%), Industrials (0.72%), Information Technology (0.71%), and Financials (0.67%). However, Health Care had a more modest increase at 0.29%, while Energy experienced a decline of -1.42% on that day.

Currency Market Updates

In the latest currency market updates, the US dollar exhibited strength, with the dollar index rising by 0.7%. This uptick was driven by a rebound in Treasury yields, following a setback on Monday, and positive flash US October PMI figures that exceeded expectations. In contrast, European and Japanese PMIs showed signs of deterioration, which put pressure on the euro. The EUR/USD pair fell by 0.74% as bund-Treasury yield spreads narrowed due to the divergence in PMIs. The potential reinforcement of this trend is anticipated with the release of US Q3 GDP data on Thursday, which is forecasted to be 4.3%. The article notes that the US dollar’s performance is also influenced by key economic data, with a focus on the European Central Bank (ECB) meeting on Thursday.

Additionally, the sterling weakened by 0.75%, primarily due to the drop in gilt-treasury yield spreads, which was accentuated by soft UK PMI data and reinforced by the view that the Bank of England’s rate hike cycle may be coming to an end. Meanwhile, the USD/JPY pair rose by 0.1%, but its upward momentum remained stalled near the 150 level. Despite a decline in 2-year Treasury-JGB yields, which was significant relative to last week’s peak, buyers are still attracted to the pair due to the substantial yield spread. However, the market remains cautious beyond the 150 level, fearing potential intervention by the Ministry of Finance (MoF) to support the yen. The article highlights that the currency market is keeping a close eye on these developments.

Picks of the Day Analysis

EUR/USD (4 Hours)

EUR/USD Surges to One-Month High as Weaker US Dollar Drives Momentum

The EUR/USD pair rallied significantly on Monday, breaking a downtrend line and reaching 1.0676, its highest level in a month, primarily due to a sharp decline in the US Dollar and improved market sentiment. As the Eurozone and the US prepare to release key PMI data and important monetary policy meetings are on the horizon, the Euro’s outlook remains favorable, though some consolidation may follow the 100-pip rally.

Based on technical analysis, the EUR/USD moved lower on Tuesday, pushing towards the middle band of the Bollinger Bands. Currently, the EUR/USD is trading just below the middle band, suggesting the potential for another push lower movement. The Relative Strength Index (RSI) stands at 49, indicating that the EUR/USD is back in neutral bias.

Resistance: 1.0616, 1.0705

Support: 1.0561, 1.0500

XAU/USD (4 Hours)

XAU/USD Slips as Resurgent US Dollar Overshadows Global Tensions

Gold prices faced downward pressure, with XAU/USD hitting an intraday low of $1,953.53 per troy ounce during London trading hours due to a resurgence in demand for the US Dollar. While global tensions simmered with delays in a ground incursion into the Gaza Strip and calls for a peaceful resolution, the Greenback gained strength, benefiting from positive US data and concerns about a steeper economic contraction in Europe, leading to a modest recovery after mid-day trading.

Based on technical analysis, XAU/USD is moving in consolidation on Tuesday and able to reach the middle band of the Bollinger Bands. Currently, the price of gold is moving just around the middle band, suggesting a possible continuation movement. The Relative Strength Index (RSI) currently registers at 58, indicating a neutral bias for the XAU/USD pair.

Resistance: $1,985, $2,002

Support: $1,973, $1,947

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| AUD | Consumer Price Index q/q | 08:30 | 1.2% (Actual) |

| AUD | Consumer Price Index y/y | 08:30 | 5.6% (Actual) |

| EUR | German ifo Business Climate | 16:00 | 85.9 |

| CAD | BOC Rate Statement | 22:00 | |

| CAD | Overnight Rate | 22:00 | 5.00% |

| CAD | BOC Press Conference | 23:00 |