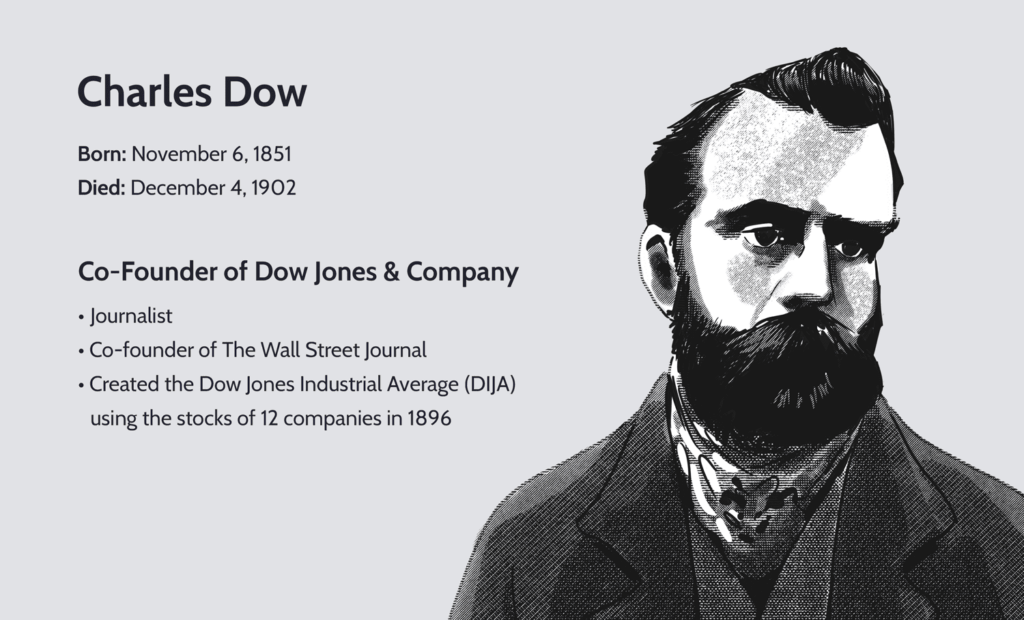

Transport yourself back to the remarkable year of 1896, a time characterised by industrial revolution and transformative economic changes. Amid the bustling streets of New York City, the brilliant mind of Charles Dow sparked an idea that would send ripples through the financial world.

With a mere selection of 12 carefully chosen companies, he crafted what we know today as the Dow Jones Industrial Average (DJIA) – a beacon of brilliance among stock indices.

Fast-forward to the present day, and these luminous indicators continue to captivate investors and economists alike. They offer a unique glimpse into a country’s economic performance, providing invaluable insights into the ever-changing global financial landscape.

If you’re interested in understanding how indices trading works, what these indices represent, and how to analyse their price movements, continue reading to explore our detailed guide.

Understanding Indices

Indices are numerical representations of the top-performing shares from a particular stock exchange. They provide a snapshot of the exchange’s major players by averaging individual stock movements, consolidating a vast amount of financial activity into a single figure.

Some of the largest indices in the world are:

- Dow Jones (in the US)

- Nasdaq (US)

- S&P 500 (US)

- DAX 40 (in Germany)

- CAC (in France)

- FTSE (in the UK)

- Hang Seng (in Hong Kong)

- Nikkei (in Japan)

- ASX (in Australia)

Stock indices can be calculated using two distinct approaches: one involves considering the performance of the largest companies, known as a market capitalisation-weighted average. This method is employed for indices like the S&P 500, FTSE, and ASX, where the movements of high-value companies carry greater influence over the overall index.

While the majority of stock indices adopt this approach, there are exceptions, and some indices are calculated using a price-weighted average. The Dow Jones and Nikkei are prime examples of indices using this method, where shares with higher prices wield more significant sway.

Since indices represent the overall stock value of multiple top-performing companies or high-value stocks, they tend to be more volatile compared to individual company stocks, providing both trading opportunities and increased risk for traders.

What is Index Trading?

Since indices are just numbers representing the performance of a group of shares on an exchange, they cannot be directly bought or sold.

Instead, traders need to choose products that mirror their performance, such as:

- Index funds

- Exchange-traded funds (ETFs)

- Futures

- Options

- Contracts for differences (CFDs).

These products track the underlying index’s price, allowing traders to speculate on whether the index’s price will rise or fall and take positions accordingly.

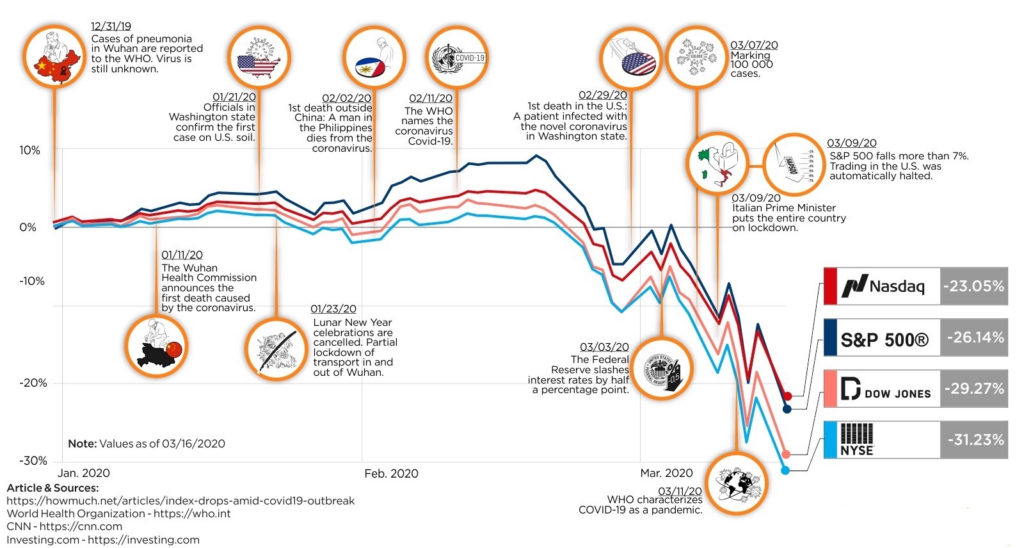

U.S stock indexes drops since 31/12/2019 (as %)

source: howmuch.net

Factors Influencing Index Prices

Various factors can cause index prices to rise or fall, and understanding these factors is essential for trading indices effectively. These factors include:

- General economic news: As indices summarise multiple companies’ stock performances, they serve as indicators of an economy’s health and are influenced by economic news.

- Global news: Multinational corporations within local indices are affected by global events, such as pandemics, natural disasters, commodity price fluctuations, supply chain disruptions, and global economic turmoil.

- Company financial results: Individual companies’ performance within an index affects the overall index, especially for highly valued companies with significant stock price movements.

- Company announcements: Changes in company leadership, mergers, manufacturing updates, and other announcements have broader implications for individual stock prices and the index price.

- Index composition changes: Adding or removing companies from an index can impact its overall price and requires traders to reevaluate their positions.

How to Trade Indices

When trading stock indices, thorough research, a good understanding of the chosen product, and proper risk management strategies are crucial. Index CFDs are among the most popular trading products. They allow traders to profit from both rising and falling index prices by predicting the price direction accurately.

Traders can approach index CFDs in two ways: going long or going short. Going long involves buying index trading products when expecting the price to rise, while going short involves selling or closing positions when expecting a price decline. Profit or loss depends on the accuracy of the prediction and the market’s overall movement.

CFD trading involves leverage, allowing traders to open positions with a small initial deposit (margin) that represents a percentage of the total asset value. While leverage provides exposure to larger markets with less capital, it also carries the risk of incurring losses greater than the initial deposit. Traders should choose suitable strategies for their portfolios when trading CFDs.

Tips on Successful Trading Indices

- Do your research: Before you start trading, it is important to do your research and understand the risks involved. Read books and articles about index trading and watch educational videos. This will help you understand how the market works and how to make informed trading decisions.

- Start small: Don’t start trading with a large amount of money. Start with a small amount and gradually increase your investment as you gain experience. This will help you minimise your losses if you make any mistakes.

- Use a demo account: VT Markets offers a Demo account [internal link: https://www.vtmarkets.com/get-trading/open-demo-account/] that allow you to trade with virtual money. This is a great way to learn the basics of trading without risking any real money. Once you feel comfortable with the process, you can start trading with real money.

- Be patient: Trading indices can be a volatile market, so it is important to be patient and not expect to get rich quick. It takes time and experience to become a successful trader.

- Use stop-loss orders: Stop-loss orders are a way to limit your losses. If the price of an index falls below a certain level, your trade will be automatically sold, preventing you from losing more money than you are comfortable with.

- Use take-profit orders: Take-profit orders are a way to lock in your profits. If the price of an index rises above a certain level, your trade will be automatically sold, ensuring that you don’t miss out on potential profits.

- Don’t trade emotionally: It is important to stay calm and make rational decisions when trading indices. Don’t let your emotions get the best of you, or you will likely make bad trading decisions.

Starting Index Trading

To begin trading indices in live markets, follow these steps:

- Select your preferred trading method: VT Markets offers indices CFDs, providing opportunities to profit from rising and falling prices.

- Choose between cash indices and index futures: Cash indices have tighter spreads and offer on-the-spot trade pricing, suitable for day traders. Index futures are preferred for longer-term views with fewer overnight funding charges.

- Create and log in to your trading account: Opening a live account [internal link: https://www.vtmarkets.com/get-trading/forex-trading-account/] with VT Markets is quick and easy.

- Choose the index to trade: Select from popular global indices [internal link: https://www.vtmarkets.com/trading/markets/indices/] based on available analysis and market insights.

- Decide to go long or short: Choose the direction based on the outlook for the economic sector or domestic market.

- Implement risk management strategies: Utilise stop-loss and limit orders to prevent excessive losses.

- Open your first position: Seize opportunities by monitoring and closing positions at the right time.

In conclusion, trading stock indices offers a window into the performance of major companies and economies worldwide. Understanding the factors influencing index prices and utilising products like index CFDs can provide traders with both opportunities and risks.

With proper research, risk management, and the support of a reliable broker like VT Markets, traders can confidently navigate the exciting world of index trading, diversify their portfolios, and hedge against market fluctuations. Happy trading!

Summary:

- Stock indices represent the overall performance of top-performing shares from specific stock exchanges, providing a snapshot of the economy’s health.

- Indices can be calculated using market capitalisation-weighted or price-weighted averages, affecting their volatility and risk levels.

- Traders can’t directly buy or sell indices but can trade products like index funds, ETFs, futures, options, and CFDs, mirroring index performance.

- Several factors influence index prices, including economic news, global events, company financial results, announcements, and changes in index composition.

- Index CFDs are popular trading products that allow traders to profit from both rising and falling index prices with leverage.

- Proper research, risk management, and selecting the right trading strategy are crucial for successful index trading.