On Monday, the U.K. markets were closed for a bank holiday, while U.S. markets were closed for Memorial Day. European stocks had a turbulent week, with the Stoxx 600 index hitting an eight-week low but recovering some losses on Friday due to a rally in tech stocks, driven by Nvidia’s impressive results.

In the U.S., political leaders are working to secure bipartisan support for the debt ceiling bill in Congress before the June 5 deadline to prevent a federal default. The U.S. House of Representatives could vote on the bill as early as Wednesday, followed by the Senate later in the week. Market concerns are expected to ease if the debt ceiling deal is approved, allowing investors to shift their focus to the economic outlook and interest rates.

The Federal Reserve, European Central Bank, and Bank of England were anticipated to pause rate hikes and assess when to change direction, but recent data has complicated the situation for all three institutions. In Asia-Pacific markets, there was a mixed performance, with Japan’s Nikkei 225 reaching its highest levels since July 1990.

Over the weekend, President Joe Biden and House Majority Leader Kevin McCarthy reached an agreement to raise the debt ceiling and avoid a default. The legislation will be voted on by Congress as early as Wednesday. Both Republican and Democratic support is crucial for the bill to pass. The agreement came just before the “X date” on June 5, which was the earliest potential default date signalled by the Treasury Department. The prolonged negotiations between the White House and congressional leaders had concerned investors, who were already dealing with inflation and a banking crisis.

Investors will also focus on May jobs data to be released on Friday, as well as the April Job Openings and Labor Turnover Survey from the Bureau of Labor Statistics on Wednesday. Additionally, corporate earnings from HP Inc. and Salesforce are expected on Tuesday and Wednesday, respectively.

On Monday, the US markets remained closed in observance of Memorial Day, resulting in a subdued atmosphere in the currency market. With limited trading activity, volatility was relatively low. The Dollar Index managed to register a slight rise of 0.05%, indicating a modest strengthening of the US dollar compared to a basket of other major currencies.

Among the currency pairs, the EURUSD experienced a slight decrease of 0.08%, reflecting a slight weakening of the euro against the US dollar. Surprisingly, the GBPUSD pair showed a rise of 0.13%, despite the closure of the UK market. This suggests that market participants may have responded to other factors, such as economic news or geopolitical developments. Meanwhile, the USDJPY pair saw a minor decline of 0.10%, signaling a marginal decrease in the value of the US dollar compared to the Japanese yen. Conversely, the AUDUSD pair demonstrated an upward movement, rising by 0.26%, indicating a relative strengthening of the Australian dollar against its US counterpart.

In terms of commodities, gold remained relatively stable, exhibiting a marginal increase of 0.05%. The price of gold often serves as a safe-haven asset during uncertain times, and its modest rise may reflect investors seeking stability amid the subdued market conditions. On the other hand, USOUSD (WTI), which represents the price of West Texas Intermediate crude oil, experienced a decline of 0.16%. This dip could be attributed to various factors, including global supply and demand dynamics, geopolitical tensions, or market sentiment regarding the energy sector. Overall, with the closure of US markets and limited trading activity, the currency and commodity markets displayed muted movements on Memorial Day.

EUR/USD weakens against US Dollar amidst data anticipation and market focus on Debt limit suspension.

The EUR/USD pair maintained its position above the previous week’s lows but experienced another daily loss, closing at its lowest level since March 17. Despite staying above 1.0700 and avoiding new monthly lows, the euro weakened against the US dollar during the European session and declined against the pound. The currency lagged other major currencies on Monday, failing to break its negative trend against the greenback. The focus shifted to Spain’s upcoming release of the preliminary Consumer Price Index (CPI) report for May, which holds significance for European Central Bank (ECB) officials and market expectations. Meanwhile, the US dollar posted mixed results, with a slight gain of less than 0.1% against a basket of currencies, reaching its highest close in two months above 104.20.

As market expectations shift from a pause to a potential 25-basis-point increase at the next Federal Open Market Committee (FOMC) meeting, any decline in the US dollar is expected to be limited. With US markets closed for Memorial Day, Monday saw subdued trading activity, as market participants analyzed the weekend’s agreement in Washington to suspend the debt limit, while awaiting Congressional approval.

Attention also turned to Friday’s US consumer inflation data and the upcoming release of key economic reports throughout the week, including housing data and consumer confidence on Tuesday, as well as the ADP employment report on Thursday and Nonfarm Payrolls on Friday.

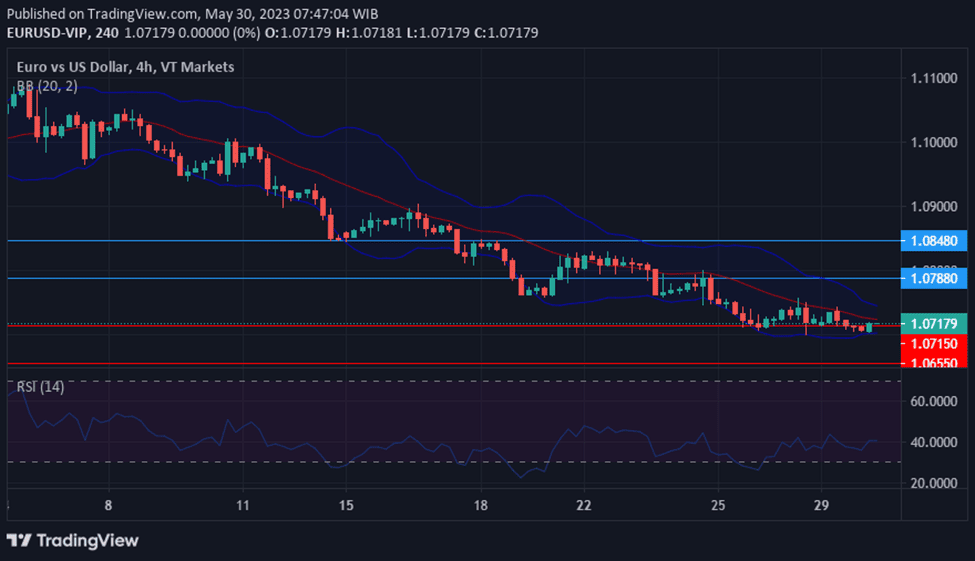

According to technical analysis, the EUR/USD pair is experiencing a slow movement on Monday due to holidays in the UK and US markets. This has resulted in a narrower range between the upper and lower bands of the Bollinger Bands.

It is anticipated that the EUR/USD will make a modest upward move today, aiming to reach the middle and upper bands of the Bollinger Bands. The Relative Strength Index (RSI) is currently at 40, suggesting that the bearish sentiment for the EUR/USD may be easing for today.

Resistance: 1.0788, 1.0848

Support: 1.0715, 1.0655

Gold (XAU/USD) holds steady amid optimism over US Debt Ceiling agreement.

Gold prices (XAU/USD) remained steady at $1,943 per troy ounce on Monday, unaffected by holidays in Europe and the United States. Investor optimism prevailed at the start of the week following an agreement on the debt ceiling reached between US President Joe Biden and House Speaker Kevin McCarthy. However, the deal still requires approval from Congress, and concerns persist due to the limited time remaining before the deadline set by Treasury Secretary Janet Yellen on June 1.

Despite the holiday-induced low trading volumes, stock futures rose, reflecting the positive market sentiment and dampening the appeal of safe-haven assets like gold. With no significant events to monitor at the beginning of the week, the macroeconomic calendar lacks substantial releases, although noteworthy data is expected in the coming days.

On Tuesday, the US will publish the CB Consumer Confidence report, while Germany and the Eurozone will release preliminary estimates of their May Harmonized Index of Consumer Prices (HICP) in the following days. Furthermore, the US will unveil the ADP Survey on private job creation ahead of the Nonfarm Payrolls report scheduled for Friday. These figures hold significance for policymakers and could fuel speculation about future decisions by central banks.

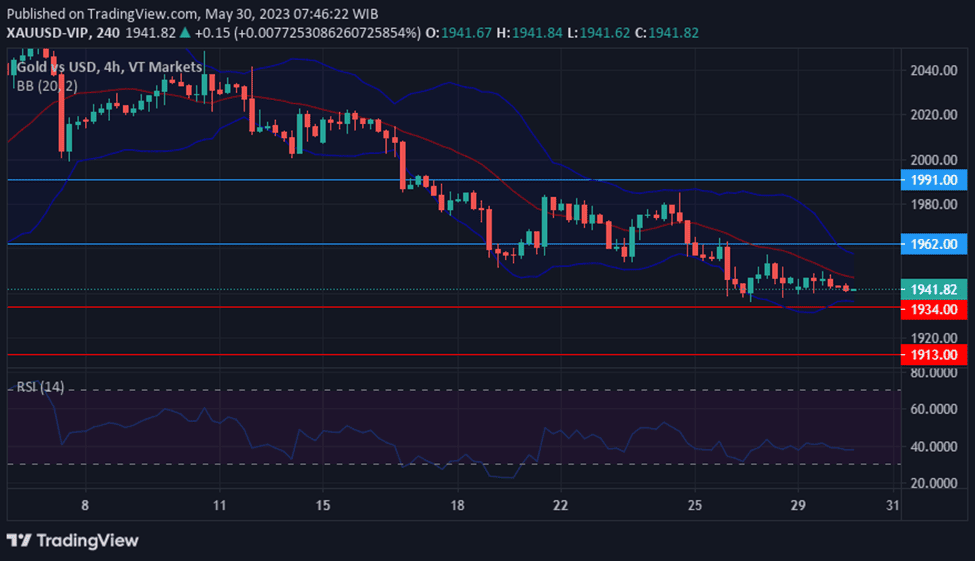

According to technical analysis, the XAU/USD is moving slower on Monday due to the US market holiday. There is a possibility that the XAU/USD will attempt to move higher and reach the middle and upper bands of the Bollinger Bands today. Currently, the Relative Strength Index (RSI) stands at 38, indicating that the XAU/USD is in a neutral position.

Resistance: $1,962, $1,991

Support: $1,934, $1,913

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| USD | CB Consumer Confidence | 22:00 | 99.1 |