On Tuesday, the S&P 500 reached its highest close since the beginning of 2023, reflecting a recent rally that propelled the index to its strongest level in nine months. The broad-market index added 0.24% to finish at 4,283.85, marking its highest close since August 2022. Similarly, the Nasdaq Composite also achieved a closing high for 2023, rising 0.36% to end at 13,276.42. Meanwhile, the Dow Jones Industrial Average experienced a slight uptick of 0.03%, or 10.42 points, closing at 33,573.28, hindered by notable losses in Merck and UnitedHealth.

In other market news, Coinbase faced a significant setback as it plummeted over 12% following a lawsuit filed by the Securities and Exchange Commission (SEC) against the cryptocurrency company. The SEC accused Coinbase of operating as an unregistered broker and exchange. On a positive note, Bitcoin saw an increase of more than 6% according to CoinMetrics. Additionally, Apple shares declined by 0.2% the day after the highly anticipated unveiling of their virtual reality headset and new software at the annual Worldwide Developer Conference, despite hitting an all-time high in the previous trading session.

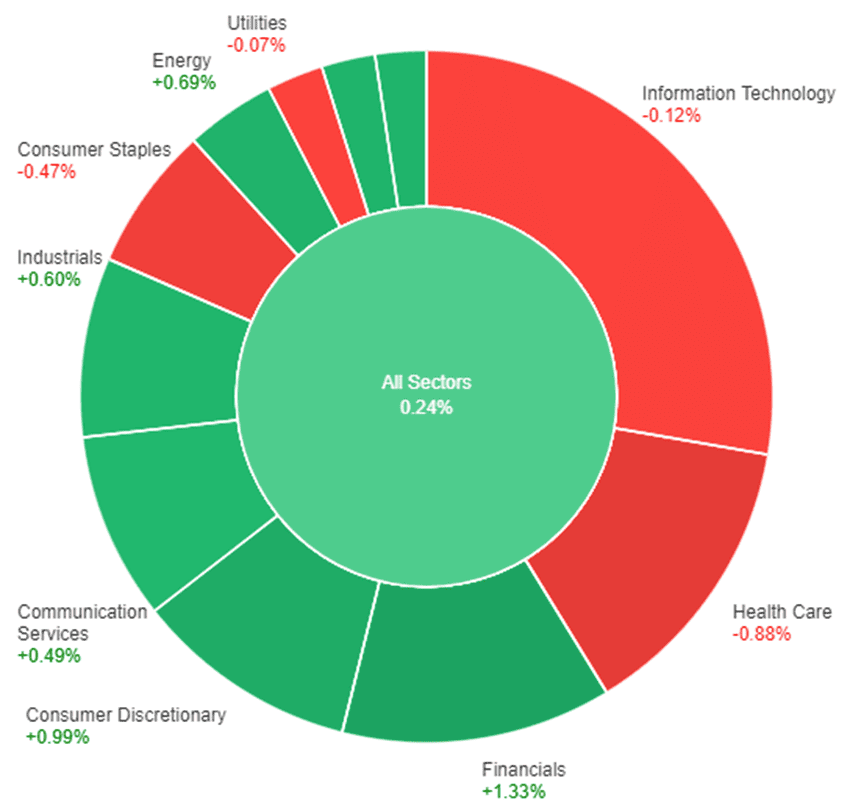

Data by Bloomberg

On Tuesday, the overall market experienced a positive price change of 0.24%. Among the sectors, Financials showed the highest increase with 1.33%, followed by Consumer Discretionary at 0.99%. Energy and Real Estate sectors also saw gains, with increases of 0.69% and 0.66% respectively. Materials and Industrials sectors had relatively smaller gains of 0.65% and 0.60% respectively. Communication Services showed a modest increase of 0.49%. On the other hand, Utilities experienced a slight decline of -0.07%. Information Technology and Consumer Staples also showed negative price changes, with decreases of -0.12% and -0.47% respectively. Health Care sector had the largest decrease of -0.88% on Tuesday.

Major Pair Movement

On Tuesday, the US dollar (USD) strengthened due to a lack of significant risk events and a limited news calendar. The US Dollar index had a volatile trading session within a narrow range. The dollar received support from weakness in the euro (EURUSD), while positive growth forecasts for the US by Goldman Sachs and the World Bank further boosted the greenback.

Among the G10 currencies, the euro (EUR) underperformed, causing EURUSD to reach lows of 1.0668 before finding some support at a Fibonacci level. This decline followed a disappointing report on German industrial orders and a consumer survey conducted by the European Central Bank (ECB), which revealed a significant decrease in inflation expectations. Adding to the bearish sentiment were dovish comments from ECB member Knot, known for his hawkish stance, who stated that “the worst of inflation is behind us.” More ECB statements are scheduled for Wednesday, which could reinforce this cautious outlook.

The Australian dollar (AUD) stood out as the top performer among the G10 currencies after the Reserve Bank of Australia (RBA) surprised the market with a 25-basis point rate hike, bringing rates to 4.10%. The RBA’s hawkish statement, indicating the possibility of further rate increases, propelled AUDUSD to a high of 0.6685, just shy of the 200-day moving average at 0.6692. The Australian dollar held most of its gains after the announcement throughout the session.

EUR/USD (4 Hours)

EUR/USD Drops Amid Cautious Markets as Focus Shifts to Central Bank Meetings

The EUR/USD experienced a decline while trading around the 1.0700 area, with attention turning to upcoming central bank meetings. The European Central Bank (ECB) is expected to raise interest rates by 25 basis points next week, followed by another potential hike in July. However, economic indicators, such as stagnant retail sales in the Eurozone and a decline in German factory orders, reflect consumer caution. The US Dollar saw modest gains as market participants remained wary ahead of a crucial week, considering a bleak global outlook and the anticipation of higher interest rates. The Federal Reserve’s upcoming FOMC meeting is awaited with caution, as analysts closely monitor the May Consumer Price Index as a determining factor.

According to technical analysis, the EUR/USD pair moved lower on Tuesday, trying to reach the lower band of the Bollinger Bands and moved flat before closing the day. Currently, the EUR/USD is running just below the middle band, with the potential for it to move lower to reach the lower band of the Bollinger Bands. The Relative Strength Index (RSI) is currently at 45, indicating that the EUR/USD is in a neutral trend.

Resistance: 1.0724, 1.0766

Support: 1.0671, 1.0634

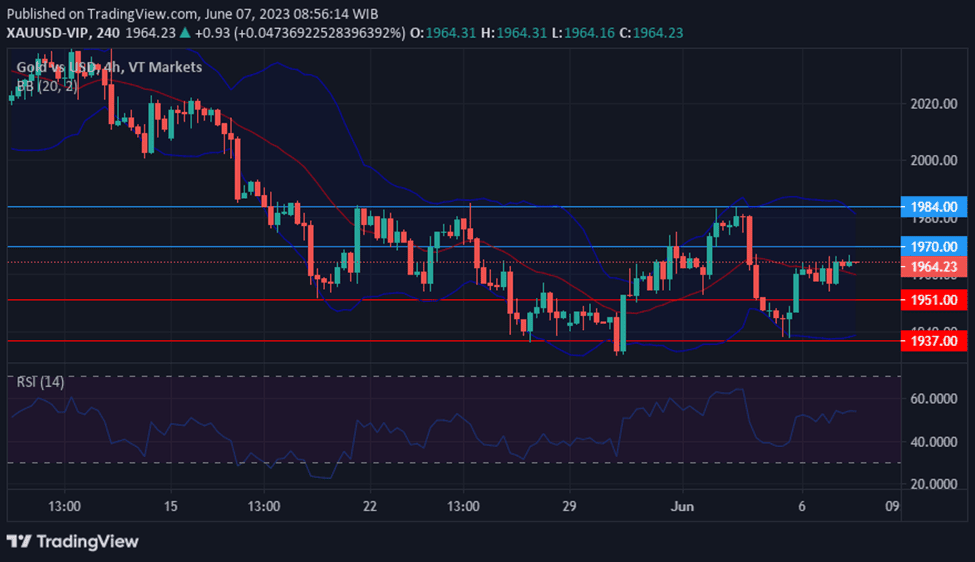

XAU/USD (4 Hours)

Gold (XAU/USD) Under Pressure as Markets Await Central Bank Decisions and Inflation Data

Gold (XAU/USD) facing slight downward pressure, hovering around $1,960, as financial markets adopt a cautious stance due to discouraging macroeconomic data and upcoming major announcements. Weighing on market sentiment are softer-than-expected figures, alongside anticipation of monetary policy decisions by the US Federal Reserve and the European Central Bank. While the Fed is expected to maintain its current stance, the ECB is likely to implement another rate hike. Additionally, the US will release an update on inflation before the Fed’s decision, with the May Consumer Price Index anticipated to rise by 4.2% YoY. Despite the Fed’s tightening measures, the labour market remains tight, and wage inflation remains a concern. Economic growth has slowed due to monetary tightening, and central banks are striving to strike a delicate balance between maintaining economic activity and curbing inflation. The recent bank crisis in March has prompted policymakers to adopt a cautious approach, but if inflation remains high and the labour market remains tight, the US central bank may resume raising interest rates, leading to uncertainty in the financial markets.

According to technical analysis, the XAU/USD pair is moving higher on Tuesday, reaching above the middle band of the Bollinger Bands. There is a possibility that the XAU/USD will continue to move higher and try to reach the upper band of the Bollinger Bands. Currently, the Relative Strength Index (RSI) is at 54, suggesting that the XAU/USD is in a neutral but slightly bullish trend.

Resistance: $1,970, $1,984

Support: $1,951, $1,937

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| AUD | Gross Domestic Product q/q | 09:30 | 0.3% |

| CAD | BOC Rate Statement | 22:00 | |

| CAD | Overnight Rate | 22:00 | 4.50% |