On Thursday, the Dow Jones Industrial Average fell 0.86%, the S&P 500 slid 0.72%, and the Nasdaq Composite shed 0.49%, marking the fourth consecutive day of declines for the major indexes. The decline was caused by contagion fears in the regional bank space as PacWest’s shares tanked over 50% due to news that the California bank has been assessing strategic options, including a possible sale. The SPDR S&P Regional Bank ETF (KRE) dropped more than 5%, while Western Alliance tumbled 38% and Zions Bancorporation lost 12%.

The Federal Reserve’s 25 basis point rate hike and commentary following its Wednesday meeting were also being digested by investors. Keith Apton, managing director at UBS Wealth Management, believes that the volatility in the banking sector will help the Fed’s mission of cooling down the economy. Apton believes that regional lenders will have to constrain capital, which will indirectly cool down the economy and bring inflation down. Additionally, he does not believe that the Fed will have to raise rates any further for the rest of this year, although Friday’s nonfarm payrolls report will be important to watch.

Overall, the decline in the major indexes was due to contagion fears in the regional bank space and investors digesting the Federal Reserve’s rate hike and commentary.

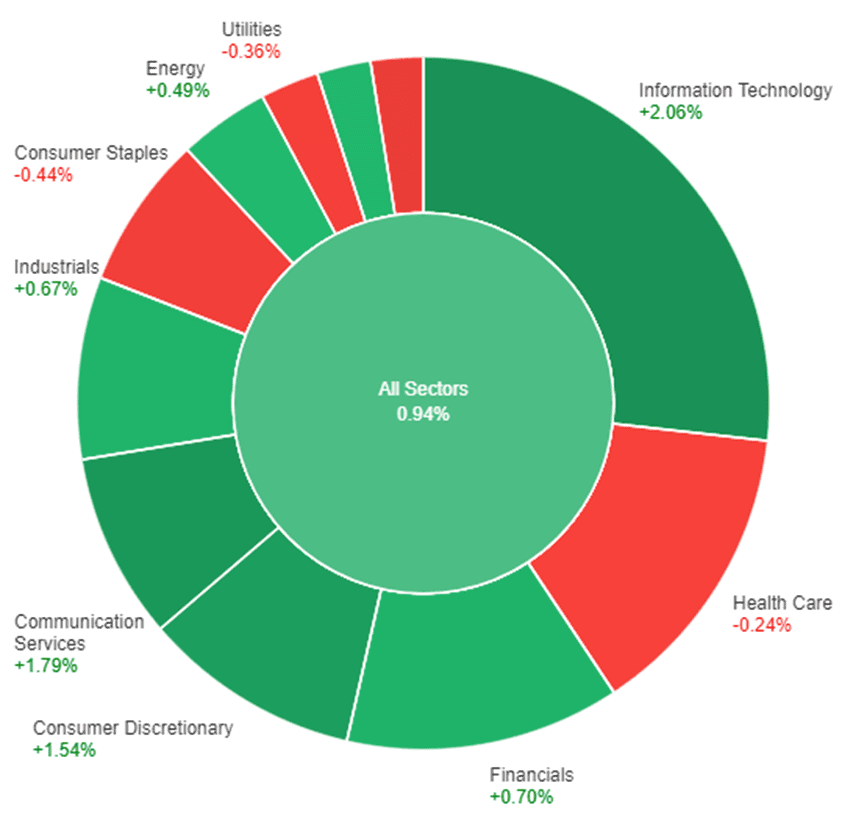

On Thursday, the US stock market fell by 0.72%, with sectors experiencing varying degrees of decline. The financial industry saw the most significant drop at 1.29%, followed by communication services at 1.26%, and energy and industrials both declined by over 1%. Real estate and utilities were the only sectors that saw gains, with real estate up 0.92% and utilities up 0.73%. Consumer staples saw a small decline of 0.29%, while information technology, materials, consumer discretionary, and health care all declined between 0.49% to 0.81%.

Major Pair Movement

On Thursday, the dollar index remained unchanged, but it gained against the euro and lost to the yen due to increasing banking and recession concerns. Market uncertainty surrounding central bank tightening combined with worries about economic and financial stability were reflected in the decreasing inversion of Treasury and euro zone yield curves. The falling German exports and retail sales and unhealthy US Q1 productivity and labor costs raised further concerns.

The implosion of US regional bank stocks could lead to a rate decline and risk-driven USD/JPY, pushing it back toward the banking crisis lows of April and March. A full percentage point of Fed rate cuts is being priced in by year-end, while the ECB is only expected to hike 28bp.

On Friday, the focus will be on US employment data, but concerns over banking stress will continue to be in the spotlight.

Technical Analysis

EUR/USD (4 Hours)

EUR/USD remains down as the ECB hikes rates and US NFP is in focus.

The EUR/USD pair fell after the ECB meeting due to declining European bond yields and lower US yields affecting the US Dollar’s performance. The ECB announced a 25 basis point hike in interest rates, signaled likely further hikes, and stopped asset purchase program reinvestments from July 2023. Market participants expect two more rate hikes at the next two meetings. The Eurozone will release Retail Sales data for April on Friday, while the US employment report will be the key event.

According to technical analysis, the EUR/USD pair is currently trending lower after a period of upward movement. At present, the price has reached the middle band of the Bollinger band, indicating a consolidation phase. It is expected that the EUR/USD will continue to consolidate and remain within our support and resistance levels. The Relative Strength Index (RSI) is presently at 51, suggesting a neutral trend in the EUR/USD market.

Resistance: 1.1051, 1.1073

Support: 1.1015, 1.0986

XAU/USD (4 Hours)

Gold (XAU/USD) Bulls Hold Strong Ahead of US Nonfarm Payrolls Report.

XAU/USD fell with the Asian opening, but then jumped back to near record highs of $2,078.36 before closing the gap. It has since retreated to around $2,050, supported by falling US Treasury yields which put pressure on the Greenback. The ECB announced a widely anticipated 25 bps hike, with market players rushing to discount at least 2 or 3 more rate hikes. Lagarde confirmed that they are not concerned about the banking situation, and the decision to hike at a slower pace was linked to the crisis. The US employment figures are now in focus, with the market anticipating the April Nonfarm Payrolls report on Friday.

The technical analysis indicates that XAU/USD is still hovering in the high territory, but it has slowed down a bit. The price is currently just below the upper band of the Bollinger Band, indicating the potential for a downward movement. Moreover, the Relative Strength Index (RSI) is currently above 70, indicating that XAU/USD is overbought.

Resistance: $2,068, $2,058

Support: $2,046, $2,033

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

| CHF | Consumer Price Index | 14:30 | 0.2% |

| CAD | Employment Change | 20:30 | 21.6K |

| CAD | Unemployment Rate | 20:30 | 5.1% |

| USD | Average Hourly Earnings m/m | 20:30 | 0.3% |

| USD | Unemployment Rate | 20:30 | 181K |

| USD | Non-Farm Employment Change | 20:30 | 3.6% |