The S&P 500 and Nasdaq continued their winning streaks, marking their longest runs in two years, while the Dow Jones Industrial Average experienced a minor decline. Earnings reports from companies like Rivian, Robinhood, and Warner Bros. Discovery influenced stock movements, with Roblox reporting strong results. In the currency market, the US dollar stabilized after earlier gains, with a dovish outlook on the Federal Reserve. The euro rebounded, while the USD/JPY pair faced resistance and potential intervention threats. Sterling remained flat, and the Australian and Canadian dollars, as well as the offshore yuan, fell due to various concerns. The week’s economic calendar is relatively light, with jobless claims and sentiment data as key points of interest.

Stock Market Updates

The S&P 500 extended its winning streak to eight consecutive days, marking its longest run in two years. The index gained 0.1%, closing at 4,382.78, which matched an eight-day winning streak from November 2021. Similarly, the Nasdaq Composite also saw gains, rising by 0.08% to reach 13,650.41, making it the ninth positive day and the longest streak in two years. However, the Dow Jones Industrial Average experienced a 0.12% decline, losing 40.33 points and breaking its best win streak since July. Investors are keeping an eye on upcoming inflation and economic data to gauge the future trajectory of equity gains. While the economy is showing signs of slowing, it is not plummeting drastically.

In earnings news, Rivian’s stock slipped 2.4% despite posting better-than-expected results. Robinhood’s shares declined by 14.3% after significant drops in trading volumes. Warner Bros. Discovery faced a 19% decline, its worst day since March 2021, due to a wider-than-expected loss. In contrast, Roblox saw an 11.8% increase in its stock price after reporting strong results. The S&P has gained 4.5% in November, the Nasdaq has surged 6.2%, and the Dow has risen by 3.2% for the month. Earnings season is winding down, with the majority of companies in the S&P 500 surpassing earnings estimates, but only 62% have exceeded revenue expectations, reflecting the impact of slowing demand. The season continues with earnings reports from companies like Walt Disney, Affirm Holdings, and MGM Resorts.

Data by Bloomberg

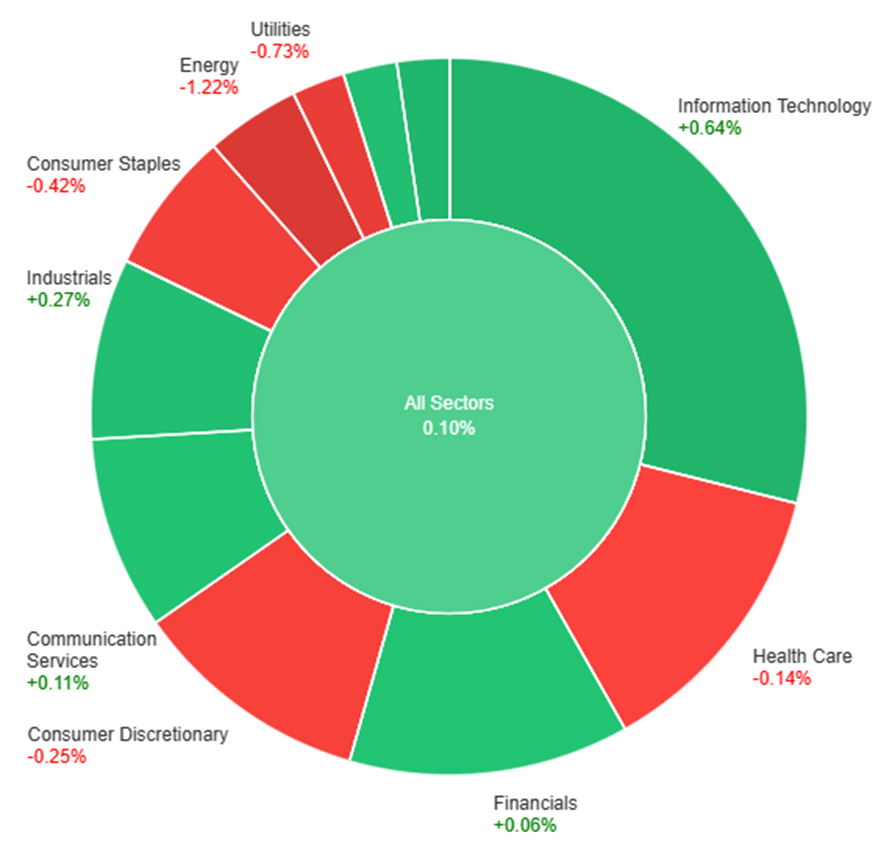

On Wednesday, the overall market saw a slight gain of 0.10%. Information Technology and Real Estate sectors performed well, with gains of 0.64% and 0.58% respectively, while Industrials and Materials sectors also showed positive movements at 0.27% and 0.26%. However, the Health Care and Consumer Discretionary sectors experienced losses of -0.14% and -0.25%, and the Consumer Staples and Utilities sectors saw larger declines at -0.42% and -0.73%. The Energy sector had the most significant decline, dropping by -1.22% during the day.

Currency Market Updates

In the latest currency market updates, the US dollar index remained relatively flat, relinquishing earlier gains. This stabilization came as Treasury yields showed signs of faltering after a 10-year auction later in the day. The dollar had been supported by concerns about rising Treasury supply lifting yields, but confidence in this support diminished following successful 3-year and 10-year auctions earlier in the week. The outlook for the US dollar and the Federal Reserve remains dovish, with the market pricing in a minimal chance of another Fed rate hike and even potential cuts by mid-year. Next week’s U.S. Consumer Price Index (CPI) and Producer Price Index (PPI) readings are forecasted to be modest at just 0.1% month-on-month, further reinforcing the dovish sentiment in the market.

In other developments, the EUR/USD pair rebounded from early losses, supported by a broader pullback in the US dollar and rising 2-year bund-Treasury yield spreads. However, the eurozone continued to experience poor economic data, and the European Central Bank (ECB) resisted easing expectations. Meanwhile, the USD/JPY pair saw a 0.3% increase but faced significant technical and options resistance at 151. It also grappled with the risk of intervention threats or actual USD/JPY sales from the Japanese Ministry of Finance. In this environment, the unexpected decline in energy prices, coupled with global geopolitical tensions such as the Israel-Hamas conflict, favored major importers like Japan and the eurozone over exporters like the United States. Sterling remained flat, with expectations of a Bank of England rate cut in mid-2024 despite UK inflation remaining high at 6.7%, indicating negative real gilts yields. Additionally, the Australian and Canadian dollars fell 0.4% and 0.3%, respectively, while the offshore yuan lost 0.12% due to ongoing concerns about China’s property sector and U.S. lawmakers’ intent to increase tariffs on Chinese-made vehicles. The week’s economic calendar is relatively light, with jobless claims on Thursday and Michigan November sentiment data on Friday.

Picks of the Day Analysis

EUR/USD (4 Hours)

EUR/USD Rebounds Despite US Dollar Strength and ECB’s Dovish Outlook

The EUR/USD staged a rebound during the American session, regaining ground to reach the 1.0700 area, despite a strengthening US Dollar against riskier currencies. The final reading of the German Consumer Price Index (CPI) displayed an annual rate of 3.8%, the lowest since August 2021, indicating a slowing economy and potential recession, leading the European Central Bank (ECB) to halt its tightening cycle, in line with market expectations. Meanwhile, Eurozone Retail Sales declined slightly in September, with August figures revised higher. In the US, Fed Chair Jerome Powell’s panel discussion and comments from Fed officials will be closely monitored, with the market expecting a dovish stance and anticipating confirmation from the upcoming US Consumer Price Index report on monetary policy expectations.

According to technical analysis, the EUR/USD moved slightly higher on Wednesday, reaching the middle band of the Bollinger Bands. Currently, the EUR/USD is trading around the middle band, indicating the potential for a consolidating move around the middle band. The Relative Strength Index (RSI) is at 57, signaling that the EUR/USD is back in neutral bias.

Resistance: 1.0711, 1.0765

Support: 1.0675, 1.0615

XAU/USD (4 Hours)

XAU/USD Faces Persistent Pressure Amidst Uncertain Rate Hike Outlook and Strong US Dollar Demand

Persistent demand for the US Dollar is keeping the XAU/USD pair near a two-week low of $1,950.93 per troy ounce. Central bank officials from the United States and Europe have downplayed the likelihood of imminent rate cuts but left room for potential tightening if inflation trends change. While global equities waver, Wall Street maintains its positive stance, and low Treasury yields raise questions about the feasibility of higher yields tightening financial conditions. Federal Reserve Chair Jerome Powell’s upcoming panel discussion may shed more light on the monetary policy outlook, impacting the gold market.

According to technical analysis, XAU/USD moves lower on Tuesday and is able to reach the lower band of the Bollinger Bands. Presently, the price of gold is moving near the lower band, creating a possibility to push lower. The Relative Strength Index (RSI) is currently at 31, indicating a bearish bias for the XAU/USD pair.

Resistance: $1,962, $1,992

Support: $1,945, $1,920

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| USD | Unemployment Claims | 21:30 | 218K |