In observance of the Juneteenth holiday, the regular trading session was suspended on Monday, providing investors with a break after a positive week. Despite minor slips on Friday, the S&P 500 and the Nasdaq Composite recorded their best weekly performances since March, with the S&P 500 rising by 2.6% and the Nasdaq adding 3.25%.

The Federal Reserve’s decision to hold off on a June rate hike was well-received by investors, contributing to the market’s upward momentum. While upcoming economic data is limited, investors remain optimistic about the market’s direction as they await the release of housing starts data and prepare for key appearances by Federal Reserve officials.

Fed Chair Jerome Powell’s remarks at a press conference last week indicated that the central bank has yet to finalize its policy decisions ahead of the July meeting. However, the decision to skip a June rate hike broke the Fed’s streak of ten consecutive interest rate increases. Despite the uncertainty surrounding future Fed policy, stocks have continued to rise, reflecting investors’ confidence.

Looking ahead, investors will closely monitor the housing starts data scheduled for release on Tuesday, while also anticipating appearances by New York Fed President John Williams, Fed Vice Chair for Supervision Michael Barr, and Fed Chair Jerome Powell, who is set to testify before Congress later in the week. Additionally, the market will pay attention to the quarterly report from shipping giant FedEx, which will be released after the closing bell on Tuesday.

Data by Bloomberg

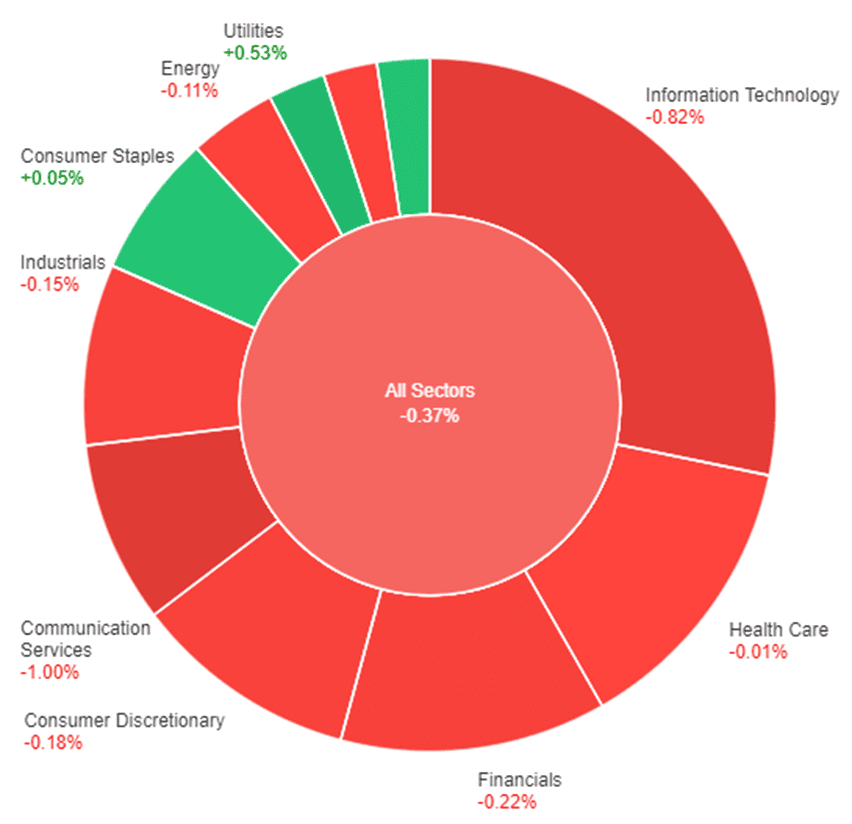

On Friday, the overall performance of the market showed a decline, with all sectors experiencing negative movements except for utilities, materials, and consumer staples. The sectors that saw positive gains were utilities with +0.53%, materials with +0.11%, and consumer staples with +0.05%.

On the other hand, the sectors that recorded losses were health care with -0.01%, energy with -0.11%, real estate with -0.11%, industrials with -0.15%, consumer discretionary with -0.18%, financials with -0.22%, information technology with -0.82%, and communication services with -1.00%. These sectors experienced varying degrees of decline, with information technology and communication services being the hardest hit.

Major Pair Movement

In the currency markets, the British pound (GBP) remains strong despite a slight dip of 0.25%. This comes as good news for the Bank of England (BoE) and inflation, as UK supermarkets report a decrease in food production costs for the first time since 2016. The easing of food price inflation contributes to the positive outlook for the British economy.

Meanwhile, the Australian dollar (AUD) has recovered against the US dollar (USD), rising above the 0.6859 level after reaching a low of 0.6835 on Monday. The AUD/JPY cross also saw a boost, increasing by 0.50% from its lowest point. The upcoming release of the Reserve Bank of Australia (RBA) minutes is expected to impact market pricing and potentially influence the RBA’s decision regarding interest rates in July. Currently, the market is anticipating a 58% chance of a 25-basis point hike to 4.35%.

Regarding the USD/JPY pair, the uptrend remains intact, but there are concerns about a divergence in the Relative Strength Index (RSI). In thin trading due to a holiday, USD/JPY has held within a narrow range of 141.50-142.00. The Bank of Japan (BoJ) continues to adopt a dovish stance, preventing excessive appreciation of the yen.

Picks of the Day Analysis

EUR/USD (4 Hours)

EUR/USD Trades with Modest Losses as Speculative Interest Remains Optimistic

The EUR/USD pair experienced slight declines in a quiet Monday session as the markets digested last week’s central bank activities. Speculative interest grew more optimistic as the tightening cycle neared its end, potentially averting potential recessions, and inflation gradually eased from its mid-2022 peak. The US Dollar strengthened due to position adjustments following last week’s sell-off but remained fundamentally weak, reflecting the prevailing preference for riskier assets. While the Eurozone’s macroeconomic calendar had limited impact, statements from European Central Bank (ECB) members, such as Philip R. Lane and Isabel Schnabel, elevated expectations for additional rate hikes. Lane deemed a hike in July appropriate, with September’s decision dependent on data, while Schnabel expressed concerns about past underestimations of inflation and suggested the potential for further rate increases this year. Looking ahead, upcoming releases of the April Current Account and Construction Output in the EU, along with May Building Permits and Housing Starts in the United States (US), will provide further insights. Additionally, Federal Reserve (Fed) Chairman Jerome Powell’s upcoming testimony before Congress on Wednesday may offer fresh clues on future monetary policy directions.

According to technical analysis, the EUR/USD pair moves slightly lower on Monday as the US market is in holiday reaching the middle band of the Bollinger Bands, with the potential to reach slightly lower before goes back higher. The Relative Strength Index (RSI) is currently at 58, indicating that the EUR/USD now in slowly back to the neutral stance.

Resistance: 1.0982, 1.1034

Support: 1.0892, 1.0803

XAU/USD (4 Hours)

XAU/USD Trades Range-bound as US Markets Observe Juneteenth Holiday

Spot Gold (XAU/USD) traded within a narrow range around $1,950 on a quiet Monday, as US markets were closed for the Juneteenth Holiday and the macroeconomic calendar lacked significant events. The metal eased slightly as the US Dollar corrected from oversold conditions, but overall market sentiment remained positive, with Asian and European shares posting minor losses. This week’s focus lies on Federal Reserve Chairman Jerome Powell’s congressional testimony and the Bank of England’s monetary policy decision. Powell’s statements, usually released beforehand, will draw speculation as they may provide insights into future monetary policy. The BoE is expected to implement a 25 basis points rate hike while keeping the possibility of additional increases open, with market players eyeing a terminal rate of 6% in early 2024.

According to technical analysis, the XAU/USD pair is moving lower and just break below the middle band of the Bollinger Bands, with the potential of moving lower move to reach the support level and the lower band of the Bollinger Bands. Currently, the Relative Strength Index (RSI) is at 43, indicating that the XAU/USD is in neutral stance but slightly bearish.

Resistance: $1,963, $1,972

Support: $1,939, $1,932