2 AI stocks that benefited from the boom in AI as much as Nvidia

The biggest names in artificial intelligence (AI) are once again beating quarterly earnings expectations.

There isn’t a hotter investment trend on Wall Street that exemplifies the FOMO trade quite like artificial intelligence (AI).

And the biggest winner was Nvidia.

Previously, we did a market analysis when the stock price of Nvidia skyrocketed to a record $1,224.40, bringing the company to hit a $3.01 trillion market cap milestone.

You can read about it here: Nvidia soars to record highs, eyes top spot by market cap

Nvidia made a move that many investors were eagerly waiting for. The tech giant completed a 10-for-1 stock split, now trading for about $120 a share compared with more than $1200 last week.

Such growth has put Nvidia on track to become the second largest company in the world.

What’s all the hype about stock splits?

When a company announces a stock split, it typically indicates strong performance in earnings and share value. This suggests that Nvidia may continue to perform well. Management is confident that, following the split, the stock has the potential to climb even higher.

But don’t expect this superior pricing power to last much longer.

The reason AI stocks have soared is simple: AI is useful in almost every industry. With more companies making A100 and H100 chips and new competitors joining the AI data center market, powerful GPUs will become less scarce. This means Nvidia might not be able to charge as much for their chips in the near future.

Nvidia may be Wall Street’s hottest AI stock right now, but investors may be better off looking at companies which are not heading for a bubble-bursting event.

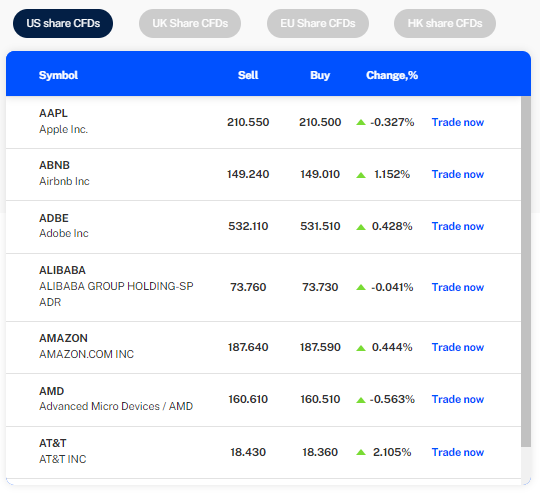

Picture: Nvidia trading at 136.26 as seen on the VT Markets app (As of 19 June 2024).

Here are 2 hypergrowth stocks that you should grab now

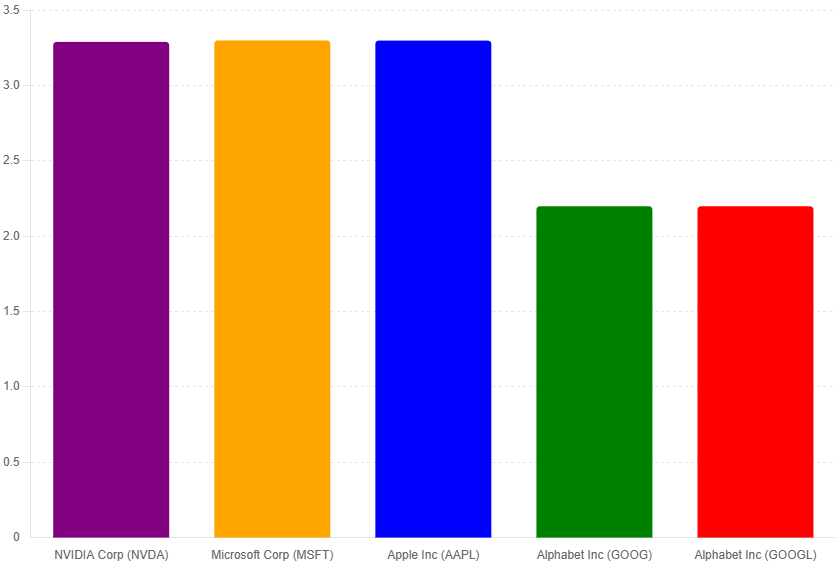

There are currently only three S&P 500 stocks in the $3 trillion club: Nvidia, Microsoft, and Apple.

Compared to the stocks already in the $3 trillion club, Alphabet trades at the lowest valuation by far at a wide discount when compared to the others. Given its current growth and future prospects, the Alphabet currently looks very undervalued.

Alphabet’s market cap now stands at $2.19 trillion, which is approximately 47.03% lower than Nvidia’s valuation of $3.22 trillion.

Here’s why Alphabet has what it takes to push its market cap above $3 trillion

Picture: Google currently trading between 180.72 to 182.48 as of 24 June on the VT Markets app.

While Nvidia dominates the hardware sire of AI, Google Cloud takes the leading role in AI software. Running AI models takes serious computing power, and many companies either don’t have it or can’t justify spending millions of dollars on a system that may not be used enough to justify its cost. Cloud computing is the answer to this problem, allowing anyone to rent computing space from a cloud computing provider like Google Cloud.

Whether it’s data storage or processing power, Google Cloud has clients covered. With access to the latest generation of Nvidia GPUs for training models, Google Cloud is a top competitor in this space.

Up next on the list: Intel

Picture: Intel trading between 31.14 to 31.47 as of 24 June. Download the VT Markets app now.

Intel has been slower in adopting AI, but it’s starting to stand out from other chip makers by jumping into manufacturing. They’re aiming to become one of the biggest semiconductor manufacturers in the U.S. and Europe, just as the demand for chips is booming.

This might be the perfect time to invest.

Intel is on the verge of a potential comeback. Last year, they announced a shift to a foundry model and plans to build chip plants all over the U.S.

Right now, Taiwan Semiconductor Manufacturing Company (TSMC) dominates the market, making at least 60% of the world’s chips. But with tensions rising between China and Taiwan, tech companies are rethinking their reliance on TSMC.

But not for Intel. They’re seizing this opportunity to dive into the manufacturing game.

However, starting a foundry business incurs significant costs, which is why most companies prefer to outsource manufacturing. As a result, it will take time for Intel to recover its investment.

Interested to add Nvidia, Intel, or Intel to your portfolio? Try CFD Share Trading.

With the VT Markets app, you can do it with just a fraction of the trade value, while also being able to control larger positions. Unlike stocks, which require the full amount of the investment upfront, trading Share CFDs offers you the opportunity to gain access to global markets faster and at a lower cost.