In a temporary halt to the recent market rally, stocks experienced a decline on Wednesday. Investor sentiment was influenced by Federal Reserve Chair Jerome Powell’s remarks on inflation. The Dow Jones Industrial Average dropped 0.30%, the S&P 500 declined by 0.52%, and the Nasdaq Composite slid 1.21%, marking the third consecutive day of losses for all three indexes.

The pullback was particularly evident among major tech stocks that had seen significant gains due to the hype around artificial intelligence. Amazon shares fell by approximately 0.8% following a lawsuit by the Federal Trade Commission, accusing the company of misleading customers and obstructing cancellation attempts. Nvidia, which witnessed an impressive 200% surge this year, saw a 1.7% decrease. Google-parent Alphabet and Netflix also experienced declines of over 2%.

The decline in stocks was further fueled by disappointing earnings reports. FedEx shares fell over 2% after reporting weaker-than-expected revenue for the last quarter, while Winnebago’s shares dropped nearly 1.3% due to the company’s failure to meet third-quarter revenue estimates.

Investor attention was also drawn to Powell’s statements, where he indicated the likelihood of future interest rate hikes in response to combating inflation. Although the central bank refrained from raising rates after 10 consecutive hikes, Powell mentioned the possibility of two more quarter-percentage-point moves this year. This cautious outlook contributed to the pause in the recent market exuberance, as investors reassessed their positions following the S&P 500’s highest level since April 2022 and its five consecutive positive weeks.

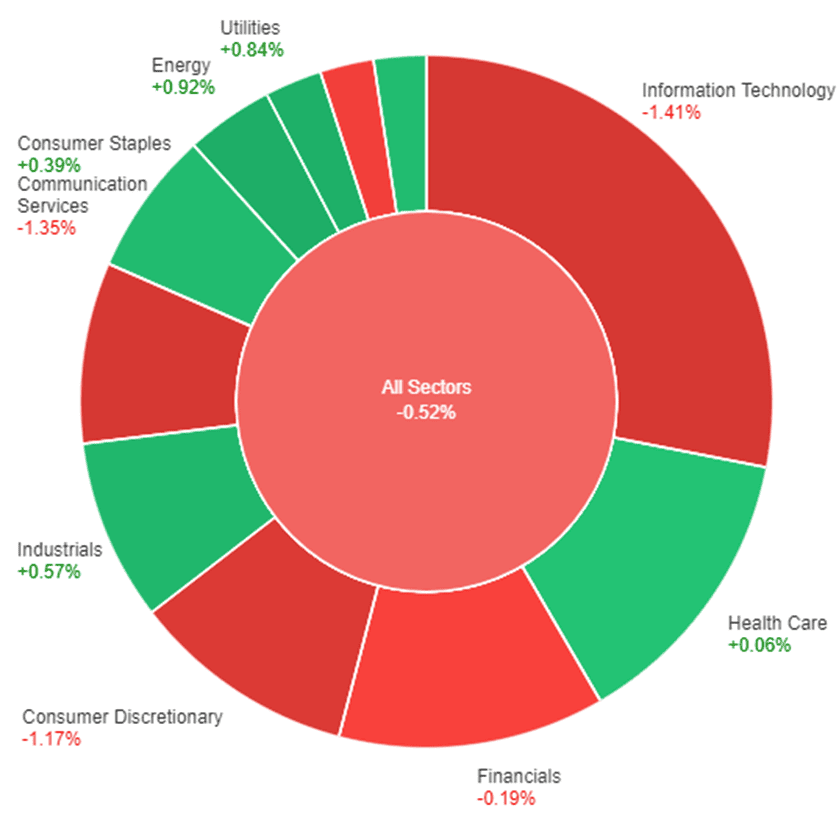

Data by Bloomberg

On Wednesday, there were varied price changes across different sectors. The energy sector experienced a positive gain of 0.92%, followed by utilities with a gain of 0.84%, and industrials with a gain of 0.57%. Consumer staples and materials sectors also saw modest gains of 0.39% and 0.35% respectively. Health care had a minimal increase of 0.06%.

However, some sectors experienced losses. The largest decline was observed in the information technology sector, which had a decrease of 1.41%. This was followed by communication services with a decline of 1.35%, and consumer discretionary with a decline of 1.17%. The financials sector also experienced a slight decrease of 0.19%. Real estate had the largest loss among the sectors, with a decline of 0.45%.

On Wednesday, the dollar index experienced a 0.45% decline as Fed Chair Jerome Powell’s testimony and comments indicated uncertainty about the extent of future policy tightening by the U.S. central bank. Powell’s comparison of the gradual tightening to slowing down a car as it approaches its destination worried dollar traders, leading to further losses.

Meanwhile, EUR/USD rose by 0.65%, surpassing previous highs after the Fed and ECB meetings, and approaching the significant psychological barrier of 1.10. The market expects two more rate hikes from the ECB before a prolonged plateau, while only one additional hike from the Fed is anticipated before rate cuts begin next year.

Sterling initially experienced losses but later recovered, returning to a flat position. Concerns about the UK’s inflation, which reached its highest level since 1992 at 7.1% in April, raised worries that the Bank of England (BoE) would need to implement substantial tightening measures, potentially leading to a challenging economic situation.

Market uncertainty regarding the extent of rate hikes by the BoE resulted in a 10-basis point increase in two-year gilts yields. However, expectations remain steady at a total of 150 basis points of hikes and a terminal rate of 6%. The doubts surrounding additional Fed hikes pulled the sterling up from its 10-day moving average support level of 1.2691, edging closer to Tuesday’s highs.

On the other hand, the Bank of Japan (BoJ) maintained its negative policy rate, implemented yield curve control, and engaged in extensive asset purchases. This policy contrast with other central banks, including the Fed, propelled USD/JPY to new highs in 2023 at 142.37.

However, significant resistance at 142.50 prevented further gains. To surpass this resistance, USD/JPY may require support from U.S. jobless claims data on Thursday and Japan’s consumer price index (CPI) release on Friday, reinforcing the bullish divergence between the Fed and BoJ policies.

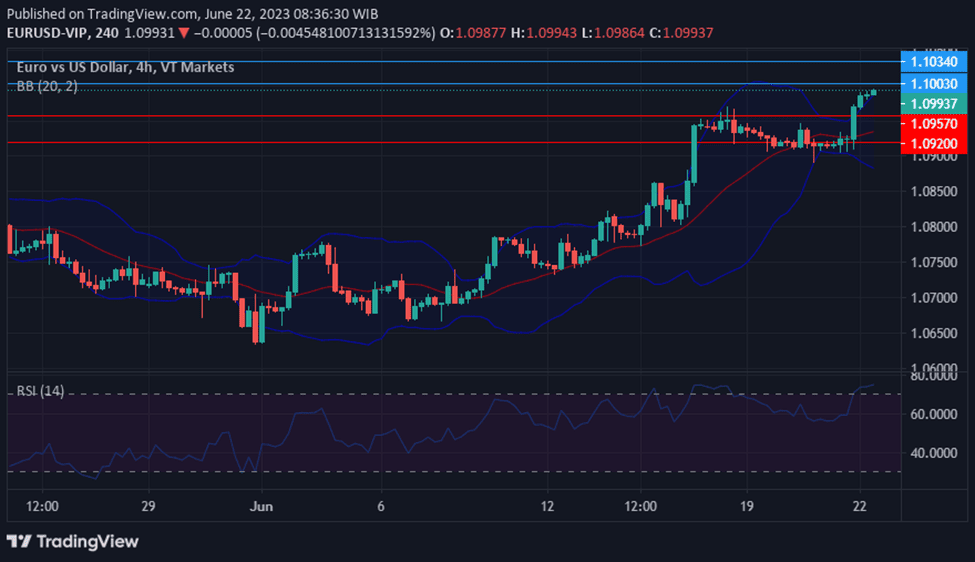

EUR/USD (4 Hours)

EUR/USD Surges as Euro Outperforms and US Dollar Weakens amid Fed Chair Powell’s Comments

The EUR/USD pair experienced a surge on Wednesday, reaching its highest level in a month at 1.0989, with the Euro displaying strength while the US Dollar weakened due to lower Treasury yields. Federal Reserve Chair Powell’s comments during his testimony to the House Financial Services Committee provided no surprises.

In contrast, the German IFO Institute warned of a sharper-than-expected German recession, leading to uncertainty about the European Central Bank’s (ECB) future rate hikes. However, ECB members Schnabel and Nagel remained hawkish, suggesting more work needs to be done. Despite UK inflation numbers, the Euro continued to outperform, particularly against the GBP.

Meanwhile, Fed Chair Powell reiterated the FOMC’s message from the recent monetary policy meeting, emphasizing potential rate hikes if the economy performs as anticipated. The US Dollar faced additional pressure as US yields turned negative, pushing the EUR/USD closer to the 1.1000 level. While no significant data from the European Union was expected on Thursday, the US would release Jobless Claims and Existing Home Sales reports. Furthermore, the Bank of England’s decision could potentially impact the markets.

According to technical analysis, the EUR/USD pair experienced a strong movement on Wednesday and able to break our resistance level and create a push to the upper band of the Bollinger Bands. The Relative Strength Index (RSI) is currently at 74, indicating that the EUR/USD is back in a bullish trend which can create another higher movement.

Resistance: 1.1003, 1.1034

Support: 1.0920, 1.0957

XAU/USD (4 Hours)

XAU/USD Recovers from Three-Month Low as US Dollar Loses Momentum on Powell’s Comments

The price of gold (XAU/USD) bounced back from a recent three-month low of $1,919.12 per troy ounce as the US Dollar lost steam following statements made by Federal Reserve Chairman Jerome Powell. Initially, the Greenback had strengthened in anticipation of a hawkish stance from the Fed chief.

However, Powell’s remarks, which echoed the latest Federal Open Market Committee (FOMC) Minutes, indicated that while the US economy was growing at a modest pace and the labour market remained tight, inflation was gradually decreasing, and consumer strength was waning.

This assurance alleviated market concerns, leading to a recovery in stock markets and a decline in the US Dollar against major currencies.

According to technical analysis, the XAU/USD pair is moving lower and has reached the lower band of the Bollinger Bands. There is potential for a slight upward movement, aiming to reach the middle band. Currently, the Relative Strength Index (RSI) is at 38, indicating that the XAU/USD is bearish but still in a neutral stance.

Resistance: $1,939, $1,950

Support: $1,932, $1,924

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| CHF | SNB Monetary Policy Assessment | 15:30 | |

| CHF | SNB Policy Rate | 15:30 | 1.75% |

| CHF | SNB Press Conference | 15:30 | |

| GBP | MPC Official Bank Rate Votes | 19:00 | 7–0–2 |

| GBP | Monetary Policy Summary | 19:00 | |

| GBP | Official Bank Rate | 19:00 | 4.75% |

| USD | Unemployment Claims | 20:30 | 261K |

| USD | Fed Chair Powell Testifies | 22:00 |