The US stock market struggled to make gains due to concerns that a recent surge in prices may be overblown, given ongoing economic risks. The fate of the 2023 stock market recovery hinges on four major events before the Federal Reserve’s March 22 meeting, which will determine if the market will rebound after its February slump or experience a setback. Prior to the influential jobs report on Friday, Fed Chair Powell’s two-day appearance before Congress will set expectations for the next policy meeting. While Powell may highlight the economy’s resilience and the challenges of reaching inflation targets, experts predict he will not be overly hawkish or suggest a 50 basis-point hike.

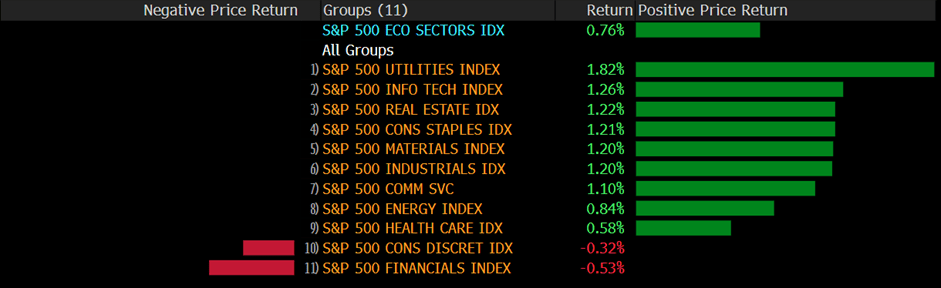

On Monday, the S&P 500 briefly rose almost 1% before losing momentum. Most sectors remained relatively unchanged, with four staying in positive territory by the end of the day. Information technology performed best with a daily gain of 0.53%, while the materials sector suffered the most, falling 1.65%. Additionally, the Nasdaq 100 remained relatively stable, the Dow Jones Industrial Average rose 0.1%, and the MSCI world index gained 0.3% for the day.

Main Pairs Movement

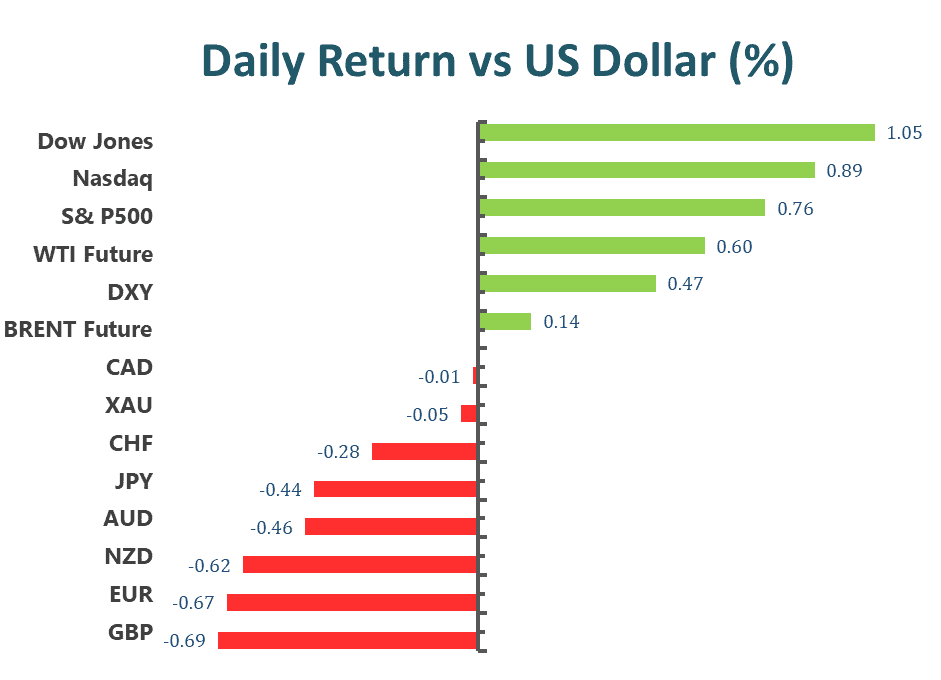

On Monday, the US dollar experienced a 0.23% decrease in value. The Euro and CHF saw gains as Eurozone bond yields rose following hawkish comments from ECB officials. Investors are anxiously waiting for the key testimony from Federal Reserve Chairman Jerome Powell, especially given the challenges for the Fed’s hawkish monetary policy in light of recently mixed US data and Fed talks.

The EUR/USD pair reached weekly highs near 1.0700 but trimmed its gains, as it struggled to reclaim the round-level resistance of 1.0700 at the end of Monday. Eurozone Retail Sales data showed an annual contraction of -2.3%, which underscores the European Central Bank’s need for increased retail demand to achieve price stability.

Gold experienced a 0.52% decrease in value and remains under pressure after reversing from a three-week high. The upcoming speech from Federal Reserve Chairman Jerome Powell this week may have a negative impact on the price of gold, and the rebound of US Treasury bond yields has extended the downward pressure on the metal. Gold’s first support level is at the confluence of $1846.00, and if it breaks through, the price is expected to fall toward the March 3 daily low of $1835.51.

Technical Analysis

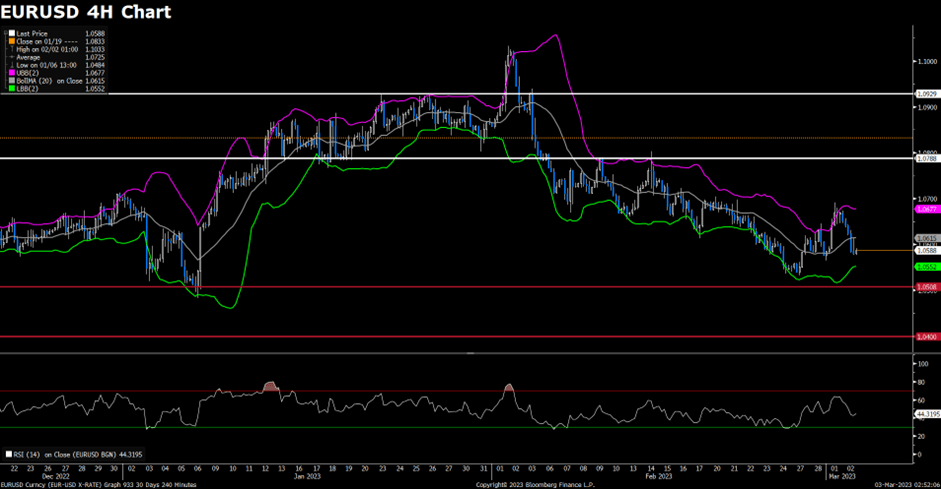

EUR/USD (4-Hour Chart)

On Monday, the EUR/USD pair gained bullish momentum, climbing to a daily high around the 1.0690 mark due to a positive shift in risk sentiment. Currently, the pair is trading at 1.0672, with a daily gain of 0.36%. The EUR/USD is staying in positive territory, mainly due to the weaker US Dollar against its major rivals and the risk-on impulse in the financial markets as reflected by US equities. Investors are also preparing for the US Federal Reserve (Fed) Chairman Jerome Powell’s speech at the US Congress on March 7 and 8, where he is expected to reiterate the Fed’s commitment to curb inflation and emphasize the need to maintain higher rates for longer periods.

Despite lower-than-expected economic data in the Eurozone, the Euro is outperforming on Monday. The Sentiment Investor Confidence index dropped in March to -11.1, and Retail Sales rose only 0.3% in February, below the 1% increase expected by the market consensus.

Regarding technical analysis, the RSI indicator is at 60, suggesting that the pair may witness some short-term corrections as the RSI is falling toward 60. The Bollinger Bands indicate that the price failed to maintain its upside traction and retreated from the upper band, indicating some downside movements. In conclusion, we believe that the market will be bearish as long as the 1.0710 resistance line holds. On the upside, bulls could have better chances if the EUR/USD regains the aforementioned 1.0710 level.

Resistance: 1.0710, 1.0790

Support: 1.0624, 1.0580, 1.0540

XAUUSD (4-Hour Chart)

The price of gold has fallen below $1,850 due to elevated US bond yields. At the time of writing, XAUUSD is trading at a daily low of $1,846.195, which represents a 0.5% or $13.085 drop from Monday’s trading session close. The US stock market is reflecting a risk-on impulse in the financial markets.

XAUUSD is likely to remain volatile as market participants prepare for US Federal Reserve Chairman Jerome Powell’s speech at the US Congress on March 7 and 8. Additionally, the market is focused on US employment data. In the prior month’s US Nonfarm Payrolls report, which crushed estimates of 200K, over 500K jobs were created in the economy. Positive data would send the price of gold further down, as further tightening in the labor market would warrant higher rates in the US economy to curb inflation.

On the technical side, from a daily chart perspective, the price is neutral to upward-biased once it conquers the 20 and 50-day EMAs. However, as US treasury bond yields trend upwards, gold is feeling the pressure, falling back to the $1,850 area. Moreover, the RSI exceeded 50 before turning bearish. Therefore, in the short term, the path of least resistance is downwards. The first support would be the 20 and 50-day EMAs at $1,846, followed by the previous low of $1835.51, the 100-day EMAs at $1,822.15, and the 200-day EMAs at $1805.16.

Resistance: 1850, 1870, 1890

Support: 1835, 1805, 1800

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

| AUD | RBA Interest Rate Decision (Mar) | 11:30 | 3.60% |

| AUD | RBA Rate Statement | 11:30 | |

| USD | Fed Chair Powell Testifies | 23:00 |