Key points

- S&P 500, Nasdaq end higher, Dow down

- U.S. dollar index edges up, dollar up vs yen

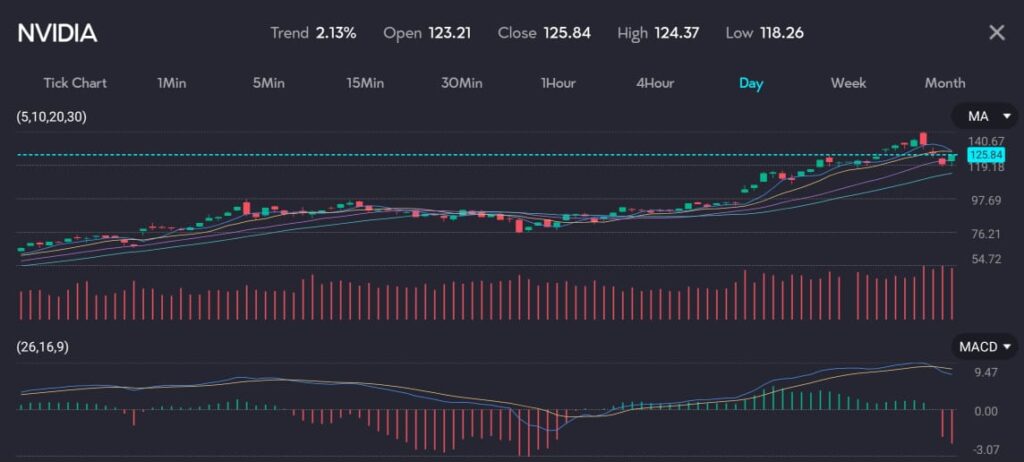

- Nvidia shares bounce after recent losses

Global stock indexes mostly climbed on Tuesday, with shares of AI chipmaker Nvidia bouncing after a three-day sell-off, while the dollar gained slightly against the Japanese yen.

Nvidia’s stock (NVDA) ended up 6.8%. The Nasdaq jumped more than 1%, also ending a three-day losing streak, while the S&P 500 technology (S5INFT) and communication services (S5TELS) sectors led gains among S&P 500 sectors.

AI hype lifts Nvidia and U.S. stocks to record high

Excitement over artificial intelligence has powered stocks like Nvidia higher and helped lift the U.S. stock market to recent record highs. However, it remains uncertain if this momentum will continue. Nvidia had surged to briefly become the world’s biggest company last week but then fell about 16% from last Thursday’s peak to Monday’s close.

Picture: Nvidia shares surge as seen on the VT Markets app.

The market showed a narrow focus, with the “Magnificent 7” group of tech-related stocks, which include Nvidia, driving the gains. Many market participants are waiting for a broader market rally.

Key inflation data and upcoming political events

Investors are gearing up for data on the personal consumption expenditures price index on Friday. This data could provide further clues on inflation and when the Federal Reserve might begin cutting interest rates. They also await snap elections in France starting at the weekend and the first U.S. Presidential debate on Thursday.

The Dow Jones Industrial Average (DJI) fell 299.05 points, or 0.76%, to 39,112.16. The S&P 500 (SPX) gained 21.43 points, or 0.39%, to 5,469.30. The Nasdaq Composite (IXIC) gained 220.84 points, or 1.26%, to 17,717.65..

You might be interested: Week ahead: Updated inflation data expected to influence policy

The U.S. dollar rose, bolstered in part by hawkish comments from a Federal Reserve official. Fed Governor Michelle Bowman repeated her view on Tuesday that holding the policy rate steady “for some time” will likely be enough to bring inflation under control. She also reiterated her willingness to raise borrowing costs if needed.

Yen nears lows, Traders watch for intervention

See: USD/JPY trading at 159.825 as seen on the VT Markets app.

The yen (USDJPY) was keeping traders alert for any signs of further intervention from Japanese authorities to prop up the currency as it traded just above a two-month low of around 160 to the dollar. It hit a record low against the euro (EURJPY) of 171.49 on Monday as pressure on the currency mounted thanks to interest rates in Japan that remain far lower than in the United States and Europe. Against the Japanese yen (USDJPY) on Tuesday, the dollar strengthened 0.06% to 159.68.

Also read: Japan’s Nikkei climbs to mid-April high on value stock surge and weaker yen

The dollar index (DXY), which measures the greenback against a basket of currencies, gained 0.11% at 105.63, with the euro (EURUSD) down 0.19% at $1.0712.

In Treasuries, the yield curve inversion between the two-year and the 10-year notes deepened to more than 50 basis points for the first time this year. It partly reversed after strong demand at a two-year auction.

The market’s immediate future hinges on upcoming economic data and geopolitical events. Investors should watch the inflation data and central bank commentary closely, as these will likely influence market directions in the near term.

Start trading now — click here to create your live VT Markets account.