As November draws to a close, U.S. stock futures indicate a favorable end to the month for major indexes, propelled by surges in Salesforce and Snowflake following stellar earnings. Despite marginal movements in the Dow and S&P 500, both remain near their year-to-date highs, while the Nasdaq holds close to its 2023 peak. November promises to break the three-month losing streak, with the S&P 500 up 8.5% and Nasdaq near 11%, marking their strongest performance since July 2022. Positive market sentiments contrast declines in Asia-Pacific markets, with the focus shifting to potential Federal Reserve rate cuts in 2024. In the currency market, the dollar rebounded on speculations of faster rate cuts, impacting forex pairs and stirring market uncertainties amidst varying economic indicators and central bank remarks.

Stock Market Updates

In November’s final stretch, U.S. stock futures edged up, signaling a positive closure for the month across the major indexes. Wednesday’s after-hours trading saw Salesforce and Snowflake soaring due to better-than-expected earnings, with Salesforce marking an 8% surge and Snowflake climbing over 7%. Despite a marginal day for the Dow and S&P 500, both indexes hover just around 0.5% and 0.8%, respectively, from their year-to-date closing highs. Similarly, the Nasdaq Composite, though slipping 0.16% during the day, remains close to its 2023 closing high by about 0.7%.

November appears poised to end the three-month losing streak for the major indexes, with the S&P 500 marking an 8.5% gain and the Nasdaq nearly reaching an 11% increase. These figures represent their most robust monthly performance since July 2022. The Dow, up by 7.2% in November, is also on track for its best month since October 2022. Amidst higher interest rates, strategist Jay Woods remains optimistic about stocks holding onto their gains, citing positive price action and supportive economic data for the Fed’s stance on rates.

European stocks closed higher, reclaiming positive momentum as markets assessed Federal Reserve board members’ statements. The Stoxx 600 index closed 0.43% higher, with Germany’s DAX index maintaining gains above 1% following a report indicating a slowdown in German inflation for November, surpassing earlier forecasts. Meanwhile, Federal Reserve Governor Christopher Waller expressed growing confidence in the Fed’s policies to rein in inflation, hinting at potential rate reductions if inflation continues to ease in the next few months. However, despite a slight retreat in Wall Street’s earlier gains, the major U.S. indexes remained on course for significant gains in November, contrasting the overnight declines in Asia-Pacific markets, primarily led by losses in Hong Kong.

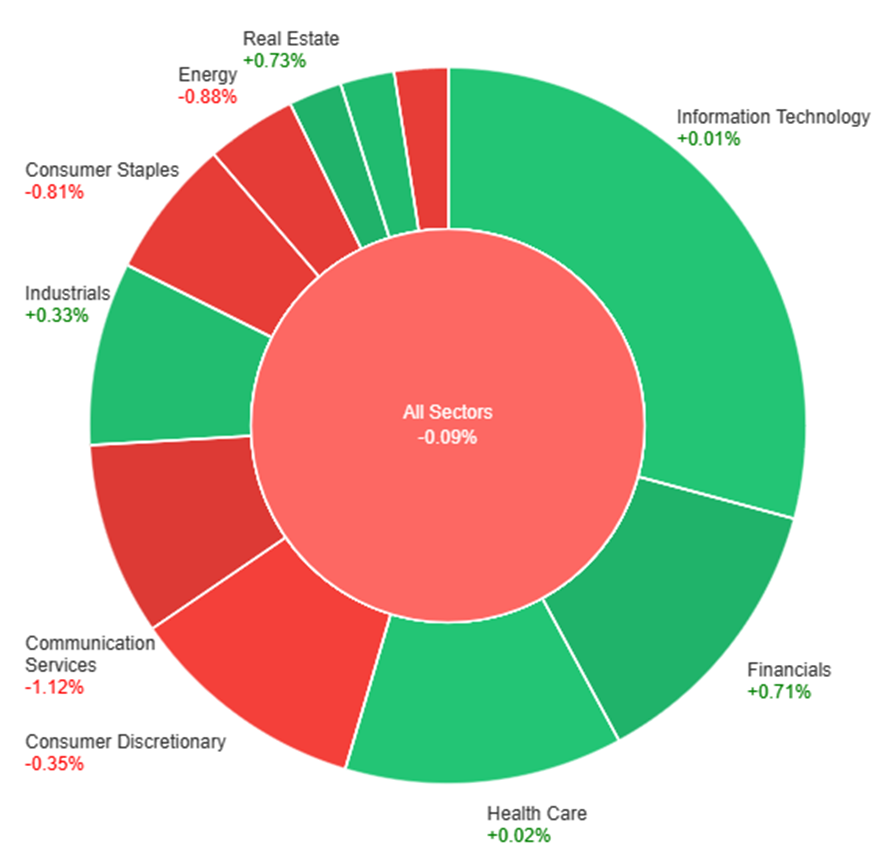

Data by Bloomberg

On Wednesday, the overall market experienced a slight decline of 0.09%. However, several sectors showed positive movements, with Real Estate leading the gains at +0.73%, followed closely by Financials at +0.71% and Materials at +0.38%. Industrials and Health Care also saw modest increases of +0.33% and +0.02%, respectively. Conversely, there were notable decreases in certain sectors, with Communication Services taking the biggest hit at -1.12%, followed by Energy at -0.88%, and Consumer Staples at -0.81%. Utilities and Consumer Discretionary also faced declines of -0.79% and -0.35%, respectively. Overall, while some sectors thrived, others encountered notable downturns during the trading day.

Currency Market Updates

In the currency market, the dollar index experienced a rebound of 0.14% after reaching oversold levels, largely influenced by speculation surrounding faster Federal Reserve rate cuts in 2024. This sentiment emerged following comments from Fed’s Waller, leading to expectations of a rate cut as early as May, with futures indicating a potential 114 basis points of cuts by 2024. Concurrently, the Euro saw a decline against the dollar, notably influenced by below-forecast German CPI, fostering a 42% probability of an ECB rate cut in March with an estimated 110 basis points of cuts by the end of 2024. The EUR/USD pair retraced to 1.0960, marking a critical level in its July-October slide.

While the dollar’s trajectory was influenced by expectations around Fed rate cuts, the market remained attentive to upcoming data releases and central bank remarks. The discrepancy among Fed speakers regarding progress in the inflation fight juxtaposed against economic indicators like Q3 GDP revisions, softer Q4 data, and core PCE adjustments to 2.3% contributed to the uncertainty. The movement of key pairs like USD/JPY, impacted by tumbling Treasury yields and contrasting JGB yields, indicated potential challenges for hefty speculative dollar longs. Amidst these fluctuations, sterling rose as it retraced a significant portion of its previous decline, echoing the broader market sentiment awaiting U.S. data releases and Fed Chair Jerome Powell’s commentary. Additionally, the Aussie and Chinese yuan pairs experienced declines and rebounds, respectively, influenced by below-forecast inflation and fluctuations in Fibonacci retracement levels indicative of market sentiment shifts.

Picks of the Day Analysis

EUR/USD (4 Hours)

EUR/USD Faces Volatility Amid Diverging Economic Signals

The EUR/USD surged to a three-month high at 1.1016 but retreated below 1.1000 despite burgeoning risk appetite. Europe witnessed a slowdown in inflation, notably in Germany and Spain, raising concerns about potential ECB rate cuts. Yet, this might not prompt immediate dovish action, as analysts anticipate a rebound in inflation over the next months. Meanwhile, the US economy revealed robust growth of 5.2% in Q3, lifting the US Dollar on confidence in its performance. However, recent indications of a slowdown before November 18 from the Beige Book compounded with upcoming critical US data—Core PCE Price Index and Jobless Claims—could exert further pressure on the Greenback if they reflect softening inflation and labor market conditions. Bond yields fell on both sides, especially in Germany, adding to the volatility gripping the EUR/USD pair.

On Wednesday, the EUR/USD experienced a downward movement, settling around the middle range of the Bollinger Bands. Presently, the price exhibits a marginal increase above this midpoint, suggesting a potential upward trajectory, potentially reaching the upper band. Notably, the Relative Strength Index (RSI) maintains its position at 55, signaling a neutral outlook for this currency pair.

Resistance: 1.1041, 1.1087

Support: 1.0968, 1.0930

XAU/USD (4 Hours)

XAU/USD Dips Amid Dollar’s Recovery and Fed’s Inflation Sentiments

Spot Gold slid to $2,040 an ounce, pulled down by a resurgent US Dollar amidst profit-taking before pivotal data releases. Despite the Dollar’s bounce, its weakness persists on hopeful sentiments that the Federal Reserve might halt tightening measures. Conflicting views within the Fed add to the uncertainty: while Atlanta Fed President Bostic signals confidence in declining inflation, Richmond Fed President Barkin remains cautious, keeping the possibility of rate hikes alive. With US bond yields retreating to multi-week lows and market focus shifting to the upcoming inflation data, Gold’s trajectory hinges on signs of easing price pressures, poised to either bolster optimism or dampen USD demand.

On Wednesday, XAU/USD underwent a period of consolidation, presently oscillating between the middle and upper bands within the Bollinger Bands. This current movement suggests a potential upward trend, potentially reaching the upper band once again. The Relative Strength Index (RSI) stands at a level below 69, indicating that the bullish sentiment for this pair remains robust.

Resistance: $2,052, $2,079

Support: $2,038, $2,012

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| ALL | OPEC-JMMC Meetings | All Day | |

| CAD | GDP m/m | 21:30 | 0.0% |

| USD | Core PCE Price Index m/m | 21:30 | 0.2% |

| USD | Unemployment Claims | 21:30 | 219K |