On Thursday, the S&P 500 and Nasdaq Composite reached impressive new heights, largely driven by Nvidia’s remarkable quarterly earnings report. The S&P 500 surged by 2.11%, its best performance since January 2023, while the Nasdaq Composite soared by 2.96%, flirting with its all-time high, thanks to Nvidia’s 16.4% share price jump after reporting a 265% revenue increase from its thriving AI business. This surge highlighted Nvidia’s growing dominance in the tech sector and boosted confidence across the broader market, particularly in Big Tech stocks like Meta, Amazon, Microsoft, and Netflix. Concurrently, the U.S. economy showed signs of robust health with a significant drop in jobless claims and a surge in existing home sales, further fueling market optimism. Meanwhile, currency markets adjusted to the mixed global economic indicators and policy expectations, with the dollar stabilizing and the USD/JPY pair experiencing an uptick, reflecting the complex interplay of global economic trends and monetary policy anticipations.

On Thursday, the S&P 500 reached new heights, propelled by Nvidia’s unexpectedly strong quarterly earnings, which not only boosted the broader market but also significantly lifted the tech sector. The S&P 500 climbed 2.11% to close at 5,087.03, marking its most impressive performance since January 2023, while the Nasdaq Composite soared 2.96% to end the day at 16,041.62, nearing its all-time closing high. Meanwhile, the Dow Jones Industrial Average experienced a notable surge of 456.87 points or 1.18%, surpassing the 39,000 mark for the first time and closing at a new record of 39,069.11, reflecting widespread optimism in the financial markets.

Nvidia, a leading chipmaker, saw its shares jump 16.4% to an all-time high after announcing a staggering 265% increase in total revenue from the previous year, primarily fueled by its booming artificial intelligence business. This growth has positioned Nvidia as one of the largest U.S. companies by market capitalization, with expectations for continued revenue growth in the coming quarter. The enthusiasm around AI and Nvidia’s extraordinary performance has significantly influenced the rally in Big Tech stocks, including notable gains in shares of Meta, Amazon, Microsoft, and Netflix, thereby bolstering confidence in the tech space, and benefiting the broader stock market.

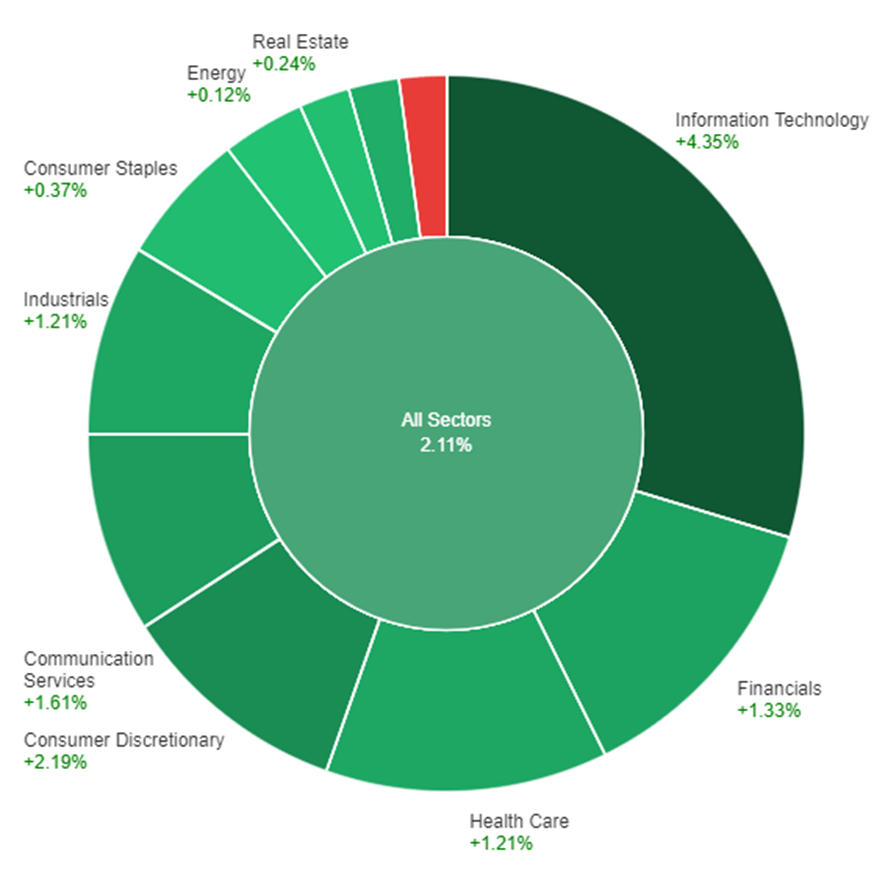

Data by Bloomberg

On Thursday, the stock market witnessed a positive trend across most sectors, with the overall sector experiencing a 2.11% increase in price. Information Technology led the gains with a significant rise of 4.35%, followed by Consumer Discretionary and Communication Services, which saw increases of 2.19% and 1.61%, respectively. Financial, Industrials and Health Care sectors also enjoyed gains, each increasing by over 1%. Materials, Consumer Staples, and Real Estate sectors saw modest rises, with Energy experiencing a slight increase of 0.12%. In contrast, Utilities were the only sector to decline, dropping by 0.77%.

The currency market has seen a notable shift as the dollar index stabilized from a three-week low, propelled by an unexpected drop in U.S. jobless claims which overshadowed the mixed performance in flash PMIs across major economies. Despite the composite PMI readings from the eurozone and the UK slightly surpassing forecasts, and a contraction in the U.S. figures, the market’s attention gravitated towards the robust U.S. jobless claims data, showcasing the lowest levels since before 2018 and comparable to figures last seen in 1969. Additionally, the U.S. housing market demonstrated resilience with existing home sales in January surging by 3.1%, marking the highest point since the previous August, suggesting a sensitivity to fluctuating mortgage rates. This economic optimism was further buoyed by stellar quarterly results from Nvidia, which underscored the rapid expansion of AI usage, influencing global equity markets positively.

Amid these developments, currency pairs reacted to the broader economic indicators and policy expectations. The Euro dipped to a flat position against the dollar, reflective of Germany’s PMI contraction and aligning with anticipations of the ECB’s rate cuts preceding those of the Federal Reserve. Meanwhile, the Sterling showed modest gains against the dollar, buoyed by promising UK PMIs, despite being significantly off its recent high. The USD/JPY pair experienced an uptick, driven by the widening yield spreads between U.S. Treasury and Japanese government bonds, and a general shift towards risk-off flows that placed more pressure on the yen. As the market anticipates upcoming U.S. economic reports, including the core PCE inflation data, income, and consumption figures, the currency landscape remains poised for further adjustments, with special attention to the potential impacts on USD/JPY’s trajectory toward its yearly highs and the looming possibility of Japanese intervention amidst speculations of policy normalization by the Bank of Japan.

EUR/USD Retreats from Three-Week High Amid Mixed US Economic Signals and ECB Caution

EUR/USD experienced a decline from its three-week peak around 1.0900, settling near 1.0820 after an initial surge, influenced by positive US job data and varied bond yield performances amidst speculation of future Federal Reserve (Fed) interest rate cuts. The possibility of the Fed easing monetary policy has been bolstered by strong US inflation figures, though the likelihood of a May rate cut seems diminished, with a greater chance anticipated for June. Conversely, the European Central Bank (ECB) maintains a cautious stance against early rate reductions, despite expectations of a downward inflation forecast revision in March. This cautious approach is echoed by ECB officials, emphasizing the premature nature of financial market relaxation, and highlighting ongoing concerns over wage pressures and the labour market’s tightness, suggesting a potential delay in the ECB’s monetary easing.

On Thursday, the EUR/USD moved higher and reached the upper band of the Bollinger Bands. Currently, the price is moving just above the middle band, suggesting a potential upward movement to reach back to the upper band. Notably, the Relative Strength Index (RSI) maintains its position at 58, signaling a neutral outlook for this currency pair.

Resistance: 1.0845, 1.0896

Support: 1.0783, 1.0723

XAU/USD Retreats from Peak as US Dollar Recovers Amid Positive Economic Indicators

Spot Gold receded from its recent high of $2,034.86 as the US Dollar regained strength following positive US economic data and increased government bond yields. Despite the Dollar’s initial drop amid a tech-led stock market rally in Asia and Europe, it rebounded before the US markets opened, influenced by less-than-expected growth in Initial Jobless Claims and a surge in February’s PMI figures, indicating a robust expansion in manufacturing and a slight contraction in services. Meanwhile, the 10-year Treasury note yields touched multi-week highs, driven by the Federal Open Market Committee’s minutes, which suggested a cautious approach towards rate cuts, awaiting further inflation progress.

On Thursday, XAU/USD moved lower to reach below the middle band after reaching the upper band of the Bollinger Bands. Currently, the price is moving just around the middle band, suggesting a potential consolidation movement as the bands are squeezing. The Relative Strength Index (RSI) stands at 56, signaling a neutral outlook for this pair.

Resistance: $2,030, $2,042

Support: $2,017, $2,004