Global uncertainty has intensified because of the danger of the Russian invasion of Ukraine. Given the possibility of an invasion on Wednesday, US Secretary of State Anthony Blinken ordered the closure of the US Embassy in Kyiv to temporarily relocate to Lviv, a city in western Ukraine on Monday.

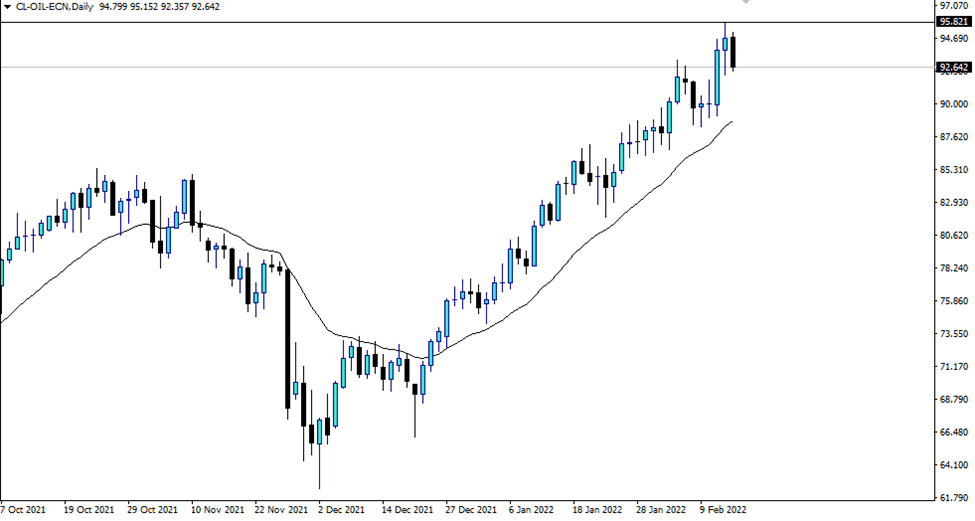

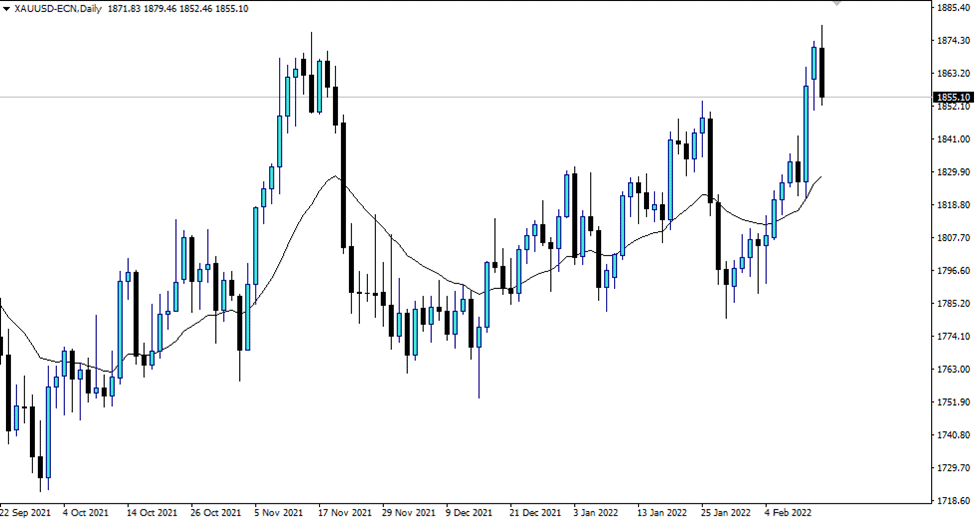

The drama surrounding the buildup of soldiers on the Russian-Ukrainian border has prompted market participants to seek a safe-haven, put pressure on the stock market due to the high-risk element, and pushed world oil prices back up to $95/barrel.

Market are awaiting word on whether the invasion will occur tomorrow or whether the Russian military exercises are only a protest against the US plans to create a military base in Ukraine. Russia’s capital, Moscow, will not be secured if Ukraine joins NATO, as it is too close to a planned military facility in Ukraine.

There are divergent perspectives among world leaders:

Soheil Al-Mazrouei, the UAE’s Minister of Energy, stated that a Russian invasion of Ukraine is improbable.

On Monday, the UK Prime Minister warned that an attack on Ukraine might occur within 48 hours.

However, Ukraine President Volodymyr Zelenskyy’s response was as follows: “We are threatened with war, and they have set a date for a major invasion.” However, he noted that this is not the first time, and their intelligence agencies are aware of Russian forces’ actions.

Similarly, there is a statement from the Russian side, in which the Kremlin dismisses US warnings of an impending strike as “hysteria” and “absurdity”.

According to recent developments, Russia has ordered the departure of its forces.

This uncertainty may result in significant fluctuation in certain pairs.

Our risk team is monitoring closely and would like to remind our investors to brace for more market volatility in the days and weeks ahead especially in oil and gold related products.

Oil and Gold prices will be the most impacted in the coming weeks.

자주하는 질문

홍보

Risk Warning: Trading CFDs carries a high level of risk and may not be suitable for all investors. Leverage in CFD trading can magnify gains and losses, potentially exceeding your original capital. It’s crucial to fully understand and acknowledge the associated risks before trading CFDs. Consider your financial situation, investment goals, and risk tolerance before making trading decisions. Past performance is not indicative of future results. Refer to our legal documents for a comprehensive understanding of CFD trading risks.

The information on this website is general and doesn’t account for your individual goals, financial situation, or needs. VT Markets cannot be held liable for the relevance, accuracy, timeliness, or completeness of any website information.

Our services and information on this website are not provided to residents of certain countries, including the United States, Singapore, Russia, and jurisdictions listed on the FATF and global sanctions lists. They are not intended for distribution or use in any location where such distribution or use would contravene local law or regulation.

VT Markets is a brand name with multiple entities authorised and registered in various jurisdictions.

· VT Global Pty Ltd is authorised and regulated by the Australian Securities & Investments Commission (ASIC) under licence number 516246.

· VT Global is not an issuer or market maker of derivatives and is only allowed to provide services to wholesale clients.

· VT Markets (Pty) Ltd is an authorised Financial Service Provider (FSP) registered and regulated by the Financial Sector Conduct Authority (FSCA) of South Africa under license number 50865.

· VT Markets Limited is an investment dealer authorised and regulated by the Mauritius Financial Services Commission (FSC) under license number GB23202269.

Copyright © 2024 VT Markets.