Today’s market preview provides a concise look at the key factors likely to influence today’s trading, helping investors prepare for the day ahead.

US Crude Oil Inventories

Oil prices fell in Asian trading hours on Wednesday, with persistent concerns over slowing economic growth and weak demand keeping prices under pressure.

Focus also remained on the Israel-Hamas war, with Hamas set to potentially retaliate against Israel over the killing of its leader last week. Fears of a broader conflict in the region offered some support to crude in recent sessions.

Crude Oil Inventories Expectations

Events since the last release of the Inventory Report:

- Saudi Aramco Hikes Oil Prices for the First Time in Months

- The weak Chinese data added to concerns over slowing demand in the world’s biggest oil importer.

- U.S. crude oil falls 2% as economic worries outweigh Middle East escalation

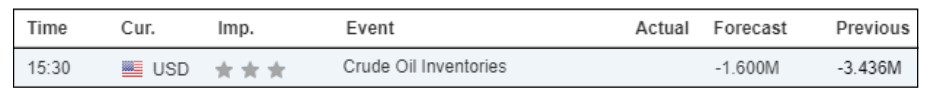

Previous Report Figures -3,436M (Barrels of Oil)

Forecast Figures for latest release -1,600M (Barrels of Oil)

Gold Prices Fell Below US 2400 Dollar

Spot gold continued to be under pressure, falling below the key level of $2400 per ounce

Gold futures expiring in December rose 0.12% to $2,434.85 an ounce, Silver futures expiring in September fell 0.94% to $26.960 an ounce, and Palladium futures expiring in September rose 1.06% to $870.53 per ounce.

Click here to open account and start trading.