In Monday’s trading session, the S&P 500 closed with minimal change, while the Nasdaq and Dow Jones showed varied movements. Investors awaited October’s Consumer Price Index (CPI) data, predicting a 3.3% year-over-year growth in inflation. Moody’s highlighted the U.S. fiscal deficits and political gridlock but maintained its AAA credit rating. The dollar retreated slightly as traders anticipated the CPI release, impacting currency markets. The EUR/USD pair gained, reflecting a dovish market sentiment. In other currencies, USD/JPY remained near flat, and GBP/USD rose due to political developments and hawkish Bank of England comments. Treasury yields saw a slight increase, gold rose, and silver edged up, aligning with expectations of a steady Federal Reserve. Bitcoin fell influenced by a cautious Fed rate outlook but remained near trend highs.

Stock Market Updates

On Monday, the S&P 500 closed nearly unchanged, down 0.08% at 4,411.55, and the Nasdaq Composite dipped 0.22% to close at 13,767.74. In contrast, the Dow Jones Industrial Average advanced 0.16%, gaining 54.77 points and closing at 34,337.87. Traders were cautiously awaiting the release of October’s consumer price index (CPI) data, a key indicator of inflation. Economists predicted a 3.3% year-over-year growth in headline inflation, with a 0.1% increase from the previous month. The market sentiment appeared cautious as investors monitored economic indicators for potential impacts on future Federal Reserve policies.

Additionally, Moody’s highlighted the United States’ “very large” fiscal deficits and political gridlock as factors influencing a negative outlook. Despite this, Moody’s reaffirmed the country’s credit rating at AAA, the highest level. This assessment followed Fitch’s downgrade of the U.S. long-term foreign currency issuer default rating to AA+ from AAA three months earlier, citing anticipated fiscal deterioration, a growing debt burden, and political disagreements on fiscal matters. Despite these concerns, Treasury yields remained flat on Monday, with the 10-year Treasury note yielding 4.638%, up about 1 basis point, indicating a somewhat stable market response to the negative fiscal outlook.

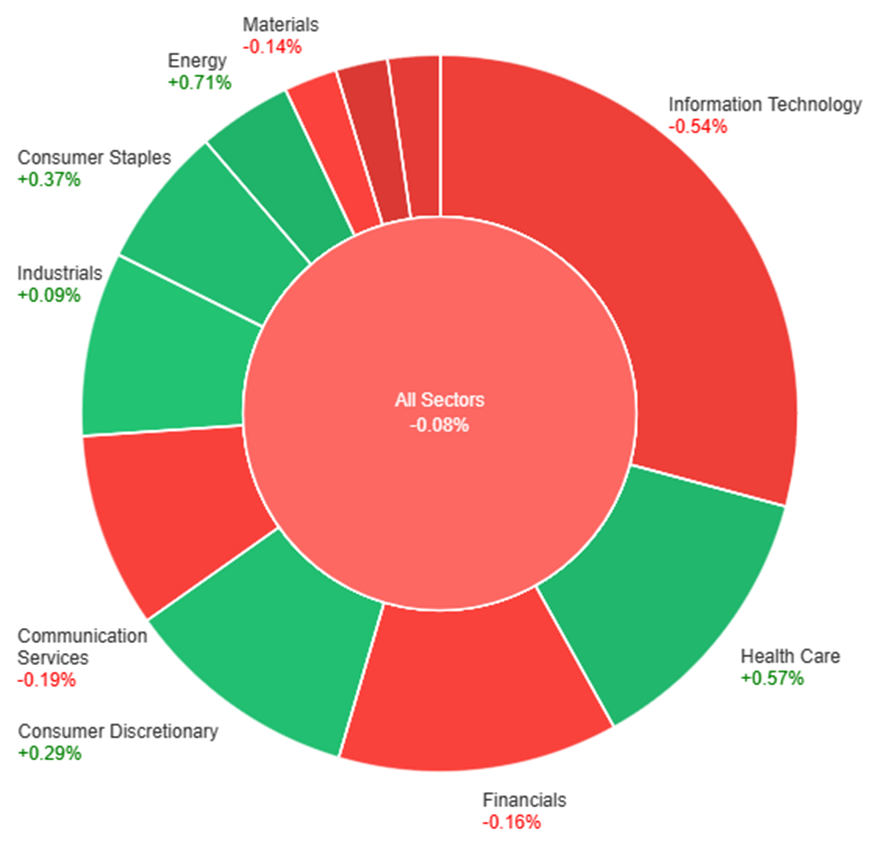

Data by Bloomberg

On Monday, the overall market experienced a slight decline of 0.08%. Among the sectors, Energy demonstrated the strongest performance with a gain of 0.71%, followed by Health Care at 0.57% and Consumer Staples at 0.37%. Consumer Discretionary and Industrials saw modest increases of 0.29% and 0.09%, respectively. In contrast, Materials, Financials, Communication Services, Information Technology, Real Estate, and Utilities all registered losses, with Utilities experiencing the most significant decline at 1.24%. The Information Technology sector led the declines with a decrease of 0.54%, contributing to the overall dip in the market on Monday.

Currency Market Updates

In the currency markets, the U.S. dollar experienced a mild retreat, holding slightly lower in U.S. afternoon trade despite earlier gains. Traders were in a state of anticipation as they awaited the release of the key U.S. Consumer Price Index (CPI) data scheduled for Tuesday. According to Reuters consensus forecasts, the core year-on-year inflation rate is expected to remain steady at 4.1%, while headline inflation is projected to decrease from 3.7% to 3.3%, influenced by a decline in oil prices. Although the anticipated core price stability is not anticipated to significantly impact Federal Reserve rate expectations, with futures markets indicating a pause in rate hikes and potential cuts in H2 2024, the market sentiment appeared more dovish ahead of the CPI release. The euro to U.S. dollar (EUR/USD) pair rallied 0.14%, asserting its influence on the U.S. dollar index as traders positioned themselves cautiously in anticipation of the CPI data, which seemed to have a more dovish impact than last week’s comments from Fed Chair Jerome Powell advocating for maintaining tight monetary policy to bring U.S. inflation back to the 2% target.

In other currency movements, the U.S. dollar to Japanese yen (USD/JPY) pair remained near flat after reaching a new high for 2023 at 151.92. However, it retreated from this peak due to reports of option-related activity, with approximately $3.45 billion set to mature during the week. Meanwhile, the British pound to U.S. dollar (GBP/USD) pair rose by 0.4% to 1.2276, driven by political developments in the UK that saw former Prime Minister David Cameron joining the Sunak government as foreign minister. Additionally, hawkish comments from Bank of England’s Catherine Mann, one of three Monetary Policy Committee members voting for a rate hike this month, contributed to the pound’s gains. Looking ahead, sterling traders are closely watching key events, including Tuesday’s UK employment and wage data and Wednesday’s UK CPI. Overall, Treasury yields saw a slight increase, gold rose by 0.5% to $1,946, and silver edged up 0.15% to $22.25, reflecting market expectations of a steady Federal Reserve and potential lower rates in 2024. Conversely, Bitcoin fell 1% to $36.7k, influenced by a more cautious Fed rate outlook, although it remained near trend highs supported by optimism surrounding crypto ETF registrations.

Picks of the Day Analysis

EUR/USD (4 Hours)

EUR/USD Gains Ground Amid Weaker Dollar and Eager Anticipation of Economic Data

The EUR/USD experienced a rise, finding support around 1.0560, propelled by a weakened US Dollar and declining US yields. This shift was influenced by a decrease in risk aversion, with Wall Street’s equity prices and commodity prices both on the upswing. As market attention turns to impending economic data releases from the US and Euro area, the focus centers on the US Consumer Price Index (CPI) report, with potential implications for interest rate decisions. A positive inflation outcome could strengthen the US Dollar, while a softer reading may boost the EUR/USD pair. Concurrently, Eurostat’s release of employment and growth data, with an expected 0.1% contraction, adds further anticipation, making the upcoming period crucial for EUR/USD dynamics.

According to technical analysis, the EUR/USD moved slightly higher on Monday, reaching above the middle band of the Bollinger Bands. Currently, the EUR/USD is trading just above the middle band, indicating the potential for a consolidating move to try to reach the upper band. The Relative Strength Index (RSI) is at 56, signaling that the EUR/USD is back in a neutral bias.

Resistance: 1.0725, 1.0755

Support: 1.0679, 1.0645

XAU/USD (4 Hours)

XAU/USD Slide to Near-Month Low as Safe-Haven Appeal Wanes Amid Hawkish Global Policies

XAU/USD continues its decline, reaching $1,918.35, its lowest point in nearly a month. Despite a less optimistic market sentiment, safe-haven assets, particularly Gold, remain unattractive, contributing to the precious metal’s downward trend. Global policymakers maintain a hawkish stance, dispelling speculation of an end to the tightening cycle or potential rate cuts in 2024. Concerns persist about inflationary pressures, as central banks hesitate to raise rates consistently, and tight labor markets hinder economic slowdown. Investors await the release of October inflation figures from the United States on Tuesday for potential insights into future market dynamics.

According to technical analysis, XAU/USD moved slightly higher on Monday and managed to reach the middle band of the Bollinger Bands. Presently, the price of gold is moving just below the middle band, creating the possibility of moving slightly higher above the middle band. The Relative Strength Index (RSI) is currently at 45, indicating that the XAU/USD pair is back in a neutral bias.

Resistance: $1,962, $1,992

Support: $1,945, $1,920

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| GBP | Claimant Count Change | 15:00 | 15.0K |

| USD | Core CPI m/m | 21:30 | 0.3% |

| USD | CPI m/m | 21:30 | 0.1% |

| USD | CPI y/y | 21:30 | 3.3% |