Major stock indices, including the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite, saw modest gains as investors awaited U.S. consumer inflation figures and monitored Treasury yields’ retreat. The market was also influenced by expectations of the consumer price index report and Federal Reserve policy, while Exxon Mobil announced a significant acquisition and Birkenstock faced a challenging market debut. Geopolitical tensions in Israel and Hamas contributed to market uncertainty. In the currency market, the US Dollar remained flat despite positive wholesale inflation data and FOMC minutes, with the focus shifting to the impending Consumer Price Index release and divergent views among committee members. The US Dollar Index and Treasury yields experienced minor fluctuations, while currency pairs like EUR/USD and GBP/USD demonstrated varied behavior. Gold and Silver rallied due to lower yields and a weakened US Dollar.

Stock Market Updates

In Wednesday’s stock market, major indices saw modest gains as investors eagerly awaited the release of the new U.S. consumer inflation figures, while Treasury yields continued their retreat. The Dow Jones Industrial Average rose by 0.19%, or 65.57 points, closing at 33,804.87. The S&P 500 experienced a 0.43% increase, ending the day at 4,376.95, while the Nasdaq Composite, dominated by tech stocks, surged 0.71% and closed above its 50-day moving average for the first time since September 14. This marked the fourth consecutive day of gains for these key indices. Investors were also anticipating the consumer price index report for September, with economists predicting a 0.3% increase from the previous month and a year-over-year rise of 3.6%. This data was seen as critical for insights into future Federal Reserve policy moves, especially after the recent revelation of hotter-than-expected wholesale inflation figures. Additionally, the release of minutes from the Fed’s September meeting indicated that a majority of officials believed one more interest rate hike was likely, with rising Treasury yields playing a significant role in their considerations.

On the corporate front, Exxon Mobil announced the acquisition of shale driller Pioneer Natural Resources in an all-stock deal worth $59.5 billion, marking the largest merger announced on Wall Street in the year. Meanwhile, sandal manufacturer Birkenstock faced a challenging market debut, with shares priced at $46 each but falling to $40.20 by the close of the session. Investors were also monitoring the ongoing conflict between Israel and Hamas, as the latter launched an attack on Israeli civilians, leading to the deadliest offensive in the region in five decades. President Joe Biden condemned the attacks as terrorism and expressed unwavering support for Israel. Overall, the market sentiment appeared uncertain, with conflicting factors such as inflation, interest rates, and geopolitical tensions contributing to the mixed outlook for stocks.

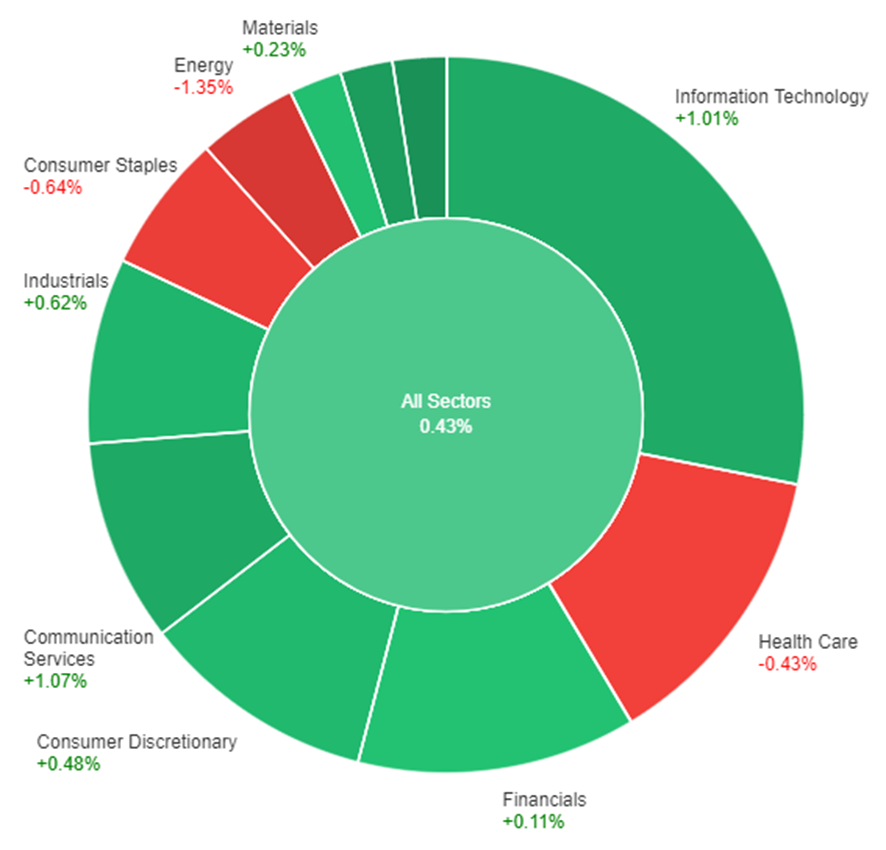

Data by Bloomberg

On Wednesday, the performance of various sectors in the market showed mixed results. Overall, all sectors combined saw a modest increase of 0.43%. Among the sectors, Real Estate performed exceptionally well with a gain of 2.01%, followed by Utilities at 1.63%, and Communication Services at 1.07%. Information Technology and Industrials also had positive gains at 1.01% and 0.62%, respectively. Meanwhile, Consumer Discretionary and Materials had smaller gains at 0.48% and 0.23%. On the other hand, Financials and Health Care experienced minimal gains of 0.11% and a decline of -0.43%, respectively. Consumer Staples and Energy were the worst-performing sectors, with losses of -0.64% and -1.35%, respectively.

Currency Market Updates

In the recent currency market updates, the US Dollar remained largely flat despite unexpected positive data on US wholesale inflation and the release of the Federal Open Market Committee (FOMC) minutes. The Greenback’s weakness persisted as US Treasury yields continued to retreat, and a risk-on sentiment in the Wall Street stock market failed to provide support. Notably, the US Producer Price Index (PPI) accelerated in September, surprising analysts by rising from 2.0% to 2.2%, as compared to the expected 1.6%. However, this development did not raise significant concerns, with all eyes turning to the impending release of the Consumer Price Index (CPI), expected to decrease from 3.7% to 3.6% in September, promising heightened volatility in the currency market. Furthermore, the FOMC minutes revealed divergent perspectives among committee members, emphasizing a data-dependent approach and the necessity of a substantial rebound in inflation to reach a consensus on further interest rate hikes.

Following the FOMC minutes, the US Dollar Index (DXY) experienced a slight pullback but managed to finish flat at 105.75, rebounding from strong support at 105.50. The US Treasury yield for 10-year bonds dropped to 4.55%. Notably, EUR/USD maintained its recent gains and stayed close to a strong resistance level at 1.0630, demonstrating a bullish tone. However, with a week of continuous ascent, the pair appeared poised for a consolidation phase, pending the release of the US CPI figures. Meanwhile, GBP/USD achieved a second consecutive daily close above the 20-day Simple Moving Average, hovering around 1.2300 and indicating signs of potential fatigue in its recovery. Key economic data releases are expected in the UK on Thursday. In addition, Gold and Silver rallied, benefiting from lower yields and a weakened US Dollar, breaking above $1,860 and $22.00, respectively.

Picks of the Day Analysis

EUR/USD (4 Hours)

EUR/USD Rebounds from Monthly Lows Amidst Weakening US Dollar and Data-Dependent Fed Stance

The EUR/USD pair tested levels above 1.0630 before pulling back, displaying modest gains as it recovers from monthly lows. Trading in a critical area, the Euro awaits more US inflation data, benefiting from the US Dollar’s weakness due to declining yields and positive market sentiment. The unexpected rise in the US Producer Price Index didn’t significantly impact the Dollar, while the latest FOMC minutes highlighted the Fed’s data-dependent approach to policy. A busy economic calendar on Thursday includes the release of ECB minutes and the US Consumer Price Index, with potential market impact depending on the CPI’s performance.

Based on technical analysis, the EUR/USD rose on Wednesday, pushing towards the upper band of the Bollinger Bands. Currently, the EUR/USD is trading below the upper band, while the bands are trending upwards, suggesting the potential for another upward move to retest the upper Bollinger Band. The Relative Strength Index (RSI) stands at 62, indicating that the EUR/USD is currently attempting to establish a bullish bias.

Resistance: 1.0674, 1.0736

Support: 1.0583, 1.0530

XAU/USD (4 Hours)

XAU/USD Surges to Two-Week High Amidst US Dollar Weakness and Bond Yield Concerns

In a strong rally, the price of gold (XAU/USD) soared to a fresh two-week high at $1,877.19 per troy ounce on Wednesday. This impressive surge was attributed to the widespread weakness of the US Dollar, which was in turn linked to declining US Treasury bond yields. The dip in yields was partially driven by renewed demand for safety amid Middle East developments and dampened expectations of another Federal Reserve rate hike, as policymakers generally anticipate that robust yields will obviate the need for further tightening. Nevertheless, even as yields have eased lately, they remain near the multi-decade highs observed in September. Investor sentiment became cautious after the release of the US Producer Price Index (PPI) and in anticipation of the FOMC Meeting Minutes, as wholesale inflation in the country surged by 2.2% YoY in September, exceeding market expectations and August figures. The release of the Consumer Price Index (CPI) on Thursday is anticipated to show a 3.6% YoY increase, further influencing the gold market.

Based on technical analysis, XAU/USD is trending higher on Wednesday, creating an uptrend within the Bollinger Bands. Currently, the price of gold is trading slightly below the upper band and is beginning to consolidate between the middle and upper bands of the Bollinger Bands. The Relative Strength Index (RSI) currently registers at 75, indicating a bullish bias for the XAU/USD pair.

Resistance: $1,874, $1,887

Support: $1,845, $1,829

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| GBP | Gross Domestic Product | 14:00 | 0.2% |

| USD | Consumer Price Index | 20:30 | 0.3% |

| USD | Core Consumer Price Index | 20:30 | 0.3% |

| USD | Unemployment Claims | 20:30 | 211K |