Forex market is considered as the biggest market in the world, it deals trillions of dollars’ worth of trades every day. Investors are always looking for the best broker to trade forex, precious metals, indices, share CFDs, and other trending assets such as digital currencies. With thousands of brokers out there when you conduct your research, determining whether a broker is legit (or not a scam) can be quite challenging. As an investor (especially for those who trade online), it is vital to research a company before making a commitment and depositing money to trade.

The key and first question you should ask is whether the broker is regulated. As scam brokers do not have to report to a governing body or authority. This means that if they scam you in any way (e.g. causing slippage intentionally, blocking your withdrawal, etc.), there is pretty much nothing you can do about it besides posting a bad review online can be helpful for others to avoid falling into the same pit. To check whether a broker is a scam, the quickest way is to check the footer of broker’s website:

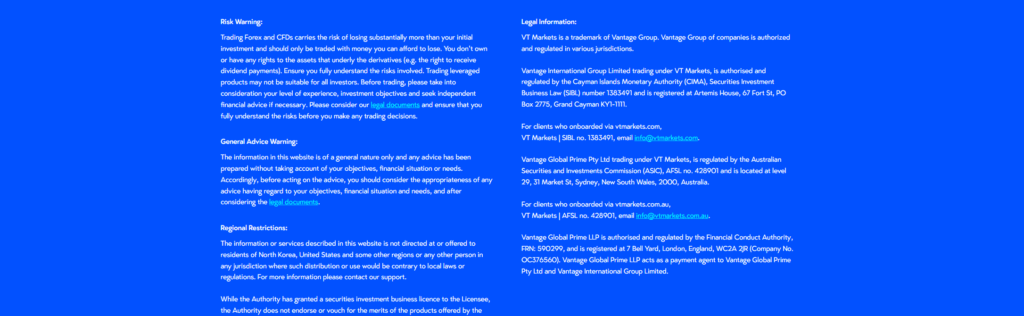

A regulated broker always includes proper risk disclaimers and regulatory information at the bottom of all their website pages. VT Markets is a fully regulated broker, which has been in the financial service industry for over a decade. VT Markets have entities that are regulated under the Australian Securities and Investments Commission (ASIC), and the Financial Sector Conduct Authority (FSCA).

After confirming the broker is regulated, the next thing you should do is to determine whether the regulatory body is trustworthy. Regulators such as International Financial Services Commission (IFSC), Securities Commission of The Bahamas (SCB) and Seychelles International Business Authority (SIBA) are certainly not as trustworthy as Australian Securities and Investments Commission (ASIC), Cyprus Securities & Exchange Commission (CySEC) and Financial Conduct Authority (FCA). Some regulatory body such as St. Vincent & the Grenadines does not monitor or regulate forex companies, thus a lot of scam brokers has St. Vincent & the Grenadine listed as their regulatory body, which means their investors are not protected at all. Here is a list of the regulatory bodies that are mostly recognized by investors:

VT Markets is regulated by ASIC and CIMA – two of the commonly recognized regulatory bodies. Our clients are well-protected.

In conclusion, it is crucial to check your broker’s regulatory information before sending money to them. The regulatory is the only thing to ensure the safety of your capital. Any other information such as awards, company stories, and corporate sponsorship can be considered as an additional endorsement of the brand, but these cannot guarantee the legitimacy of a broker without appropriate regulation.

Education

Company

FAQ

Promotion

Risk Warning: Trading CFDs carries a high level of risk and may not be suitable for all investors. Leverage in CFD trading can magnify gains and losses, potentially exceeding your original capital. It’s crucial to fully understand and acknowledge the associated risks before trading CFDs. Consider your financial situation, investment goals, and risk tolerance before making trading decisions. Past performance is not indicative of future results. Refer to our legal documents for a comprehensive understanding of CFD trading risks.

The information on this website is general and doesn’t account for your individual goals, financial situation, or needs. VT Markets cannot be held liable for the relevance, accuracy, timeliness, or completeness of any website information.

Our services and information on this website are not provided to residents of certain countries, including the United States, Singapore, Russia, and jurisdictions listed on the FATF and global sanctions lists. They are not intended for distribution or use in any location where such distribution or use would contravene local law or regulation.

VT Markets is a brand name with multiple entities authorised and registered in various jurisdictions.

· VT Global Pty Ltd is authorised and regulated by the Australian Securities & Investments Commission (ASIC) under licence number 516246.

· VT Global is not an issuer or market maker of derivatives and is only allowed to provide services to wholesale clients.

· VT Markets (Pty) Ltd is an authorised Financial Service Provider (FSP) registered and regulated by the Financial Sector Conduct Authority (FSCA) of South Africa under license number 50865.

· VT Markets Limited is an investment dealer authorised and regulated by the Mauritius Financial Services Commission (FSC) under license number GB23202269.

Copyright © 2024 VT Markets.