-

التداول

-

الأكاديمية

-

العروض الترويجية

-

عن الشركة

-

الشراكة مع VT

On Monday, the stock market showed subdued performance ahead of the Federal Reserve meeting later in the week. The S&P 500 inched up by 0.07%, the Nasdaq rose by 0.01%, and the Dow Jones gained 0.02%. Investors overwhelmingly expected the Fed to maintain its current policy, but uncertainty loomed about November’s actions, with a 31% chance of a rate hike. Apple’s stock surged by 1.7% on positive outlooks, while Ford, Stellantis, and General Motors faced declines due to ongoing union disputes. The US dollar dipped by 0.2% in anticipation of central bank meetings, and EUR/USD rose by 0.24%. USD/JPY struggled to breach resistance, and Sterling hovered below the 200-DMA. USD/CAD dropped by 0.23%, while AUD/USD and USD/CNH made modest gains. The market awaited crucial data and central bank decisions throughout the week.

In the stock market, Monday saw a relatively flat performance as investors eagerly anticipated the upcoming Federal Reserve meeting later in the week. The S&P 500 made a modest 0.07% gain, closing at 4,453.53, while the Nasdaq Composite edged up by 0.01% to finish at 13,710.24. The Dow Jones Industrial Average also advanced by a slight 0.02%, closing at 34,624.30. Traders are overwhelmingly expecting the Federal Reserve to maintain its current policy during its two-day meeting, with a 99% probability of no change in interest rates, according to the CME Group’s FedWatch tool. However, the market remains uncertain about the Fed’s actions in November, with roughly a 31% chance of a rate hike. Investors are keen to decipher the central bank’s future guidance and messaging for potential insights into its next moves.

In company-specific news, Apple saw a 1.7% increase in its stock price, buoyed by optimistic outlooks from Goldman Sachs and Morgan Stanley regarding new iPhone demand. Conversely, Ford’s stock slid by over 2% as the United Auto Workers’ strike persisted, while Stellantis and General Motors, also embroiled in disputes with the union, saw their stocks decline by over 1%. The previous trading week ended with the S&P 500 and Nasdaq posting losses for the second consecutive week, while the Dow managed a slight 0.1% gain, setting the stage for a week of anticipation and cautious observation as market participants await the Federal Reserve’s decisions and guidance.

Data by Bloomberg

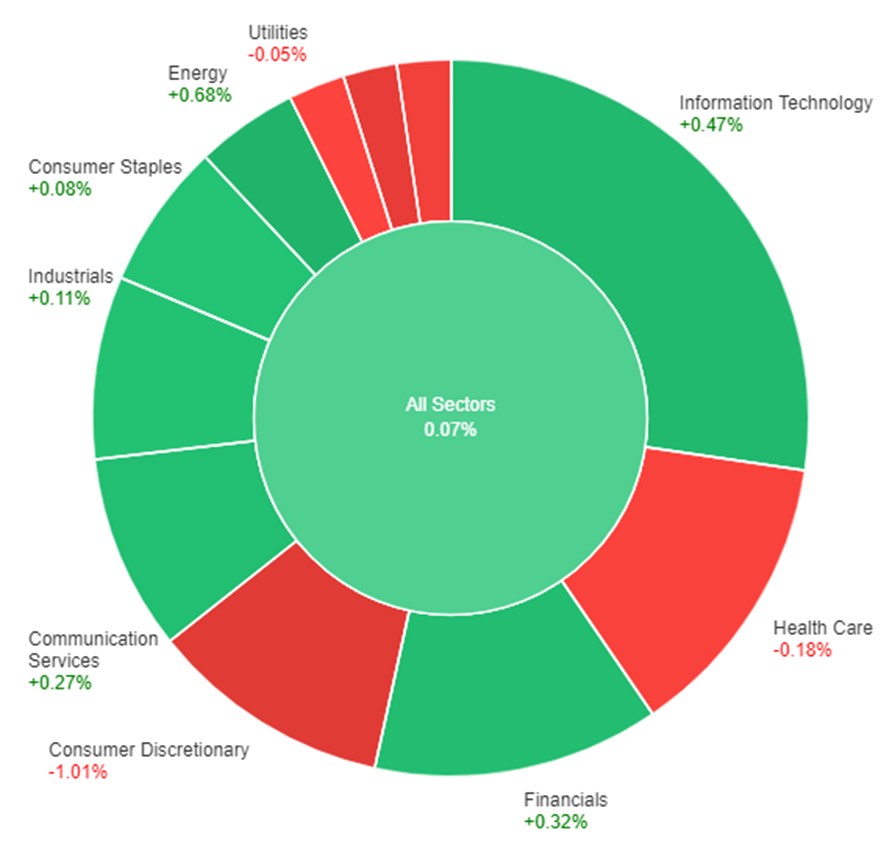

On Monday, across all sectors, there was a slight increase of 0.07% in the market. The sectors that saw gains were led by Energy, with a 0.68% increase, followed by Information Technology at 0.47%, Financials at 0.32%, and Communication Services at 0.27%. However, there were declines in other sectors, with the largest decreases occurring in Consumer Discretionary, which dropped by 1.01%, and Real Estate, which saw a decline of 0.81%. Other sectors that saw declines were Materials at -0.43%, Health Care at -0.18%, and Utilities at -0.05%. Industrials and Consumer Staples had smaller gains of 0.11% and 0.08%, respectively.

In the midst of various global economic factors, the US dollar faced a 0.2% decline on Monday as it encountered significant resistance and EUR/USD found support. This decline occurred in anticipation of upcoming meetings by central banks, including the Fed, BoE, and BoJ. The day saw limited US economic data, with only the NAHB housing market index showing an unexpected downturn. Investors remained vigilant, considering the potential risks posed by the UAW strike and the looming threat of a US government shutdown.

EUR/USD experienced a rise of 0.24%, with factors such as opposition from ECB hawks to rate cut expectations and disappointing Michigan sentiment data lending support. Furthermore, the bond yields in the eurozone outpaced Treasury yields, and Brent crude oil prices approached triple-digit figures. Despite these dynamics, USD/JPY faced a 0.1% decline, failing to breach the 148 hurdle that had been impeding its upward trend for an extended period. The forthcoming Fed meeting was expected to influence the market’s perception of future rate hikes and Treasury yields, potentially opening room for USD/JPY to rise towards resistance around 150 before any substantial correction.

Meanwhile, Sterling remained stable but below the 200-day moving average (200-DMA), which it had broken and closed below in the previous week. Market expectations indicated an 81% probability of a BoE rate hike on Thursday, although Sterling’s performance could be influenced by perceptions of the likelihood of a follow-on rate increase. In addition, USD/CAD experienced a 0.23% drop, breaking below September’s lows, initially bolstered by rising oil prices, but subsequently facing a setback as WTI oil prices retreated below $90 later in the day. Canadian CPI data was awaited on Tuesday, potentially influencing the trajectory of USD/CAD. Meanwhile, AUD/USD and USD/CNH both recorded modest gains of 0.06% and 0.14%, respectively.

EUR/USD Fluctuates Amidst Central Bank Moves and Growth Outlook Uncertainty

The EUR/USD saw an initial rise to near 1.0700 on Monday, driven by a US Dollar correction in a calm session. Despite the European Central Bank’s expected 25 basis point rate hike last Thursday, the Euro weakened but found support at 1.0630, subsequently recovering. Market sentiment suggests no further ECB rate increases, shifting the focus to rate duration. Likewise, the Federal Reserve’s upcoming FOMC meeting anticipates no rate changes, focusing on statements, projections, and Chair Powell’s remarks. Current fundamentals favor the US Dollar due to a stronger US growth outlook. This week’s data, including preliminary PMIs and CPI readings, will offer insights into differing growth prospects between Europe and the US.

According to technical analysis, EUR/USD moved slightly higher on Monday and is currently trading just around the middle band of the Bollinger Bands. This movement suggests the possibility of further consolidation. The Relative Strength Index (RSI) is currently at 47, indicating that EUR/USD is in a neutral stance.

Resistance: 1.0711, 1.0759

Support: 1.0653, 1.0605

XAU/USD Starts the Week with Optimism Amidst Economic Uncertainty

XAU/USD started the week on a positive note, trading near the upper end of Friday’s range, while market focus remains on stocks and government bond yields due to a lack of significant news. The demand for the US Dollar is subdued as stock markets grapple with tepid earnings reports, particularly in the tech sector. European indexes saw modest losses, but Wall Street rebounded from last week’s slump. US Treasury yields continue to rise due to inflation concerns ahead of the Federal Reserve’s monetary policy meeting this Wednesday. Currently, the 10-year note yields 4.33%, while the 2-year note offers 5.06%. Speculators anticipate the Fed will keep rates unchanged this week, though caution prevails as market players hope for hints regarding future interest rate moves.

According to technical analysis, XAU/USD moved higher on Monday and was able to create a higher push to the upper band of the Bollinger Bands. Currently, the price is trading slightly below the upper band with the potential for further higher movement. The Relative Strength Index (RSI) is currently at 65, indicating that the XAU/USD pair is now entering the bullish bias.

Resistance: $1,939, $1,951

Support: $1,928, $1,915

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| CAD | Consumer Price Index | 20:30 | 0.2% |